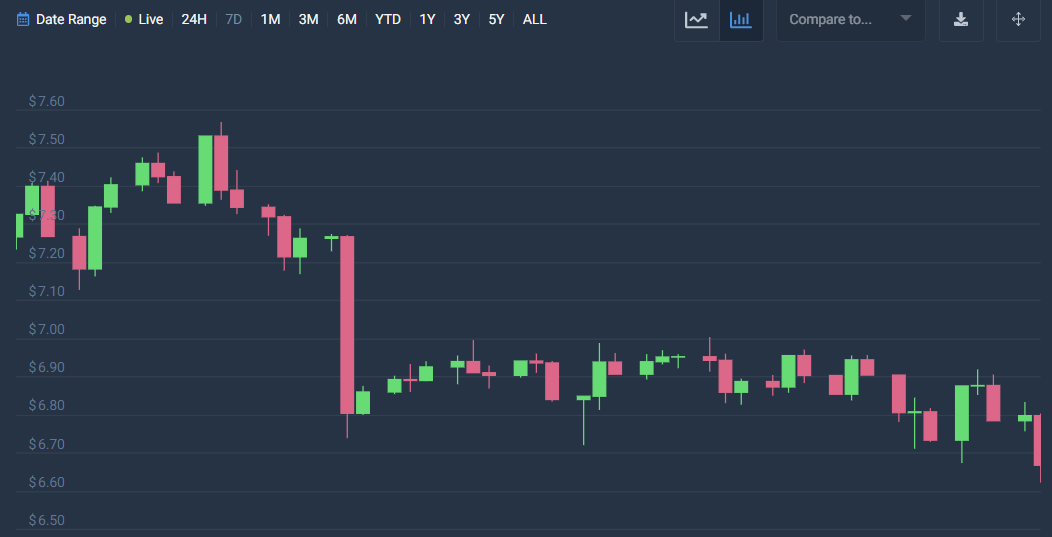

ChainLink price analysis for March 8, 2023, reveals the market following a massive downward movement, showing decreasing momentum, signifying negativity for the LINK market. The price of ChainLink has remained bearish over the past few hours. On March 7, 2023, the price reached $6.7 from $6.9. However, the market further decreased in value soon after and lost some value. Moreover, ChainLink has decreased and reached $6.6, just moving onto the $6.5 mark.

Chainlink’s price today is $6.66 with a 24-hour trading volume of $615.26M, a market cap of $3.44B, and a market dominance of 0.34%. The LINK price decreased by 1.64% in the last 24 hours.

Chainlink reached its highest price on May 10, 2021, when it was trading at its all-time high of $52.89, while Chainlink’s lowest price was recorded on Sep 23, 2017, when it was trading at its all-time low of $0.126297. The lowest price since its ATH was $5.36 (cycle low). The highest LINK price since the last cycle low was $9.45 (cycle high). The Chainlink price prediction sentiment is currently bearish, while the Fear & Greed Index is showing 50 (Neutral).

Chainlink’s current circulating supply is 517.10M LINK out of the max supply of 1.00B LINK. The current yearly supply inflation rate is 10.73% meaning 50.09M LINK were created in the last year. In terms of market cap, Chainlink is currently ranked #3 in the DeFi Coins sector and ranked #6 in the Ethereum (ERC20) Tokens sector.

LINK/USD 1-day price analysis: Latest developments

ChainLink price analysis reveals the market’s volatility following a declining movement. This means that the price of ChainLink is becoming neither less prone to the movement towards either extreme, showing dormant dynamics. The opening price is $6.68, while the high price appears to be $6.68. Conversely, the low price is present at $6.65, with a close price remaining at $6.66. ChainLink market is undergoing a change of -0.38%.

The LINK/USD price appears to be moving under the price of the Moving Average, signifying a bearish movement. The market’s trend seems to be dominated by bears. Moreover, the LINK/USD price appears to be moving downward, illustrating a decreasing market. The market appears to be showing bearish potential. The price is expected to surely crash to $6.5 by the end of next week.

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 39 showing an unstable cryptocurrency market. This means that cryptocurrency is under the lower neutral region. Furthermore, the RSI appears to move downward, indicating a decreasing movement. The dominance of selling activities causes the RSI score to decrease.

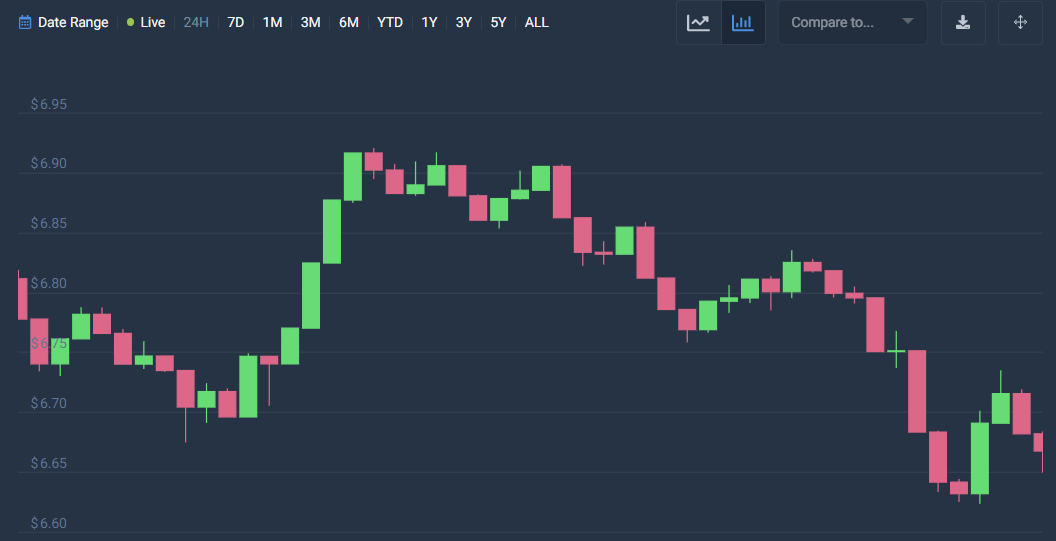

ChainLink price analysis for 7-days

ChainLink price analysis reveals the market’s volatility following a decreasing movement, which means that the price of ChainLink is becoming less prone to experience variable change on either extreme. The Opening price appears to be $6.80, while the high price is present at $6.81. Conversely, the low price is present at $6.62, with a change of -2.15% and a close price of $6.65.

The LINK/USD price appears to be moving under the price of the Moving Average, signifying a bearish movement. Moreover, the market’s trend seems to have shown bearish tendencies in the last few hours. Moreover, the market has decided on a negative movement, which will decrease its value and strengthen the bearish control of the market.

Chainlink price analysis shows the Relative Strength Index (RSI) to be 45, signifying a stable cryptocurrency. This means that the LINK cryptocurrency falls in the lower-neutral region. Furthermore, the RSI path seems to have shifted to a downward movement. The decline in the RSI score also means dominant selling activities.

ChainLink Price Analysis Conclusion

Chainlink price analysis reveals that the cryptocurrency follows a declining trend with much room for activity on the negative extreme. Moreover, the market’s current condition appears to be following a declining approach, as it shows the potential to move further downwards.