Digital assets manager CoinShares says that institutional crypto investors poured millions of capital into digital asset investment products last week.

In its latest Digital Asset Fund Flows report, CoinShares says that the surge was likely caused by the remarks of Fed Chair Jerome Powell last week when he implied that lower interest rates could be on the way.

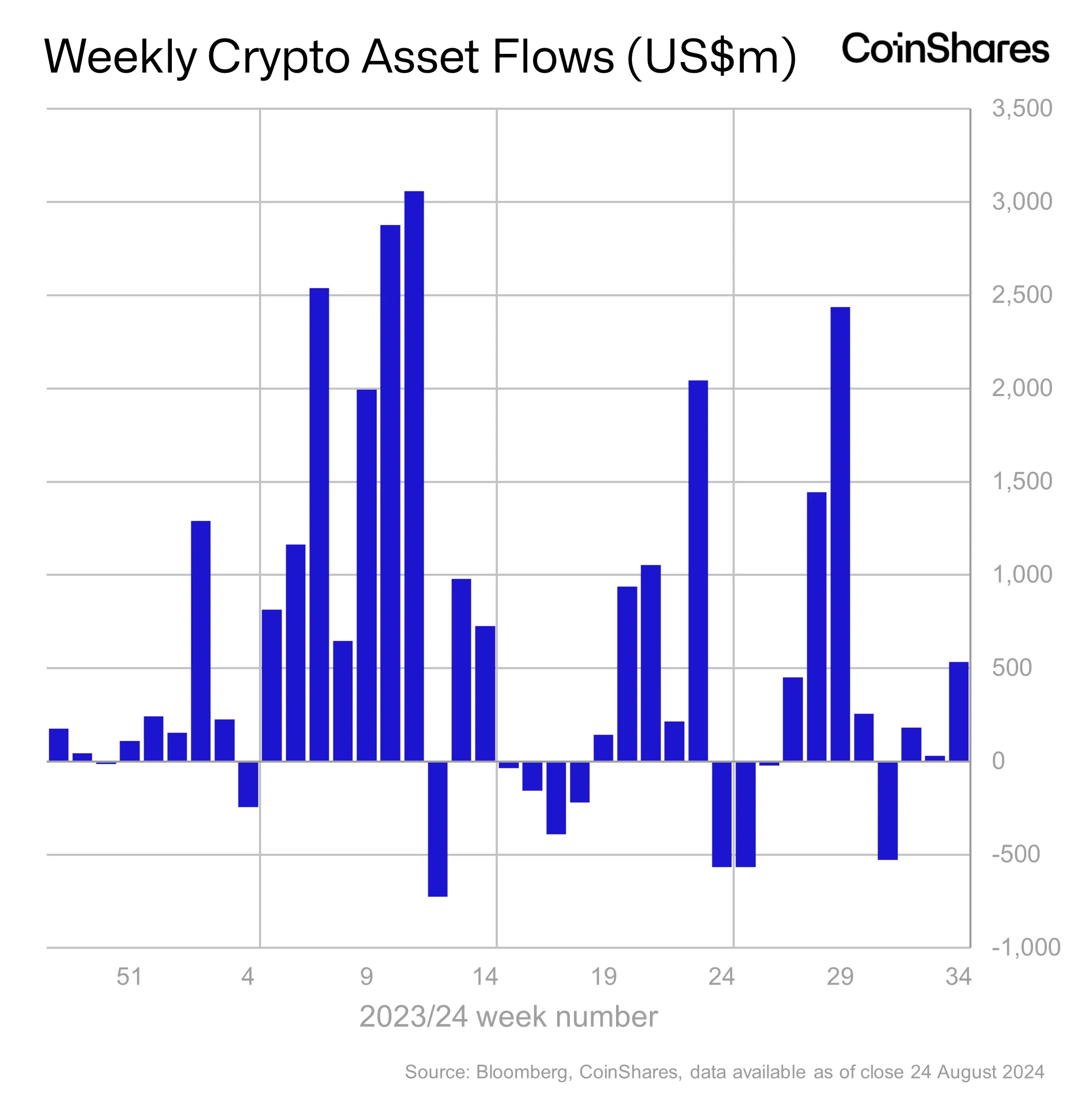

“Last week, digital asset investment products saw inflows totaling US$533m, marking the largest inflows in five weeks. This surge followed remarks by Jerome Powell at the Jackson Hole Symposium, where he suggested that the first interest rate cut could occur in September. Although trading volumes were lower than in recent weeks, they remained high, reaching US$9bn for the week.”

Particularly, the massive inflows into Bitcoin (BTC) suggest an increased sensitivity to interest rate fluctuations.

“Bitcoin was the primary focus, seeing US$543m of inflows, interestingly, the majority of those inflows were on Friday, following the dovish comments from Jerome Powell, indicating Bitcoin’s sensitivity to interest rate expectations.”

From a regional perspective, the US saw $498 million in inflows. Hong Kong and Switzerland also raked in $16 million and $14 million, respectively.

“Minor outflows were seen in Germany totaling US$9m leaving it as one of the only countries with net outflows year-to-date.”

Ethereum (ETH) products suffered outflows of $36 million last week, though CoinShares does point out a silver lining.

“… although new issuers continue to see inflows with the Grayscale Ethereum trust offsetting this with US$118m outflows. A month in from the ETH ETF launches, the new Ethereum ETFs have seen US$3.1bn of inflows, partially offset by outflows from the Grayscale Trust of US$2.5bn.”

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post $533,000,000 Flows Into Crypto Products Following Hints of Fed Rate Cuts: CoinShares appeared first on The Daily Hodl.