In the latest reports, a number of the nine spot bitcoin exchange-traded funds (ETFs) that were launched on Jan. 11, 2024, have increased their bitcoin holdings following the last day of trading activity recorded on Feb. 2, 2024. According to the data, Blackrock’s IBIT now possesses 72,466.64 bitcoin, valued at $3.12 billion, and Fidelity’s Wise Origin ETF, FBTC, currently owns 60,054.87 BTC, estimated at $2.58 billion.

177,949 Bitcoin Stashed by 9 ETFs, Blackrock and Fidelity Hold Nearly 75%

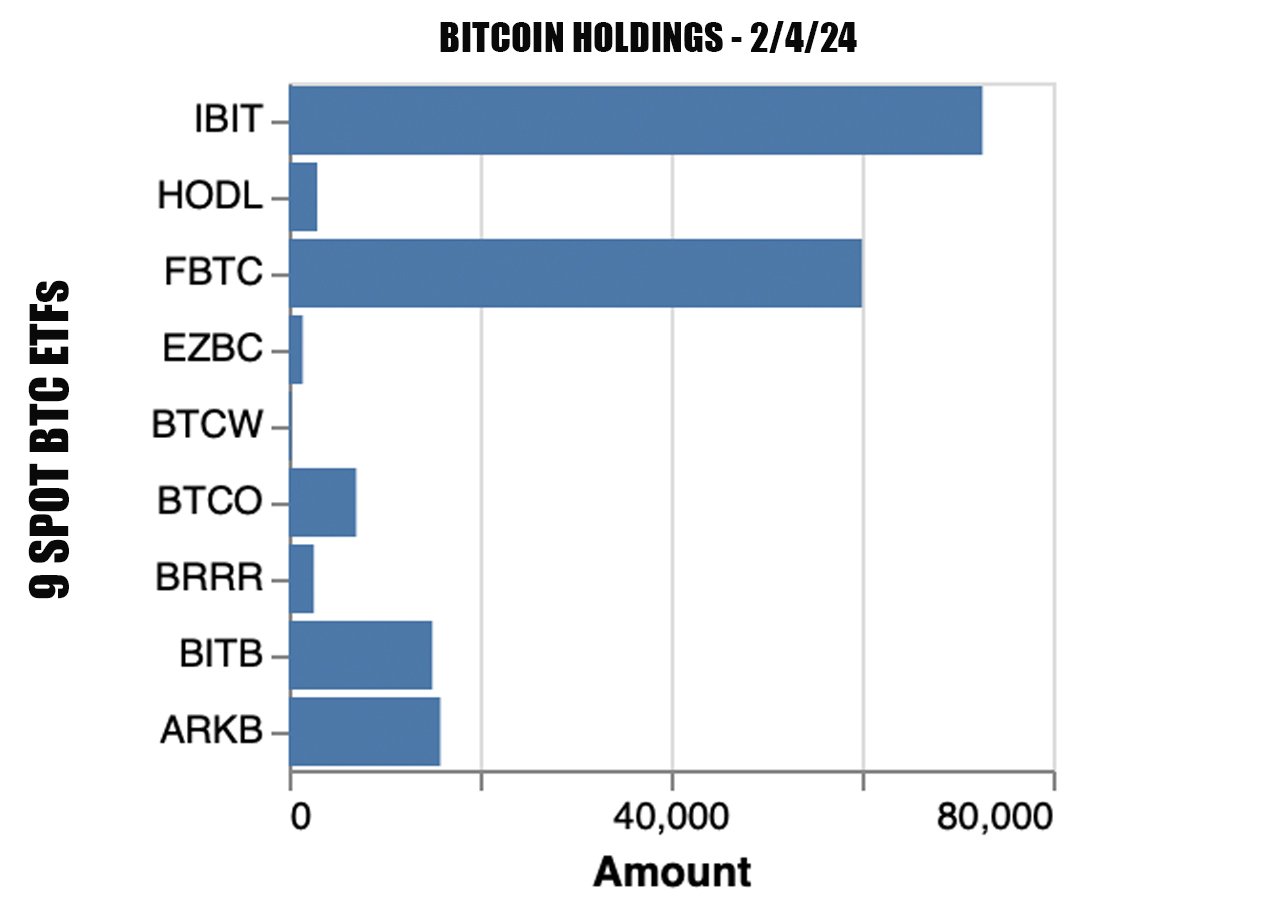

While the bitcoin reserves in GBTC have diminished, the nine newly launched spot bitcoin exchange-traded funds — IBIT, FBTC, ARKB, BITB, BTCO, HODL, BRRR, EZBC, and BTCW — have gathered a significant amount of BTC. Currently, Blackrock’s IBIT stands as the premier holder of bitcoin among U.S. spot bitcoin ETFs, with the exception of Grayscale’s GBTC.

The Ishares Bitcoin Trust (IBIT) now boasts 72,466.64 BTC, representing 0.369% of the total 19.61 million BTC circulating globally. The runner-up in bitcoin holdings among the nine newly unveiled spot bitcoin ETFs is Fidelity’s FBTC, which now oversees 60,054.87 BTC, equating to 0.306% of the total bitcoins in circulation.

The Ark Invest 21shares fund, ARKB, is in possession of 15,890 BTC, while Bitwise’s BITB has accumulated 15,053.66 BTC. Combined, ARKB and BITB’s reserves total 30,943.66 BTC, or 0.157% of the circulating bitcoin supply.

Furthermore, the Invesco Galaxy ETF holds 7,081 BTC, which represents 0.036% of the total supply. Vaneck’s HODL ETF is the custodian of 2,998.48 BTC, while Valkyrie’s BRRR ETF has amassed 2,649.46 BTC.

The EZBC fund by Franklin Templeton is home to 1,479 BTC, and Wisdomtree’s BTCW secures a holding of 276 BTC. Together, these four ETFs possess a combined total of 7,402.94 BTC, or 0.037% of the total bitcoins currently in circulation.

Collectively, the nine ETFs manage a significant cache of 177,949.11 BTC, valued at $7.62 billion according to the latest BTC exchange rates. These nine ETFs account for 0.907% of the total BTC supply.

Including GBTC, the aggregate of all ten ETFs amounts to 656,286.54 BTC, representing 3.345% of the 19.61 million BTC that exists. As of Jan. 12, 2024, GBTC possessed 617,079.99 BTC, but as of today, with its holdings reduced to 478,337.43 BTC, the trust has divested a total of 138,742.56 BTC.

This reduction, coupled with the inflows into the nine newly established ETFs, has resulted in 39,206.55 BTC, valued at $1.68 billion, being withdrawn from the market and allocated to these funds. Despite the emergence of these newer funds, Grayscale’s Bitcoin Trust, which pioneered years before, remains significantly larger, holding 2.687 times more BTC reserves than the combined holdings of all nine funds.

What do you think about the number of bitcoins spot ETFs amassed over the past few weeks? Share your thoughts and opinions about this subject in the comments section below.