As the Argentine peso (ARS) faces persistent inflation, Bitcoin’s (BTC) price reached an all-time high in ARS terms last week. On April 18, the BTC-to-ARS exchange rate surpassed 6.59 million ARS, according to Google Finance price data. Despite a correction to around 6 million ARS, marking a 9% decrease, the price is still more than 100% higher year-to-date (YTD).

The decline in the ARS has led Argentinians to seek shelter in the US dollar, which has become increasingly scarce due to rising demand in the country. However, as traditional currencies struggle, Bitcoin and other cryptocurrencies outside the purview of governments and central banks have emerged as alternative options.

Argentinians embrace Bitcoin amid currency woes

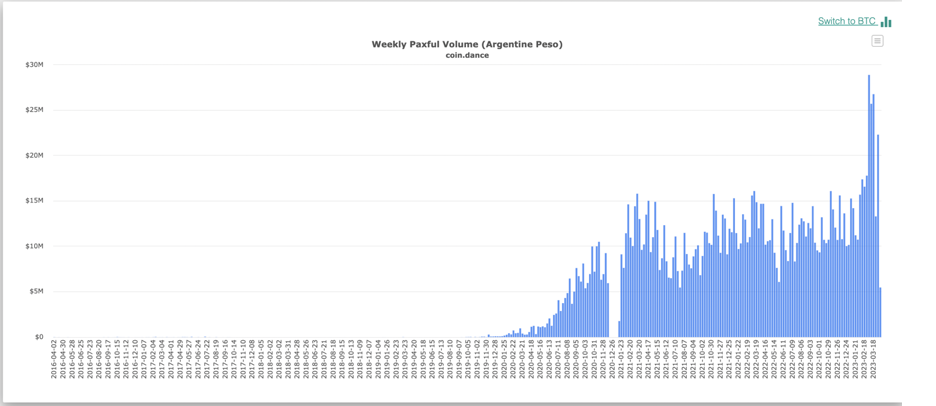

As the value of the peso decreases, Argentinians are growing more interested in cryptocurrencies. Data shows that Bitcoin’s peer-to-peer weekly volume in Argentina reached a record high of nearly $30 million on the Paxful exchange in March.

Furthermore, a 2022 study revealed that about 60% of Argentinians believe Bitcoin can preserve the value of their savings in the long term.

Leading US cryptocurrency exchange, Coinbase, supports the idea of Bitcoin becoming legal tender in Argentina, highlighting the growing trust in digital currencies. This trend is further evidenced by a recent bill proposed by the Ministry of Economy, which encourages citizens to declare their crypto holdings and offers tax benefits as an incentive.

Argentina’s financial sector warms to cryptocurrency

In response to the growing demand for cryptocurrencies, Argentina’s financial sector has taken several steps toward embracing digital assets. In April, the country’s securities regulator, the National Commission of Value (CNV), approved a Bitcoin-based futures index on the Matba Rofex exchange. This peso-settled derivative, scheduled to debut in May, will enable accredited investors to gain exposure to the Bitcoin market.

Additionally, in December 2022, an Argentine province announced its intention to issue a dollar-backed stablecoin. These developments illustrate Argentina’s evolving financial landscape as cryptocurrencies begin to play a more significant role in the nation’s economy amid ongoing currency challenges.