Some of the biggest financial institutions in the world are building bridges into the crypto space and expanding the potential investor pool for digital assets, according to Meltem Demirors, the chief strategy officer at the alternative asset manager CoinShares.

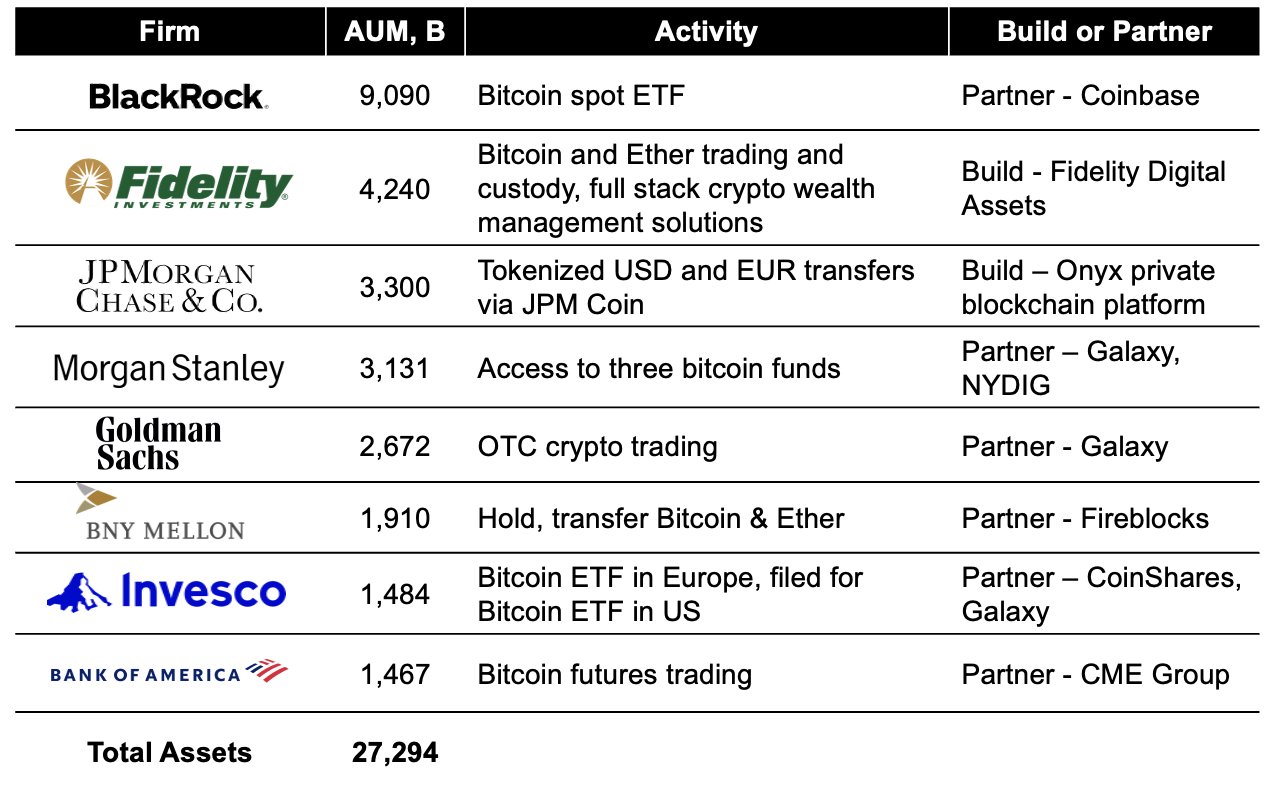

Demirors shares a chart with her 257,100 Twitter followers indicating how a select group of large financial institutions with a combined $27 trillion worth of assets under management (AUM) have entered the digital asset space.

“Last week’s BlackRock spot Bitcoin ETF filing was big news! But, it’s not the only story. many of the largest financial institutions in the US are actively working to provide access to Bitcoin and more. A quick glance – $27 trillion of client assets here!”

The CoinShares executive says it’s clear crypto as an asset class “is here to stay.”

“This is by no means a complete overview of all the offerings available, but it’s always helpful to zoom out and look at the bigger picture.

While ‘the institutions are coming’ has been more of a trickle than a wave, we’re seeing the bridges being built in real-time.

It’s also helpful to analyze whether firms are choosing to build, buy, or partner. So far, we’ve seen a lot of ‘partner’ but some are choosing ‘build.'”

Demirors argues that it’s important to provide investment pathways to all sorts of users, even if that means expanding away from Bitcoin’s (BTC) early “cypherpunk vision.”

“And when it comes to AUM, people like my dad (love you!) are the big $$$ audience.”

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $27,000,000,000,000 in Institutional Assets Coming Into Crypto Signals New Chapter for Industry: CoinShares CSO appeared first on The Daily Hodl.