Coinspeaker

$1.1B Worth of Bitcoin Options Set to Expire Today, What’s Next?

It is Friday, and crypto market enthusiasts will be closely observing Bitcoin options expiry, and the possible movements in BTC price going ahead. Approximately 18,000 BTC options are nearing expiration, featuring a Put Call Ratio of 0.64 and a Maxpain point set at $62,000. This week’s expiring BTC contracts hold a notional value of approximately $1.15 billion, slightly less than the previous week’s expiry.

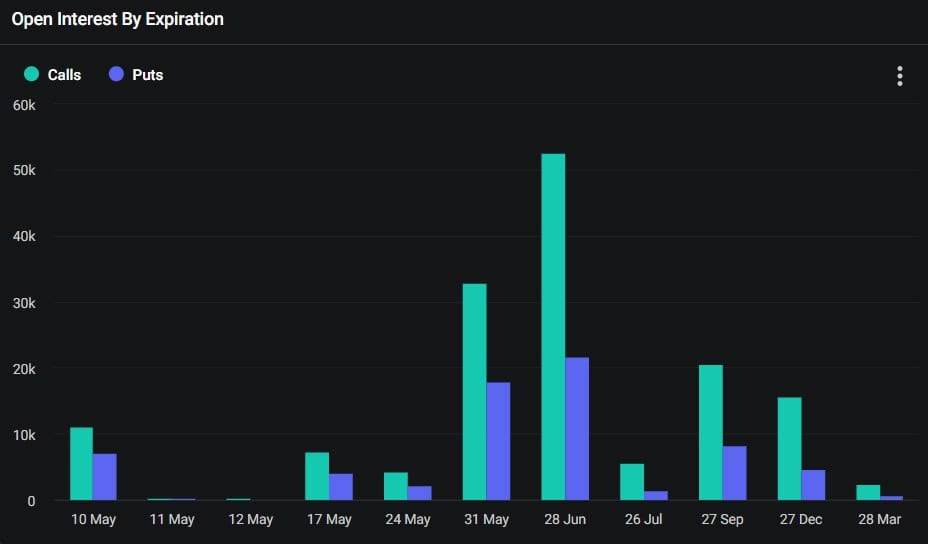

This put/call ratio of 0.64 suggests that more long contracts, or calls, would be expiring in comparison to the short contracts, or puts. Furthermore, the Bitcoin open interest has also surged to $700 million at the strike price of $70,000 and $100,000, which clearly hints that the longs are in a dominating position. On the other hand, the Open Interest (OI) for put calls has also surged to $360 million.

However, it is clear that the open interest (OI) for Bitcoin call options is twice the open interest for the put options, indicating an overall bullish sentiment. Call options provide the holder with the privilege to buy the underlying asset at a predetermined price on or before a specified date.

Additionally, trading firms such as QCP Capital and Paradigm have noticed a resurgence in demand for upward call options. This includes buyers closing current positions to transition into higher strike calls set to expire in July and September.

A Look At Bitcoin Options Implied Volatility (IV)

As per the data from Greeks.Live, the crypto market experienced a downturn over the last week amid the drop in the trading volume. Although there was a reduction in outflows from the US Bitcoin ETF, the market structure and block trading indicated persistent weakness in prices.

This downward trend has contributed to diminishing confidence among investors, reflected in the decreasing implied volatility (IV) across major terms. Presently, IV levels are marginally below the historical average, signaling some support. However, there is limited scope for further decline at this juncture.

“Empirically May has not been a good month for the market, and it is good value for money to buy some monthly puts now” Greeks.live notes.

May 10 Options Data

18,000 BTC options are about to expire with a Put Call Ratio of 0.64, a Maxpain point of $62,000 and a notional value of $1.2 billion.

280,000 ETH options are about to expire with a Put Call Ratio of 0.74, Maxpain point of $3,050 and a notional value of $800… pic.twitter.com/lurrMvi8cO— Greeks.live (@GreeksLive) May 10, 2024

In the last 24 hours, Bitcoin price has bounced back from under $61,000 levels and is currently trading close to $63,000. If BTC price gives a strong breakout above $64,000, we can see the levels of $70,000 coming soon.

$1.1B Worth of Bitcoin Options Set to Expire Today, What’s Next?