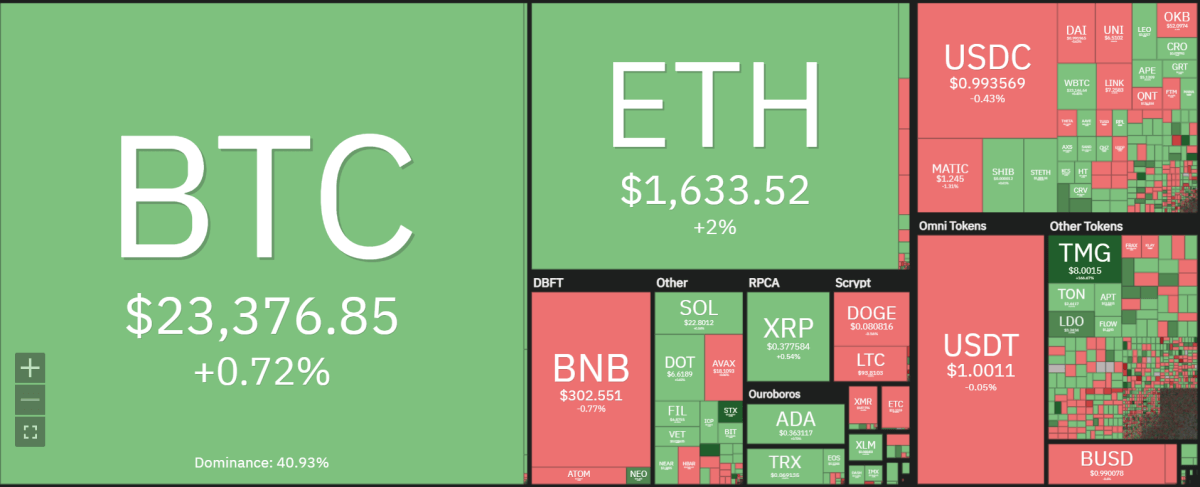

Our Polkadot price analysis for 27th Feb shows the altcoin is trading inside a range-bound zone. The DOT/USD pair has a low at $6.62 and a high at $7.09.Polkadot prices have been moving steadily upwards in a series of higher highs and higher lows on the daily chart. Polkadot is trading at $6.63, with a minor price change of +0.78% in the last 24 hours. Polkadot’s trading volume is currently at $260,131,382, as the market rank of the cryptocurrency is at the 12th spot.

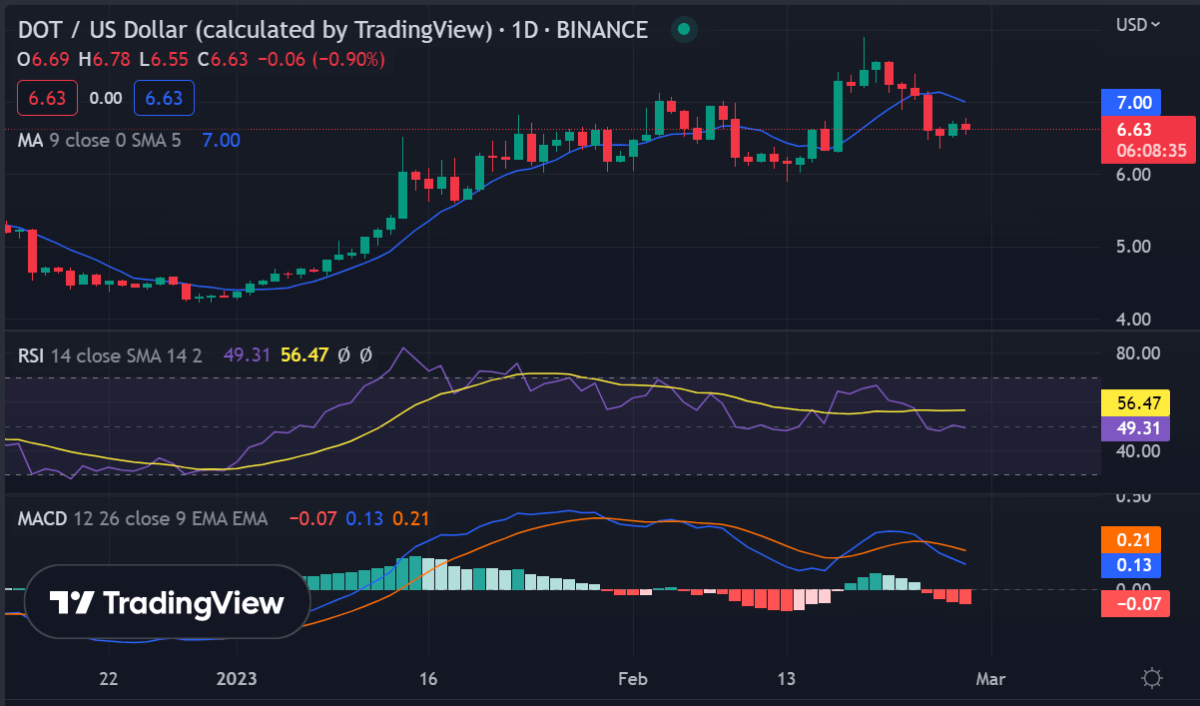

DOT/USD daily chart analysis: Polkadot support present at the 21MA

Polkadot price analysis on the daily chart indicates the 21-day moving average on the daily chart is currently supporting DOT prices at $6.63. The coin has formed a series of higher highs and higher lows, indicating that bulls are in control. The Exponential Moving Average (EMA) of Polkadot is also trending upward. The EMA shows a strong bullish bias, with the 7-day and 25-day EMAs trading at $6.78 and $6.60, respectively.

The Relative Strength Index (RSI) for DOT is currently around the 50-level after dropping from 64. The RSI has turned flat, indicating the market hasn’t yet decided which way it wants to go. The MACD shows a bearish crossover as the Signal line has crossed over from below the histogram, signaling a downward correction.

The major support for the Polkadot price lies at $6.00, with minor supports at $6.50 and $6.30. The major resistance for DOT/USD pair lies at $7.0, with minor resistances at $6.75 and $6.90. If the prices break above the resistance level of $7.0, they could test the next resistance at $7.5 in the near future.

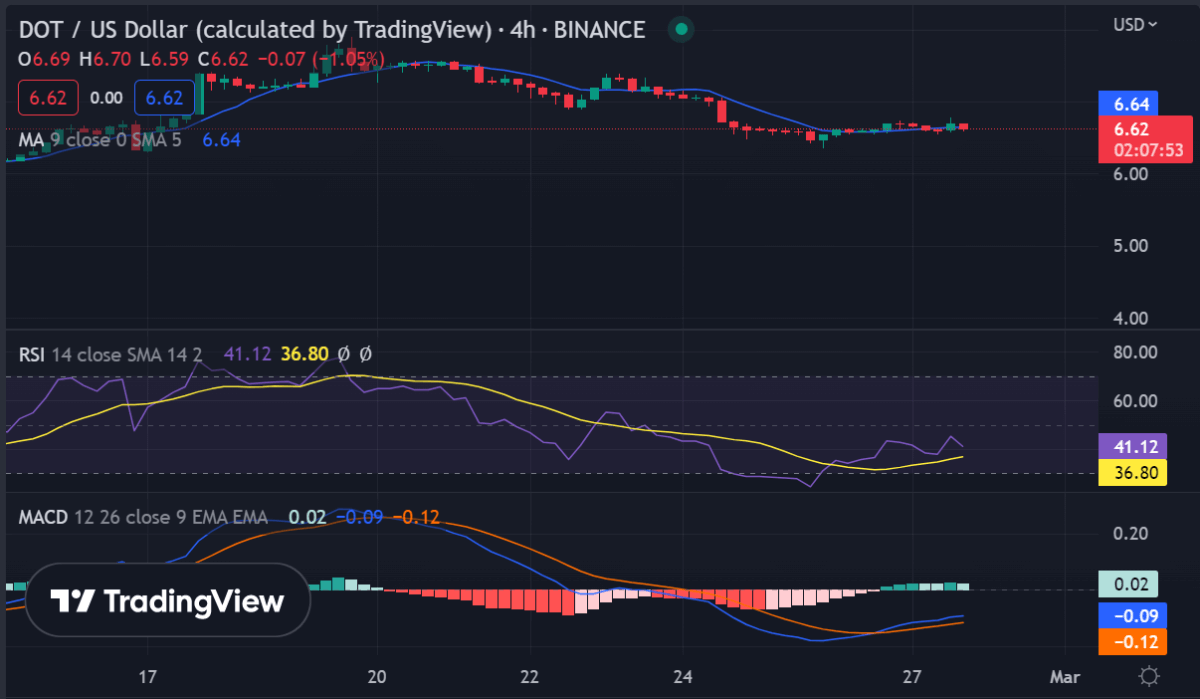

Polkadot price analysis on a 4-hour chart: Fibonacci Retracement levels indicate bearish sentiment

Our Polkadot price analysis on a 4-hour chart reveals the coin is trading between the Fibonacci retracement levels of 61.8% and 78.6%. The prices have been ranging within these levels, which indicates that bears are dominating the market in the short term. The RSI has dropped to 43 and is still heading south, signaling a bearish trend in the near future. The MACD shows a bullish crossover as the Signal line has crossed over from below the histogram.

The moving average lines are also indicating a bearish trend. The 50-MA is currently trading at $6.92, with the 7-day and 25-day EMAs placed around $7.02 and $6.91, respectively.

The major support for the Polkadot price is $6.00, which represents the Fibonacci retracement level of 61.8%. The major resistance has been seen at the Fibonacci retracement level of 78.6%, which is currently placed at $7.0. If the prices break above this level, then it could test the next resistance at $7.5 in the near future.

Polkadot price analysis conclusion

Overall, our Polkadot price analysis for 27th February shows a slow but steady pace, with bulls controlling the market. The prices are likely to continue in this range-bound zone as the major support and resistance levels remain unchanged. Bulls will have to break past $7.0 for a further upside movement, while bears should look out for a drop below $6.00.