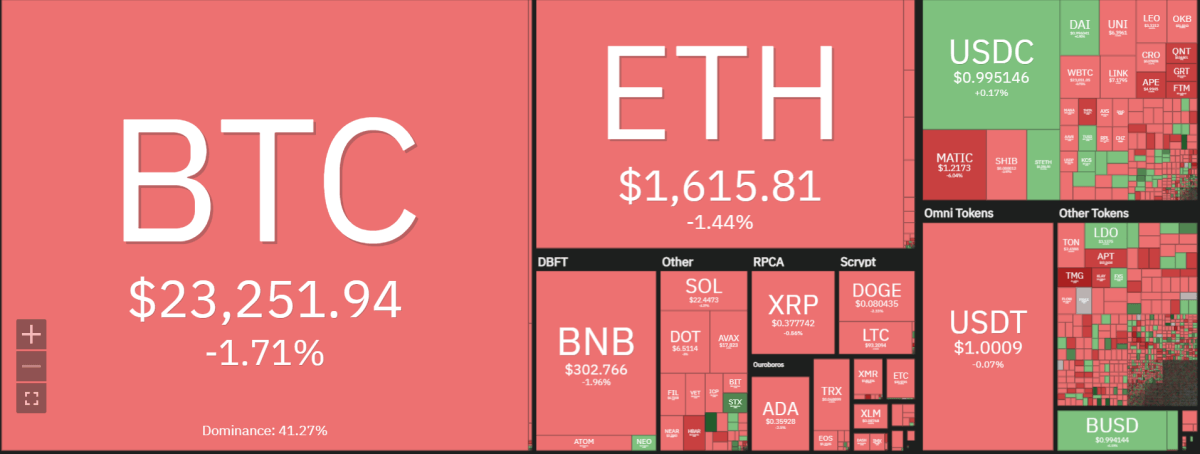

Bitcoin price analysis reveals that selling pressure is starting to weigh on the bullish momentum seen in the past few hours. BTC currently sits below its previous support of $23,800. This marks a significant retracement as the asset peaked at highs of nearly $26,000. As Bitcoin has dropped, it has found some temporary support near $22,700 but traders will be watching this level closely.

At the same time, overhead resistance has formed at the $23,800 zone. This could pose a problem for BTC as it struggles to break higher. The cryptocurrency is currently trading just above the 50-day moving average. If buyers can’t manage to push through this area of resistance in the coming hours, then a deeper pullback could be on the cards.

Bitcoin has formed a bearish crossover between its 50 and 200-day moving averages. This is seen as a sign of weakening bullish momentum which could pressure BTC prices further in the near term. Bitcoin is trading at $23,252.28, down by 1.16 percent in the last 24 hours.

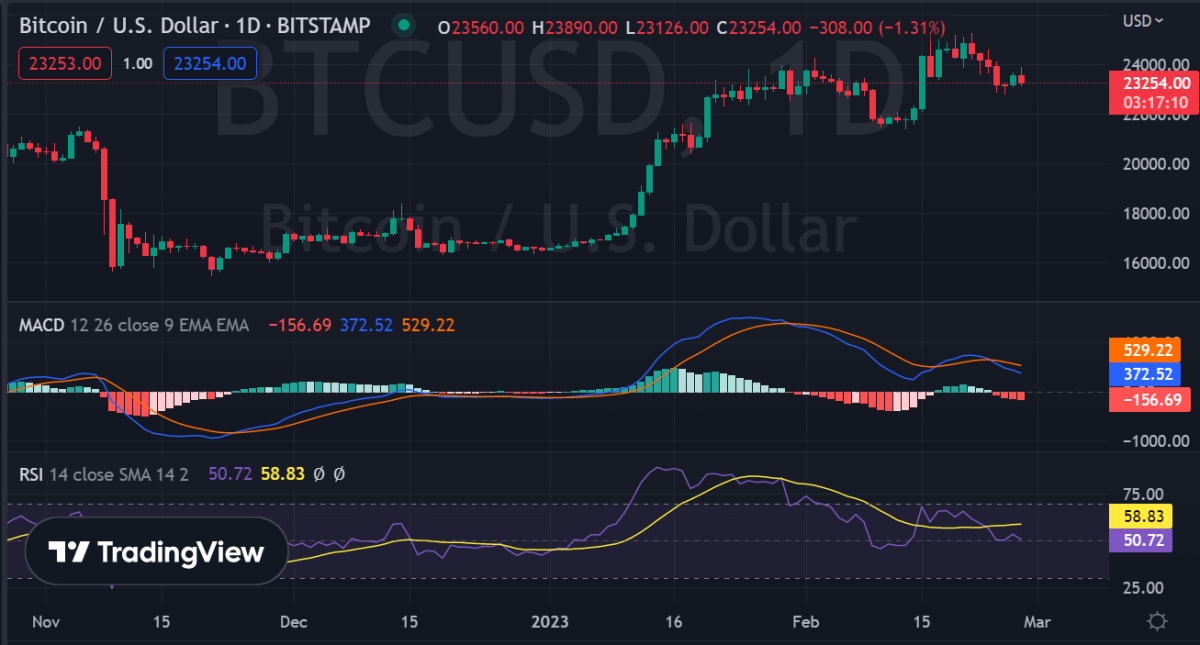

BTC/USD analysis on a daily chart: Bears overwhelm the bulls

On a daily chart, Bitcoin price analysis reveals the BTC/USD pair is searching for support at $22,700 as it retraces from previous highs. The 50-day moving average has crossed below the 200-day moving average, signaling that selling pressure is currently outweighing buying interest. Bitcoin opened today’s trading charts at an intraday low of $23,213.85 and managed to rally higher toward the $24,857 level before falling sharply as bears took control.

At the same time, BTC has now entered a bearish trend on its daily chart as it faces multiple levels of overhead resistance. The United States equities markets and Bitcoin are attempting to begin the week on a positive tone, yet the recent price action shows the bulls are still struggling for momentum.

On Feb. 25, Bitcoin managed to surge past the $22,800 support level before surpassing its 20-day EMA ($23,417) two days later on Feb. 26. This indicates that a steady buildup of buyers is transpiring at lower prices levels – a promising sign for investors.

The technical indicators are also favoring a bearish outlook, with the Relative Strength Index (RSI) trending lower and currently sitting at 50.87 and the MACD being in bearish territory.

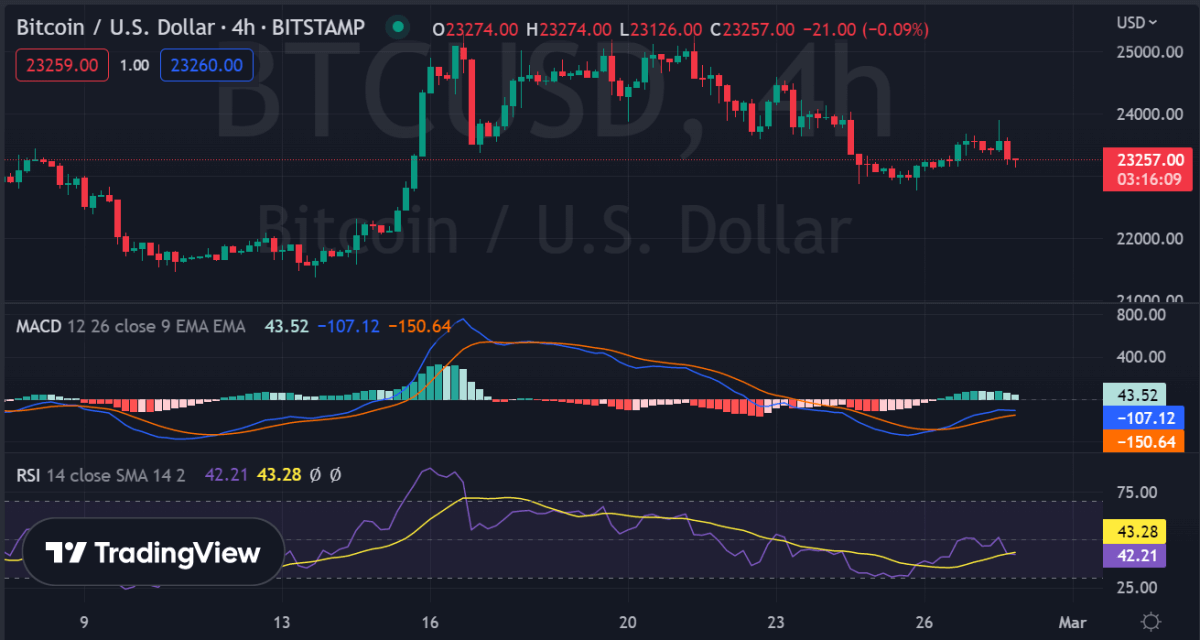

Bitcoin price analysis on a 4-hour chart: Bulls unable to challenge 200-day MA

A 4-hour Bitcoin price analysis chart reveals that BTC/USD is trading just above its 50-day moving average. The asset is attempting to break higher but has met resistance at the 200-day MA ($23,540). At the time of writing, it looks like the bulls are unable to challenge this overhead resistance and a deeper pullback could be on the cards.

The RSI is also trending lower and currently sitting at 48.21 while the MACD line is below the signal line, indicating a bearish divergence in momentum.

Bitcoin price analysis conclusion

Bitcoin price analysis for today reveals that the asset is struggling to break higher amid overhead resistance. The cryptocurrency has retraced below its previous support of $23,800 and is attempting to find a floor near $22,700. Technical indicators are also favoring a bearish outlook as well, with no signs of a recovery in sight.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Polkadot, and Curve