Coinspeaker

100 Days after Bitcoin Halving 2024, What’s Ahead for BTC in H2 2024?

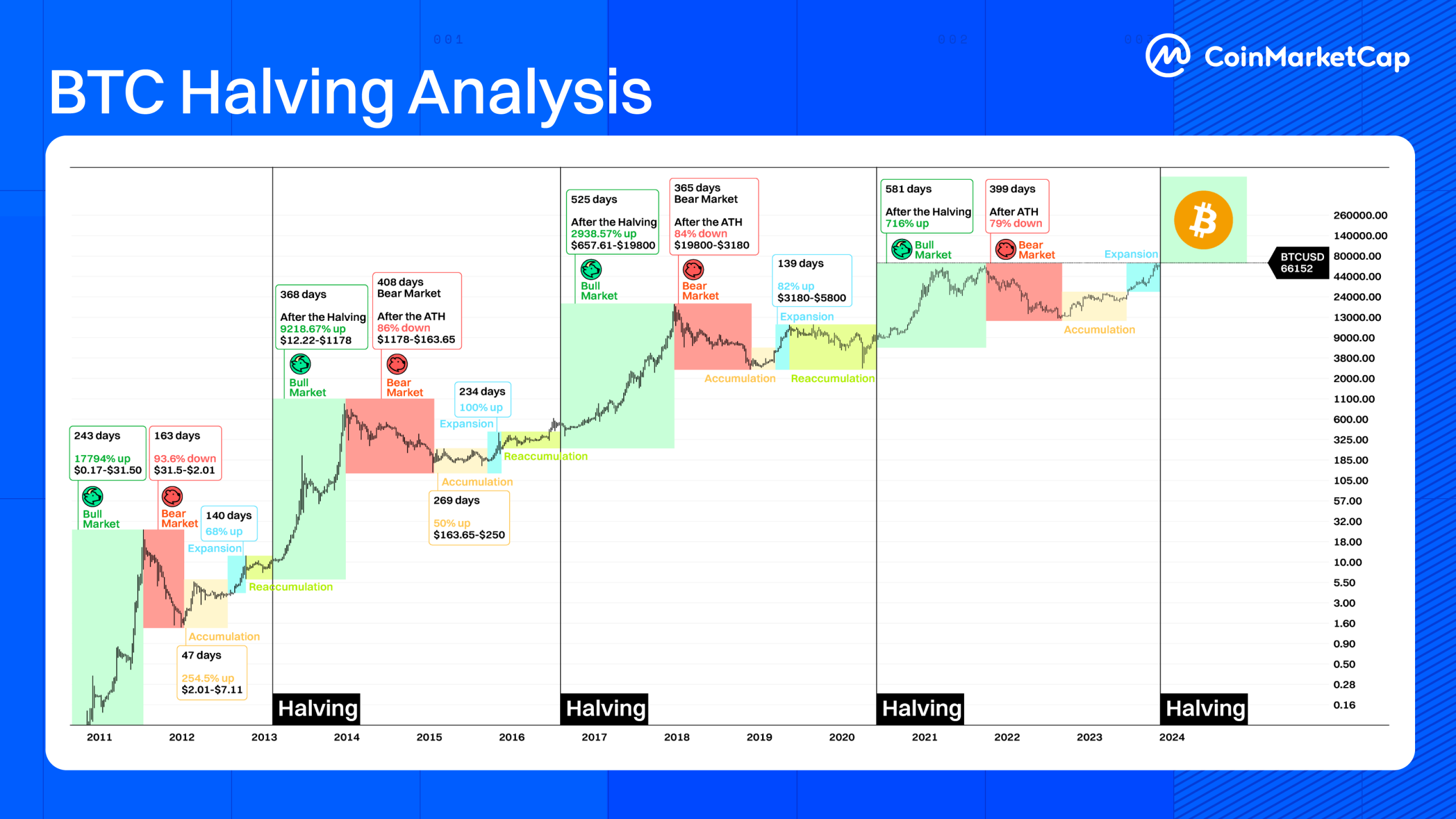

Today, July 29, the Bitcoin blockchain network completes an important milestone of 100 days to this year’s Bitcoin halving event. Over the last 100 days, the Bitcoin price has been subjected to strong volatility along with strong inflows in the newly launched spot Bitcoin ETF.

The quarter following the Bitcoin halving event witnessed strong BTC miner capitulation as the miners offloaded their Bitcoin holdings in order to meet the operational costs. However, in the past few weeks, the BTC miner capitulation has slowed down reducing the selling pressure on the asset.

On the other hand, the recently held Bitcoin Conference and the upcoming US elections are providing the catalysts for the Bitcoin price rally going ahead. In the message on the X platform, Andre Dragosch, head of research at ETC Group said:

“Today marks exactly 100 days after the Bitcoin Halving event on April 20. The market tends to have a short memory, but the halving-induced supply deficit should just start taking effect from now on.”

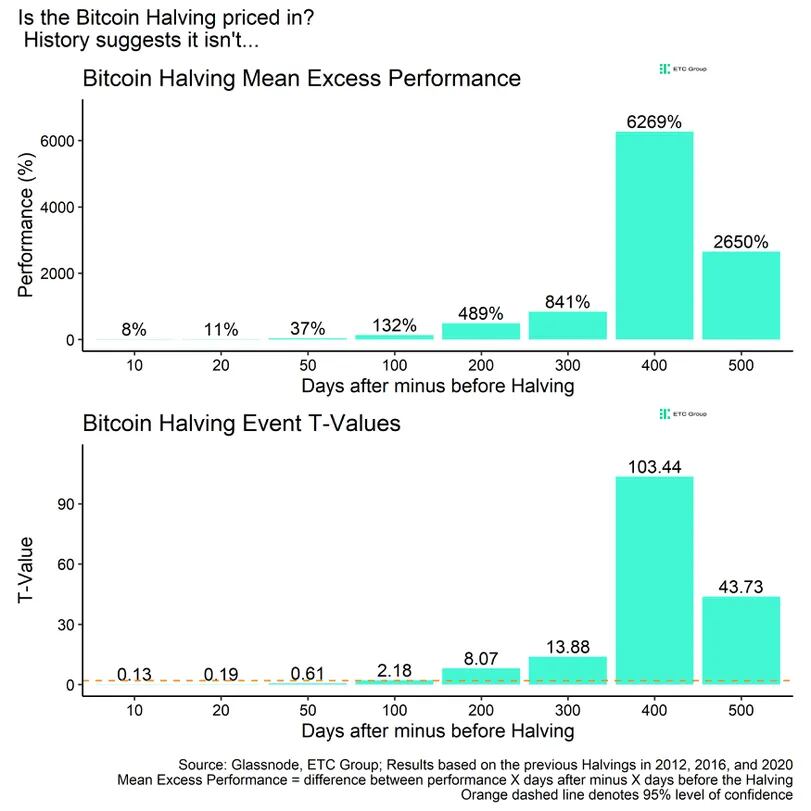

Dragosch reached his conclusion after analyzing performance data from the three previous halvings in 2012, 2016, and 2020. The study revealed that the mean excess performance—the difference between performance X number of days after the halving and X days before the halving, increases significantly 100 days post-halving and becomes statistically significant, with T-values exceeding 2%.

“The key takeaway is that 100 days after the Halving, the performance difference becomes statistically significant (T-value > 2) and then becomes increasingly significant until around 400 days after the Halving,” he added.

Photo: Glassnode

Bitcoin Price Action Ahead

From the lows of $53,900 in early July, the Bitcoin price has staged a strong recovery all the way to $70,000 around the Bitcoin conference event. As we approach closer to the US elections, analysts predict greater volatility for BTC.

Using the AI module, on-chain analyst Spot on Chain predicted that there’s a 63% probability that the Bitcoin price would rally to $100,000 during the second half of 2024. All eyes are currently on the FOMC meeting scheduled on Wednesday, July 31.

However, the CME data shows that there’s a 96% probability that the Federal Reserve will keep interest rates unchanged for August. On the other hand, analysts also predict an 85% probability of 25 basis points cut in September.

“Looking further ahead, into the first half of 2025, we notice a compelling probability of BTC surpassing the $150,000 threshold. Specifically, there is a 42% chance assigned to this scenario, reflecting a bullish outlook for Bitcoin’s price trajectory. Moreover, the likelihood of Bitcoin exceeding $150,000 amplifies to 70% when considering the entire year of 2025,” Spot on Chain noted.

100 Days after Bitcoin Halving 2024, What’s Ahead for BTC in H2 2024?