Coinspeaker

$3B Worth of ETH Withdrawn from Exchanges since Ethereum ETF Approval, Rally Ahead?

While the world’s second-largest cryptocurrency Ethereum (ETH) has been flirting around $3,800 levels, on-chain data indicates that it’s preparing for a major rally going ahead, and a breakout above $4,000 looks imminent.

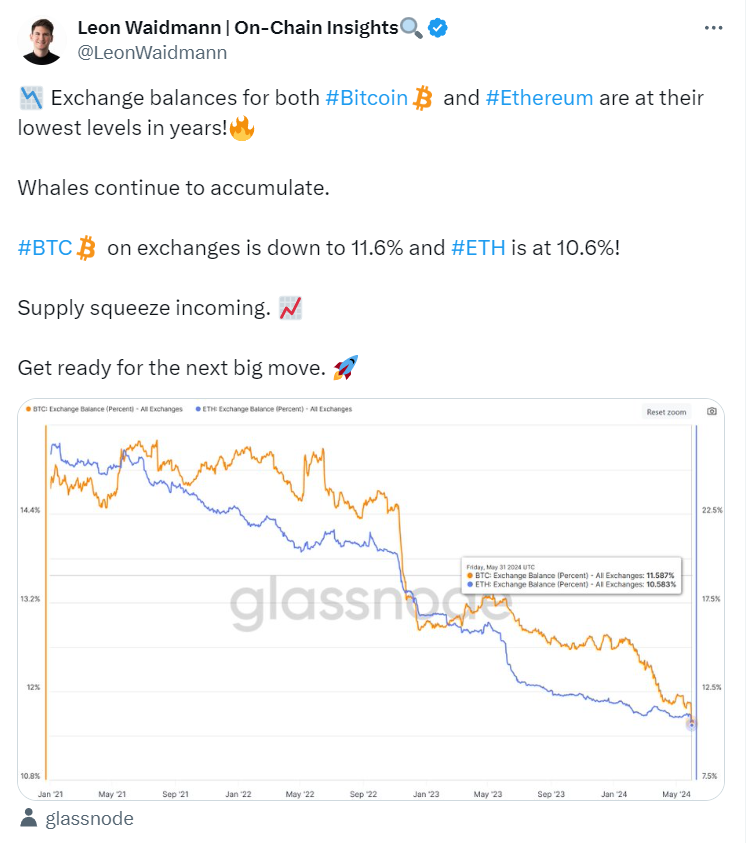

Over the last week since the spot Ether ETF approval, the total number of Ethereum (ETH) moving off exchanges has surged by 800,000 worth a staggering $3 billion. This signals a potential supply squeeze that could drive the ETH price higher from the current levels. Lower exchange reserves serve as bullish indicators highlighting that lower coins are available for sale as more and more investors move their holdings into self-custody.

In its recent post, CryptoQuant explains who could be behind this massive movement of ETH coins off exchanges. Firstly, whales or individual investors who anticipate a surge in prices following the approval of the Spot ETF. This group may be capitalizing on the expected market uptrend to maximize their gains.

Secondly, institutions gearing up for the spot ETF launch could be driving this surge in purchases. These institutions may be preparing to meet the anticipated demand from their investors once the ETH Spot ETF is introduced.

While both explanations remain speculative, the observed trend of heavy outflows lasting over eight days from exchanges, totaling more than 800,000 Ethereum, could potentially have a positive impact on prices in the medium term, reported CryptoQuant.

All Eyes Are on Ethereum ETFs

While the US SEC approved the 19b-4 filings for spot Ethereum ETF last week, they have yet to approve the S-1 registrations for the crypto fund to go live for trading.

Last week, Bloomberg analyst Eric Balchunas stated that Ether ETFs have a strong possibility of going live by June-end. Some market analysts also believe that Ether could break its all-time high of $4,840 once the Ethereum ETFs start trading amid rising demand pressure. This means that a similar scenario after the Bitcoin ETF launch could pan out for Ethereum as well.

In a report dated May 28, crypto analyst Michael Nadeau from the DeFi sector highlighted that Ether might experience even greater benefits from demand dynamics compared to Bitcoin. Nadeau pointed out a key distinction: while Bitcoin often faces “structural sell pressure” due to periodic sales by miners to cover mining expenses, Ethereum validators do not encounter similar operational costs, potentially leading to reduced selling pressure on Ether.

On the other hand, there are concerns that the Grayscale Ethereum Trust (ETHE), if converted to an ETF, could influence the ETH price action similar to what happened with GBTC. The Grayscale fund ETHE currently manages over $11 billion in AUM.

$3B Worth of ETH Withdrawn from Exchanges since Ethereum ETF Approval, Rally Ahead?