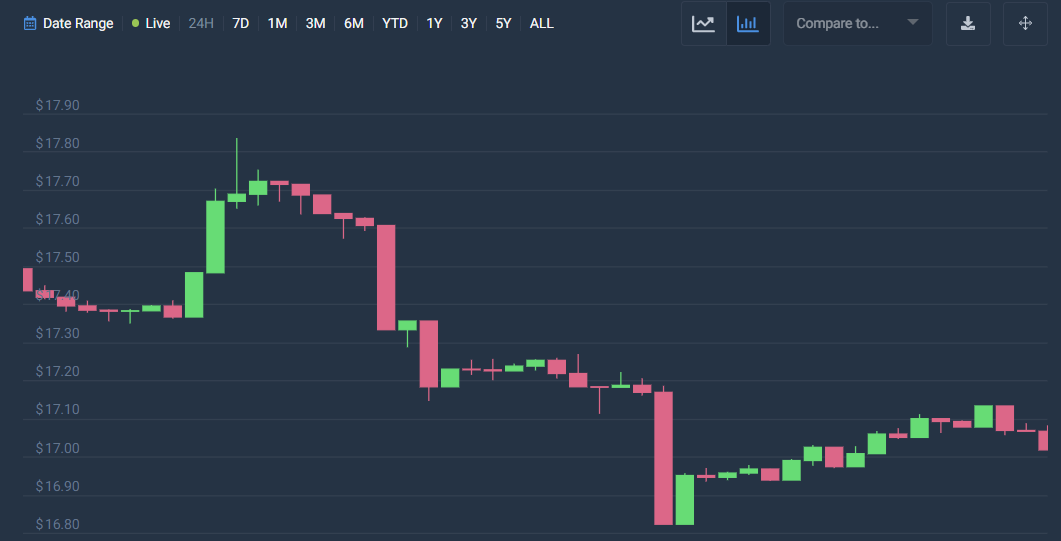

Avalanche price analysis reveals that there is a notable downward trend indicating that the price may continue to decline, and possibly reach new lows. In the last 48 hours, the price has decreased significantly, experiencing a sudden drop from $17.8 to $16.8 on April 29, 2023, followed by a subsequent increase in momentum. Despite this temporary recovery, the bearish trajectory has persisted, with the price reaching a low of $16.9 on May 1, 2023, before modestly rebounding to its current level.

As of today, Avalanche’s price is $17.00, and it has a trading volume of $283.08M in the last 24 hours. Its market cap is currently $5.56B, with a market dominance of 0.47%. In the past 24 hours, AVAX has experienced a decrease of -2.21%. Currently, the market sentiment for Avalanche’s price prediction is bearish, while the Fear & Greed Index is showing 63 (Greed).

Avalanche’s circulating supply is currently 326.93M AVAX out of its maximum supply of 720.00M AVAX. The yearly supply inflation rate is 21.71%, which means that 58.32M AVAX was created in the last year. In terms of market capitalization, Avalanche is ranked #7 in the Proof-of-Stake Coins sector, ranked #1 in the Avalanche Network sector, and ranked #11 in the Layer 1 sector.

AVAX/USD 1-day analysis: Latest developments

Avalanche price analysis indicates that the AVAX/USD pair is presently in a state of instability marked by a bearish trend and decreasing levels of volatility. The AVAX opened at $17.03, with the highest price point of $17.05, while the lowest price recorded was $16.99, indicating a minor shift of -0.22%. As of the latest update, the closing price for AVAX is reported at $16.99.

Avalanche price analysis shows that there is currently a downward trend, as the price has fallen below the Moving Average curve. Recent market activities also indicate that bearish forces have dominated and are expected to continue in the near future. However, the price is displaying a declining pattern and approaching the support level, which suggests that if the bulls are able to take advantage of this situation, there is a possibility that the trend could shift favorably in the upcoming times.

Avalanche price analysis reveals that the AVAX/USD pair has an RSI reading of 43, which suggests a stable market condition. The RSI trend has been on a decline, with the indicator dropping below the lower neutral zone. This indicates that selling activity is currently dominating the market.

Avalanche price analysis for 7-days

Based on the Avalanche price analysis, the current market volatility is displaying a downward trend, which indicates a lower probability of price fluctuations. The high price of AVAX at present is $17.14, whereas the open price is $17.10. However, the current low price of AVAX stands at $16.99, indicating a decrease of -0.37%, with the close price being reported at $17.04.

According to the latest Avalanche price analysis, the AVAX/USD pair is experiencing a bearish trend as the price is crossing below the Moving Average curve. Despite a negative market sentiment in recent days, the bullish momentum seems to be weakening, and bearish activity is taking over. However, there are signs that the AVAX/USD price might attempt to exceed the support level, which could lead to a market breakout.

Avalanche price analysis reveals that AVAX price suggests that it is currently stable, with an RSI reading of 46, indicating equal buying and selling activities. The RSI’s linear path indicates that the AVAX/USD pair is maintaining its stability. The cryptocurrency is currently located in the central-neutral region, suggesting a linear price path. This implies that the price may continue to follow a stable trajectory and maintain its stability in the near future.

Avalanche Price Analysis Conclusion

Avalanche price analysis suggests a significant bearish movement, which may potentially reverse in the future. The market is currently being influenced by bearish forces, leading to a decrease in value and a weakened position for buyers. However, a successful breach of the current support level may prompt a reversal in favor of the buyers, thereby leading to a possible market recovery. The cryptocurrency’s behavior is characterized by volatility and unpredictability, with a stable RSI indicating balanced buying and selling activities reflected in the linear path.