Japan’s institutional investors are increasingly looking to diversify their investment portfolios by entering the cryptocurrency market. According to a recent survey conducted by Nomura Securities, 54% of these investors plan to invest in cryptocurrencies within the next three years.

This growing interest in digital assets is primarily driven by the need to fight against inflation. The introduction of a cryptocurrency ETF in Japan could further invigorate the market, making it more active and attractive to institutional investors.

Nomura Holdings, along with its subsidiary Laser Digital Holdings, conducted the survey to understand the trends regarding crypto among institutional investors.

The survey, carried out from April 15 to April 26, 2022, involved 547 investment managers employed by domestic institutional investors, family offices, and public interest corporations.

The results indicate a significant shift in the perception and adoption of cryptocurrencies in Japan’s financial sector.

Positive impressions and diversification opportunities

A notable 25% of the respondents expressed a positive outlook on cryptocurrencies for the coming year, while 23% had a negative view, and 52% remained neutral, indicating uncertainty.

The survey highlighted that Bitcoin and Ethereum received particularly favorable impressions among the respondents, showcasing their dominance in the cryptocurrency market.

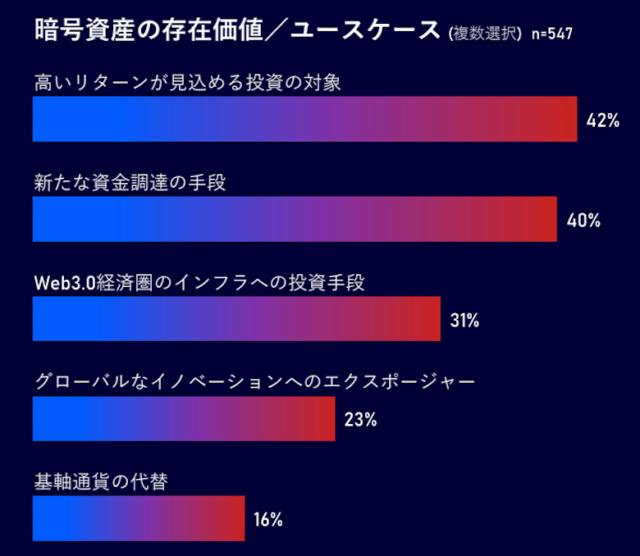

An impressive 62% of the respondents view cryptocurrencies as an excellent opportunity for diversifying their investments. The primary motivation behind this interest is the potential for high returns, which digital assets are known to offer.

Furthermore, only a small fraction, 16%, sees cryptocurrencies as an alternative to base currencies. This means that most investors are more interested in the investment potential of cryptocurrencies rather than using them for transactional purposes.

When it comes to asset allocation, a significant 66% of respondents indicated that they would allocate 2-5% of their assets under management to cryptocurrencies.

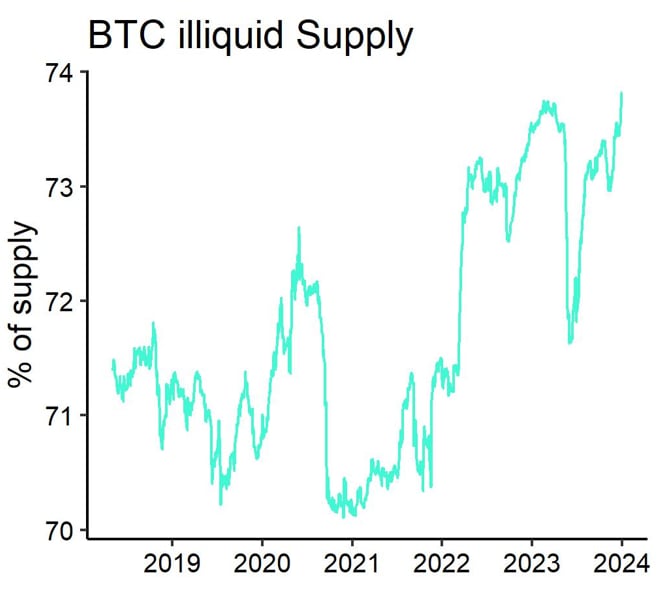

The expected investment period for these cryptocurrency investments is also noteworthy. A massive 76% of the respondents plan to hold their investments for one year or more.

In addition to traditional investment strategies, the survey found that more than half of the respondents are interested in exploring staking, mining, and lending.

Jai Hamid