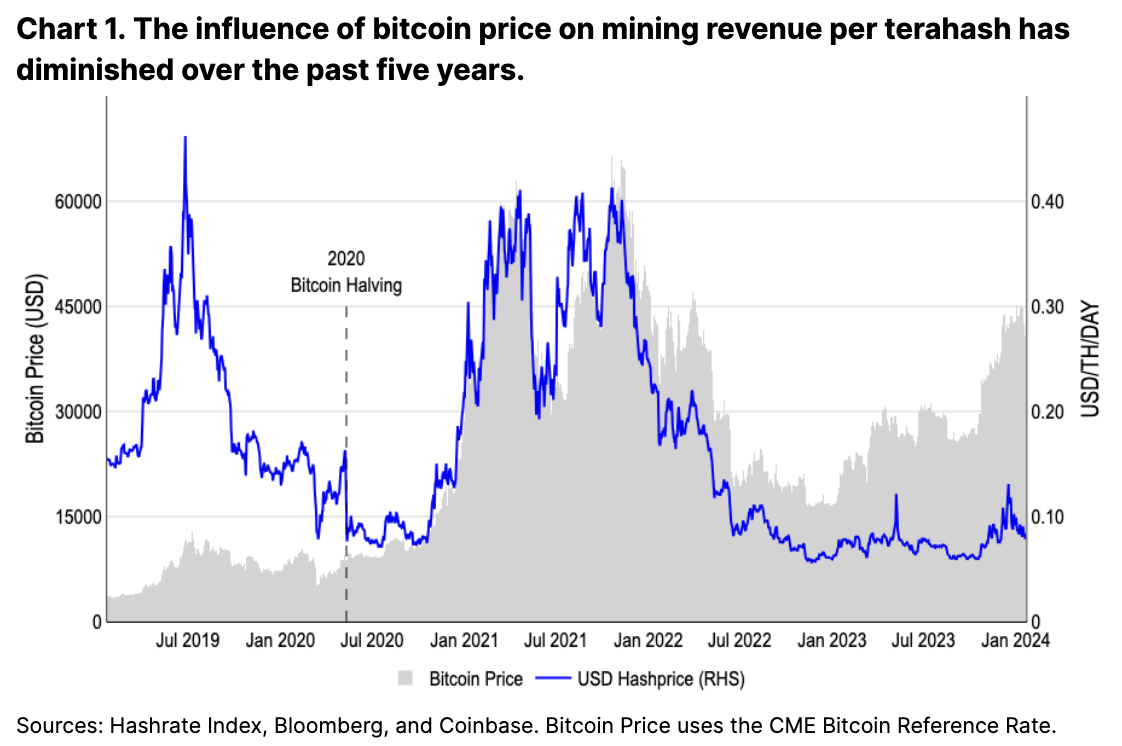

The Bitcoin halving could spell a great deal of pain for many Bitcoin miners if the price of BTC fails to surge in lockstep.

Eleven of the largest publicly traded Bitcoin (BTC) miners may struggle to mine Bitcoin profitably if the price of BTC fails to increase significantly after the halving, analysts at financial services firm Cantor Fitzgerald have reportedly found.

A Jan. 25 post to X from CleanSpark executive chairman and co-founder Matthew Shultz — which cited research from Cantor Fitzgerald — found that many Bitcoin miners, including Marathon Digital, Riot Platforms, and Core Scientific, may come under increased pressure following the Bitcoin halving, as the Bitcoin miners receive from their operations fail to outweigh the costs.

The United Kingdom-based miner Argo Blockchain (ARBK) and Florida-based Hut 8 mining were shown as the most potentially unprofitable after halving, (at the current price of Bitcoin), with an “all in” cost-per-coin rate of $62,276 and $60,360, respectively.