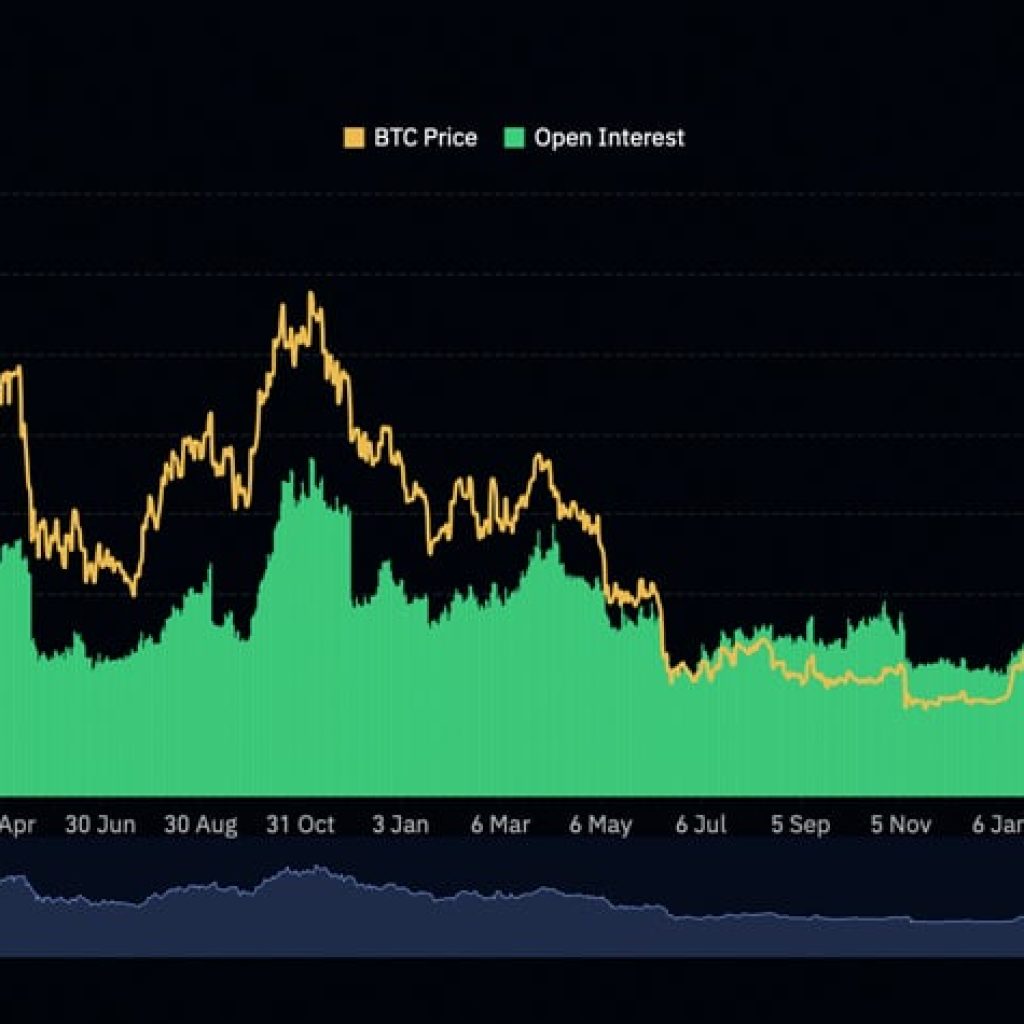

The total OI notional value for all outstanding BTC options contracts is $19 billion.

On May 31, 69,000 Bitcoin options worth $4.7 billion and 920,000 Ether options worth $3.5 billion expire. The expiry of crypto options contracts is historically linked to price volatility in the crypto market.

According to the Derbit data, the put/call ratio for the expired Bitcoin (BTC) options is 0.61. This means more calls (or long contracts) are expiring than puts (or shorts). On the other hand, Ether (ETH) options had a put/call ratio of 0.46.

The put/call ratio (PCR) is a technical indicator that reflects trader market sentiment. A PCR below 0.7 is considered a strong bullish sentiment, while a PCR above 1 is considered a strong bearish sentiment.