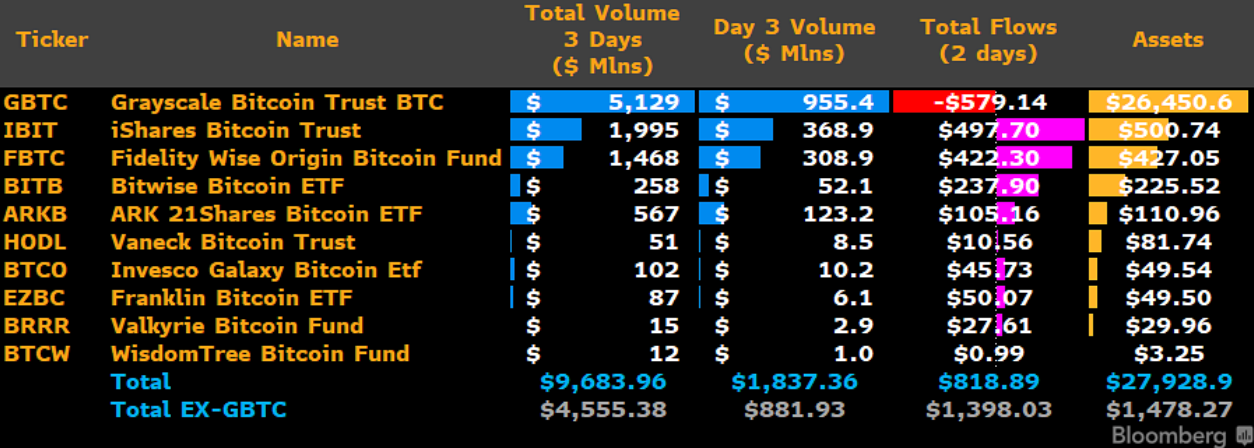

Despite aggressive selling by the Grayscale Bitcoin Trust ETF, the spot Bitcoin ETF ecosystem in the U.S. collectively added around 10,000 BTC in January.

The Grayscale Bitcoin Trust (GBTC) exchange-traded fund (ETF) was aggressively selling Bitcoin (BTC) in January, but other ETFs bought significantly more BTC.

According to public holdings data tracked by Cointelegraph, GBTC dumped a total of 132,195 BTC in January, reducing its Bitcoin stash by 21% from 619,220 BTC on Jan. 11 to 487,025 BTC on Jan. 31.

However, the nine other funds actively caught up, adding 142,294 Bitcoin in total since the first trading day. The non-GBTC ETFs have increased their holdings by as much as 674%, from just 18,390 BTC at the trading start to 160,684 BTC as of Jan. 31.