Coinspeaker

90% of Bitcoin Holders in Profit, BTC Price Shoots $44,500 amid Whale Accumulation

It seems that the period of consolidation for Bitcoin is ending as BTC price has given a fresh breakout to $44,500, eyeing a further rally to $50,000. Moreover, on-chain indicators continue to show strength suggesting further gains for Bitcoin, with a strong support at $43,080.

PlanB, the creator of the Stock-to-Flow model for Bitcoin, recently shared a BTC chart indicating that 90% of all Bitcoins are currently in profit. This is the highest number of Bitcoin holders in profit since Bitcoin’s peak at $69,000 in mid-November 2021.

In a YouTube video linked in the tweet, PlanB provided a comprehensive analysis of the chart. Currently, the chart displays orange dots, signifying that 90% of all mined Bitcoins are profitable. PlanB clarified that red dots will appear on the chart when 100% of all Bitcoin becomes profitable, with red dots always following the current orange ones.

90% of all bitcoin is in profit, highest since Oct 2021 ath.

More info here: https://t.co/UahB9zJf4n pic.twitter.com/dL0GAMQj3Q— PlanB (@100trillionUSD) February 7, 2024

PlanB noted that the profitability is not likely to drop to 60% (as indicated by the yellow dots on the chart) until the metric reaches the “red” level of profitability. Currently, the analyst emphasized, only those who purchased Bitcoin at the 2021 price peak are experiencing losses, while all other BTC holders are currently in a profitable position.

BTC Price Rally

Amid strong recovery in the broader cryptocurrency market, Bitcoin price is up more than 4% in the last 24 hours shooting all the way to $44,500. This is the first time that the BTC price has crossed $44,000 ever since the spot Bitcoin ETF launch last month.

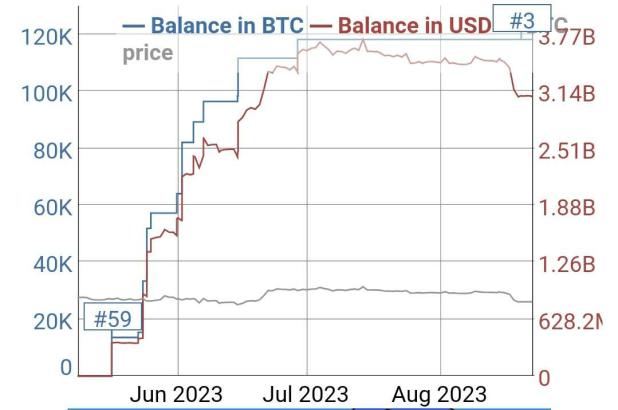

According to insights from on-chain data provider Santiment, this resurgence is partially credited to the uptick in holdings among wallets containing over 1,000 Bitcoins. The collective holdings of these large wallets have surged to their highest level in over 14 months, indicating renewed confidence among major Bitcoin holders.

#Bitcoin is back above $44.5K for the first time since the '#ETF hangover' retrace began back on Jan. 12. This bounce is partially attributed to the rise in 1K+ $BTC wallet holdings. Their collective holdings are at their highest level in 14+ months. https://t.co/mxCoXJbHcW pic.twitter.com/FjZdmPeMvj

— Santiment (@santimentfeed) February 8, 2024

The ongoing momentum in US stock markets also provided support for risk assets such as cryptocurrencies. The S&P 500 closed at a record high, nearing the 5,000 level, while the Dow Jones Industrial Average approached its all-time high, and the Nasdaq Composite edged closer to its record.

Given the enduring correlation between cryptocurrencies and the S&P 500, there is an expectation that Bitcoin, Ethereum, and other cryptocurrencies will eventually catch up. Analysts are also expecting a pre-halving rally for Bitcoin going ahead. On the other hand, the Bitcoin miners have been selling heavily to raise capital to add more rigs to their mining fleet.

90% of Bitcoin Holders in Profit, BTC Price Shoots $44,500 amid Whale Accumulation