Bitcoin price analysis for the new month is bullish as Bitcoin has managed to surge past yesterday’s high of $23,880.63. Bitcoin opened today’s trading session trading along the support line of $23,000 whereby the bears came and dipped the prices to lows of $22,800. However, the bulls managed to defend this level and push higher past yesterday’s high. The price is currently trading at $23,734.05 and is showing further upside potential. If BTC continues to sustain the bullish momentum it could reach prices of $24,000 or even higher in the days ahead.

Bitcoin closed February with a green monthly candle and looks to be entering a new bullish phase in March. It is also important to note that the bulls have been defending the support line of $23,000 for three days now thus confirming its strength as a key support level. Bitcoin seems to have bottomed at the $23,000 level as the bulls have held the line for over a week. The buyers seem to be back in full force and the market could start surging north of $24,000 once more if there is enough bullish momentum.

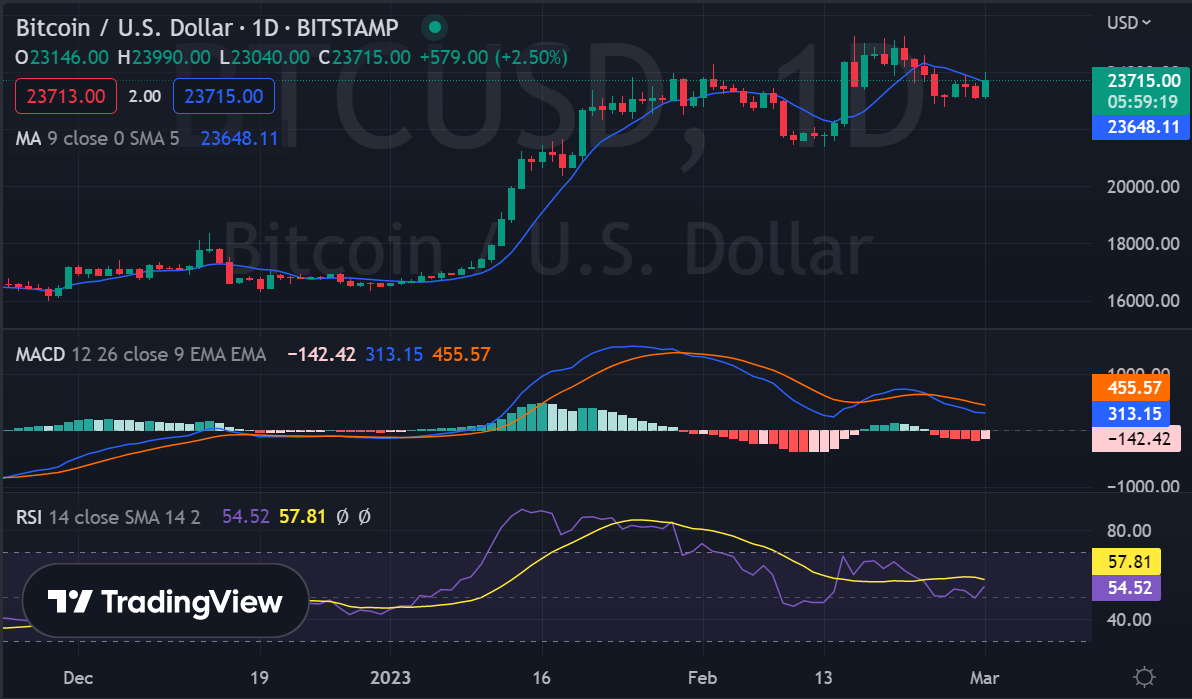

Bitcoin price analysis on a daily chart: Bulls gather steam above the $23,500 level

On the daily chart, Bitcoin has been trading in a range-bound manner with support at $23,400 and resistance at $24,000-$24,100. The previous day’s high of $23,880.63 is currently acting as strong support for the bulls and could be tested once again. If the bulls manage to push the price past this level and sustain it, we could see Bitcoin surge above $24,000 in the days ahead. However, if the bears make a comeback and break below the SMA 50 and the $23,400 support level, we could expect Bitcoin to dip toward the SMA 200 at $22,600.

Bitcoin technical indicators reveal the bulls have not yet established firm control of the market. The RSI is still hovering in neutral territory and the 8-day EMA is trading below the 21-day EMA indicating that further sideways action could be expected in days ahead. The MACD line is still trending below the red signal line, thus confirming that the bears still have a stronghold in the market.

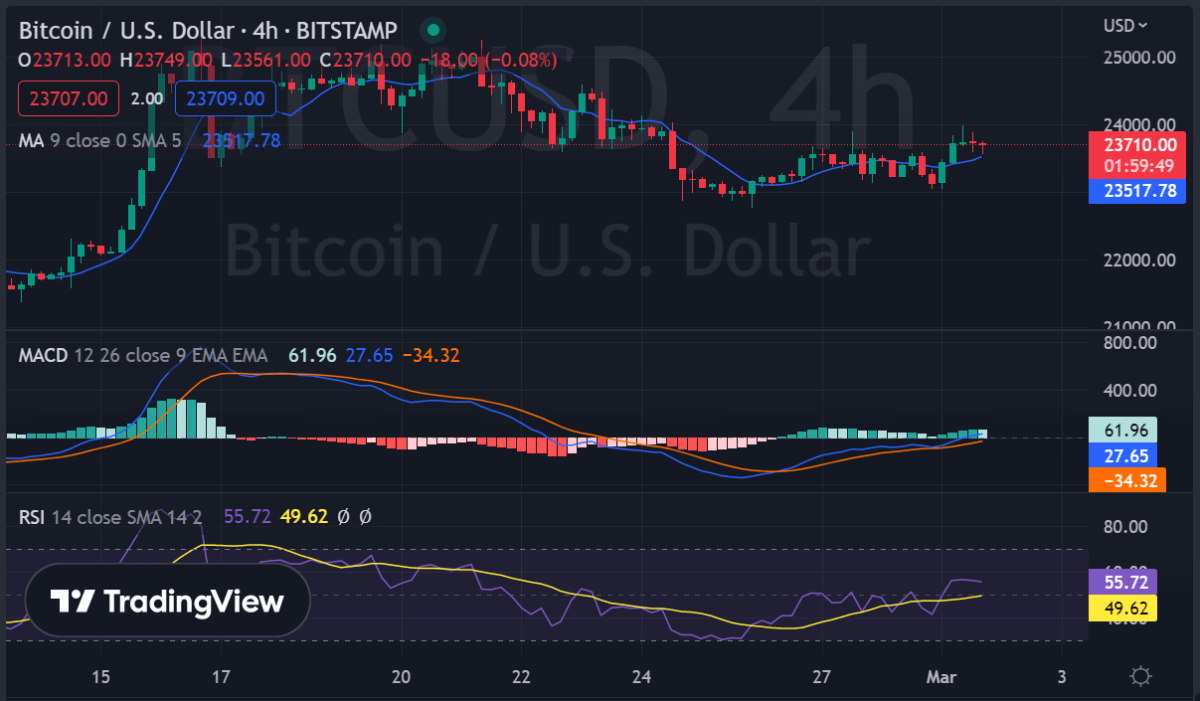

Bitcoin price analysis in a 4-hour timeframe: Bullish divergence

Bitcoin price analysis on a 4-hour chart reveals BTC could potentially break out from the $23,500-$24,000 range. The MACD line is trending above the red signal line indicating that the bulls are slowly but surely gaining control of the market. Furthermore, a bullish divergence has formed on the 4-hour chart which could be signaling a possible reversal in trend sometime soon if Bitcoin manages to close above $24,000.

The price of BTC is however below the daily moving average and the 8-day EMA, indicating that further sideways action is likely before we see any major moves. The Relative Strength Index indicator is currently at 55.75, signaling that there is room for further upside if the buyers can continue to gain momentum in the upcoming days.

Bitcoin price analysis conclusion

Bitcoin price analysis for today shows Bitcoin remains bullish and could potentially surge past $25,000 this month if enough bullish momentum is maintained. The key support level to watch out for is at $23,500 while resistance lies at $24,000-$24,100. Further sideways action is likely before we see any major moves and the RSI indicator needs to move into overbought territory for a more definitive uptrend to be confirmed.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Polkadot, and Curve