The rise of cryptocurrency has been nothing short of meteoric since Bitcoin launched in 2009. From just a few cryptocurrencies, the market has exploded to encompass over 9,000 cryptocurrencies as of 2024, with a total market size of $2.67 trillion.

In recent days, we’ve witnessed a growing interest in crypto, from the introduction of Bitcoin ETFs to the approval of Ethereum ETFs in the United States.

Despite regulatory challenges and varying adoption rates, one trend remains clear, global interest and confidence in cryptocurrencies continue to grow steadily.

In this overview of cryptocurrency statistics, we’ll explore the latest trends shaping the world of cryptocurrency today.

Top Crypto Statistics

- Since 2013, the crypto market has welcomed 103,888 crypto coins; among which, 2,383 cryptocurrencies were recorded to be dead.

- Binance leads crypto exchanges with the highest trading volume, amounting to $2,781 billion. 1 in 3 Crypto Investors Lack Basic Knowledge about Cryptocurrency.

- Since 2018, over 100 billion USD has been hacked, with 2022 being the biggest year for crypto hacking, recorded with a total loss of $39.6 billion.

- Cryptocurrency is legal in 119 countries; among which, El Salvador is the most crypto-tax-friendly country.

- Ever since the approval of Bitcoin ETFs in Jan 2024, the BTC ETFs now hold nearly 4% of all Bitcoin, with a total of 776,464 BTC valued at about $52.7 billion.

- The United States is the top Bitcoin mining country, with a monthly hashrate share of over 37.84%

- There are around 37,900 crypto ATMs worldwide, with the United States hosting the highest number at 31,719, approximately 83.69% of all crypto ATMs.

- At least 21 Billion of crypto value has been airdropped for users, with Uniswap having the largest crypto airdrop amount, distributing $6.43 billion worth of UNI

- 60% of employees in the crypto industry work in crypto trading entities, and 30% of all crypto workers are US-living employees

General Cryptocurrency Statistics

There are 9,000+ Cryptocurrencies Created as of 2024 (Statista)

Since the beginning of 2024, over 9,024 cryptocurrencies have been created so far. In early 2022, there were even more and some estimates say there are about 29,000, but many are inactive or just pump/dump.

However, the top 20 cryptocurrencies make up almost 90% of the market, with Bitcoin having a market cap of $1.3 trillion (as of May 2024), making up around 50%.

Over 2,383 Dead Cryptocurrencies Since 2013 (CoinKickoff)

Since 2013, 2,383 cryptocurrencies have become inactive. Additionally, 91% of the coins from the 2014 crypto crash are now dead. Many projects fail due to poor planning, scams, or lack of adoption.

Total Population Who Owns Crypto (Triple-A)

As of 2024, global cryptocurrency ownership is estimated at 6.8%, with over 560 million users worldwide. India, China, the USA, and Brazil are the top countries with the highest number of crypto investors.

India ranks number one with over 93.5 million crypto users, followed by China with 59.1 million, the United States with 52 million, and Brazil with 25 million.

Crypto is the Most Trusted Financial Product Among Americans, Second Only to Savings Accounts (Statista)

Americans continue to rely on savings accounts for their financial security, with nearly 48% reporting ownership. A notable 17% of US investors hold cryptocurrency, the same 17% share as for equity investments.

While life insurance and real estate investments follow closely behind at 16 and 15 percent, respectively. Only a small fraction, 9%, have invested in precious metals like gold.

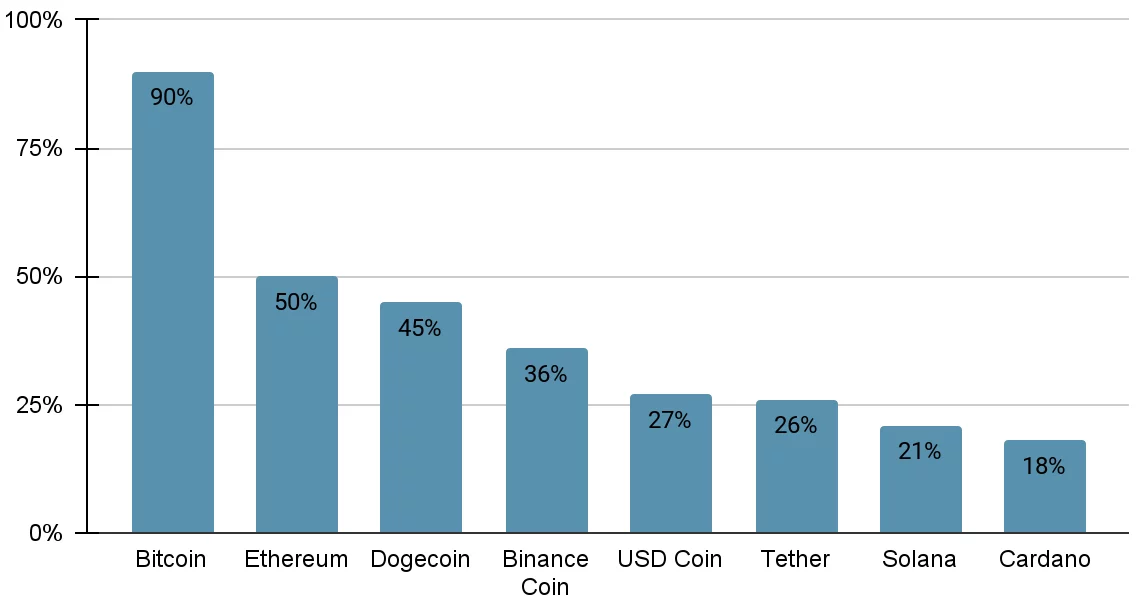

Bitcoin and Ethereum are the Most Popular Cryptocurrencies (Security.org)

Among cryptocurrency investors, Bitcoin and Ethereum are the most favored coins, comprising 76% and 54% of portfolios, respectively. Following closely behind is Dogecoin, making up 26% of investors’ portfolios.

Other popular altcoins include Shiba Inu (SHIB), Cardano (ADA), U.S. Dollar Coin (USDC), and Stellar (XLM), each representing 12% of portfolios.

Crypto Ownership Rates Increase to 40% in the US (Security.org)

Cryptocurrency awareness and ownership rates have reached record levels in the United States. Currently, 40% of American adults, or about 4 out of 10 citizens, own crypto, up from 30% in 2023.

Cryptocurrency Trading Statistics

Binance Leads Crypto Exchanges with Highest Trading Volume (Statista)

Binance dominates the crypto exchange market with a volume of $2,781 billion. Bybit comes in second with $501 billion, followed by Upbit with $487 billion and OKX with $442 billion. Coinbase holds the fifth spot with a volume of $395 billion. (These figures represent data collected from the beginning of 2024 to May 2024)

The Biggest Crypto Liquidation of All Time (Nasdaq)

On March 18, 2023, the crypto market saw its biggest single-day liquidation, amounting to a staggering $1.05 billion.

This was due to external factors such as the Federal Reserve’s indication of increased interest rates and reports of Elon Musk’s SpaceX selling off its Bitcoin holdings.

38% of US Crypto Investors Have Lost More Money Than Made It (LendingTree)

Among Americans who have owned a form of cryptocurrency, 38% report selling it for a lower price than their initial purchase, while 28% claim to have made a profit. Merely 13% state that they have broken even in their cryptocurrency transactions.

This is roughly 4 out of 10 investors are losing money in crypto trading and investing.

1 in 3 Crypto Investors Lack Basic Knowledge about Cryptocurrency (CNBC)

33.5% of crypto buyers either have no knowledge about it or consider their understanding of the space to be minimal. Meanwhile, just 16.9% of investors who bought cryptocurrency feel they fully understand Bitcoin and the crypto market.

Cryptocurrency Hacks Statistics

2022 was the Biggest Year Ever for Crypto Hacking (Chainalysis)

The value of money hacked in billions from 2018 to 2023 showed a fluctuating trend. It rose from $4.6 billion in 2018 to $39.6 billion in 2022, marking a substantial increase. However, in 2023, there was a notable decrease to $24.2 billion.

North Korea Hacked more Crypto Platforms than ever in 2022 (Chainalysis)

North Korean hacking groups like Kimsuky and Lazarus Group have been using different sneaky methods to steal lots of cryptocurrency.

In 2022, hackers linked to North Korea took about $1.7 billion in cryptocurrency. In 2023, the estimate shows they stole a bit more than $1.0 billion.

ETH and Solana are 2 of the most Attacked Blockchains (Halborn)

Between 2016 and 2022, DeFi hacks resulted in a total loss of $5.56 billion. The year 2022 marked a peak with DeFi chain hacks amounting to $3.05 billion. Ethereum blockchains and Solana emerged as the two most exploited chains.

The Fall of LUNC (Terra Classic) during the FTX Collapse Was the Biggest Fund Lost in Crypto History (De.Fi)

In 2022, Terra Classic faced a substantial $40 billion fund loss due to the FTX crypto exchange collapse.

In another event, Africrypt crypto exchange founders, Ameer and Raees Cajee, disappeared after alleging a $3.2 billion loss due to a purported hack. Furthermore, the Silk Road incident saw the U.S. Government seize bitcoins worth $33.36 billion.

Cryptocurrency Regulation Statistics

119 Countries have Legalized Cryptocurrency (Coingecko)

Cryptocurrency is legal in 119 countries and four British Overseas Territories, representing over half of the world’s nations. Among these, 64.7% are emerging or developing countries in Asia and Africa.

However, 16.8% of legal countries have enforced bank bans, inhibiting financial institutions from engaging with cryptocurrency. Europe is the leading region, with 39 countries acknowledging the legitimacy of crypto. Plus, only 52.1% of the 119 legalizing countries have comprehensive crypto regulations.

El Salvador is The Most Tax-Friendly Country (Technopedia)

In 2021, El Salvador was the first country to make Bitcoin a legal tender. Now, they have a tax-friendly system for cryptocurrency to get more investment from other countries. Places like Dubai, Singapore, Switzerland, and Malta also have clear laws and low taxes.

Cryptocurrency Hedger Funds Statistics

Bitcoin ETFs now Hold Nearly 4% of all Bitcoin (Blockworks)

Bitcoin Exchange-Traded Funds (ETFs) in the United States now own nearly 4% of all Bitcoins available. The total amount of Bitcoin held by spot ETF funds is 776,464 BTC, equivalent to about $52.7 billion.

Currently, there are around 19.64 million Bitcoins in circulation, with a maximum limit of 21 million expected to be reached in the next century or more.

21% of Non-Bitcoin Owners Looking to Invest Through ETFs (Security.org)

Around 21% of people who don’t own Bitcoin said they are more likely to invest in cryptocurrency through Bitcoin ETFs. This could mean that approximately 29 million more Americans might start investing in the crypto market soon.

Grayscale Bitcoin ETF Holds the Most Number of Bitcoins (Blockworks)

The top Bitcoin ETFs include Grayscale, BlackRock, Fidelity, Ark/21 Shares, Bitwise, and VanEck.

As of the latest data, Grayscale leads the pack with $24.33 billion in assets under management, followed by BlackRock with $17.24 billion, and Fidelity with $9.90 billion.

Crypto Investment Funds Manage over $70.11 Billion in Assets (CFR)

Till Q4 2023, the number of crypto funds surpassed 868. During this period, assets under management (AUM) for crypto funds increased by nearly 25%, reaching a historic high of $70.11 billion.

Approximately half of all crypto funds are situated in North America, with the majority located in the United States. Europe and Asia each house approximately 20% of these funds.

The Cayman Islands and the British Virgin Islands are the Predominant Offshore Legal Domiciles for Crypto Funds

Most crypto funds are headquartered in the United States, although fewer than 20% are technically registered there. The Cayman Islands and the British Virgin Islands serve as the primary offshore legal domiciles for crypto funds, collectively hosting 47% of such funds.

Solana Was the Most Traded Altcoin by Crypto Hedge Funds in 2023 (PwC)

Although Bitcoin (BTC) and Ether (ETH) often receive the most trading volume, Solana (SOL) remains the top traded altcoin by crypto hedge funds in 2023. Polygon (MATIC) and Uniswap (UNI) also maintained high trading volume after Solana.

44% of Crypto Hedge Funds Traded on DEXs, with the Most Popular being Uniswap (PwC)

In 2023, 44% of crypto hedge funds engaged in trading on decentralized exchanges (DEXs), marking a slight increase from 31% reported in 2021 and 42% in 2022. For those abstaining from DEX usage, the primary reasons cited included potential regulatory and cybersecurity apprehensions.

Nevertheless, Uniswap continues to dominate as the preferred DEX, experiencing a remarkable surge in usage from 20% in 2022 to 75% in 2023.

Cryptocurrency Mining Statistics

The United States is the Top Bitcoin Mining Country (University of Cambridge)

The United States is the leading country for crypto mining, with a monthly hashrate share of over 37.84%. China follows with 21.11%, and Canada holds 6.48%.

Lebanon is the Cheapest Country to Mine 1 BTC (Coingecko)

Bitcoin mining is most profitable in countries with low household electricity costs, primarily located in Asia and Africa. Lebanon offers the most affordable environment for mining Bitcoin, with a cost of $266.02 per coin. Iran follows at $532.04, while Syria has a cost of $1,330.10.

The Average Cost of Production Per Bitcoin Post Halving is $37,856 (CoinShares)

The typical cost of producing one Bitcoin after the halving event in 2024, reveals an average expense of US$37,856. Only a few miners will likely make a profit if Bitcoin prices stay above $40,000.

Global Electricity Consumption in Crypto Mining is 120TWh (EIA)

In 2023, Estimates suggest that Bitcoin mining uses between 67 TWh and 240 TWh of electricity, with an average of 120 TWh. Thus, Bitcoin mining uses about 0.2% to 0.9% of the world’s electricity. This is roughly equal to the total electricity consumption of Greece or Australia.

Cryptocurrency ATM Statistics

There are around 37,900 Crypto ATMs Worldwide (Coin ATM Radar)

As of May 2024, there are about 37,900 crypto ATMs worldwide. People can exchange crypto for cash in 70 countries. Currently, there are about 468 crypto ATM operators.

The United States has the Highest Number of Bitcoin ATMs (Coin ATM Radar)

The United States has 31,719 Bitcoin ATMs, while Canada has 2,995. Los Angeles alone boasts 1,715 Bitcoin ATMs. Other major locations in the US include Houston with 1,328, Chicago with 1,112, and Atlanta with 872 Bitcoin ATMs.

Cryptocurrency Airdrop Statistics

Uniswap (UNI) is the Biggest Crypto Airdrop (Coingecko)

Uniswap (UNI) had the largest crypto airdrop, handing out $6.43 billion worth of $UNI in 2020. Apecoin (APE) followed with $3.5 billion and dYdX with over $2 billion. Together, Uniswap, Apecoin, and dYdX giveaways amounted to $11.9 billion, making up 45.1% of the top 50 biggest crypto airdrops.

46% of the Largest Crypto Airdrops Peaked within 14 days (CoinTelegraph)

Over the past four years, almost half (46%) of the top 50 crypto token airdrops, including well-known tokens like Ethereum Name Service, Blur, and LooksRare, reached their highest prices within two weeks of launching.

Cryptocurrency Jobs Statistics

60% of Employees in the Crypto Industry Work in an Entity that is Focused on Crypto Trading and Investment (K33 Research)

Organizations employ 60% of cryptocurrency employees primarily focused on enabling crypto trading and investment. Approximately 62,000 individuals work for crypto exchanges and brokerages, while nearly 50,000 are employed by firms providing various other crypto financial services.

US with Over 30% Global Crypto Workers (K33 Research)

The crypto world mostly focuses on the United States, where many big crypto companies come from, and about 30% of crypto workers live there. However, most crypto workers, about 70%, live in other parts of the world. Western countries and Eastern Europe have more crypto workers compared to their population size.

The United States has the Highest Salaries for Web3 Developers (Web3 Career)

In the United States, Web3 developers earn the highest salaries, averaging $150,000 per year. They are followed by remote Web3 workers, who earn $123,000 annually, and Canadian developers, who earn $120,000 per year on average.

New York is Among the top Web3 Cities for Crypto Jobs (Web3 Career)

In the United States, New York boasts the highest number of Web3 jobs, totaling 6242 positions, followed by San Francisco with 4172, and Singapore with 2570. Additionally, there are a total of 10,546 remote Web3 jobs available.

Wrap Up

Today, there are thousands of cryptocurrencies with diverse applications. Despite challenges like hacking and regulatory issues, interest and confidence in digital currencies are increasing globally. Bitcoin and Ethereum are the most popular, while new innovations like Bitcoin ETFs are attracting more investors.

Crypto exchanges and trading platforms play a crucial role in this ecosystem, with Binance leading in trading volume. However, the market is also fraught with risks, including significant losses for many investors and numerous cyberattacks. The regulatory landscape is evolving, with more countries legalizing cryptocurrencies, although approaches vary.

Mining continues to be a significant activity, with the United States leading in Bitcoin mining. Crypto ATMs and decentralized exchanges (DEXs) are also becoming more common, making digital currencies more accessible.