Crypto coins have been a hot topic in recent years, with Bitcoin (BTC) leading the way as the most popular and valuable digital asset. However, the price of Bitcoin and other cryptocurrencies can be volatile, with significant fluctuations in value occurring frequently. Today, many investors and analysts are asking, “Why is the BTC price down?” as the market experiences another dip in prices.

Some are even questioning whether this is the beginning of another “crypto winter,” a period of prolonged market downturns in the crypto space. Here we look at the reasons behind the current market conditions and analyze what they might mean for the future of the crypto ecosystem, particularly Bitcoin.

Crypto markets take an unprecedented nosedive

Bitcoin price is down today as ongoing “congestion” frustrates traders and pressures market sentiment. The total crypto market cap (TOTALCAP) and Bitcoin (BTC) both fell after rejections from the closest horizontal resistance area.

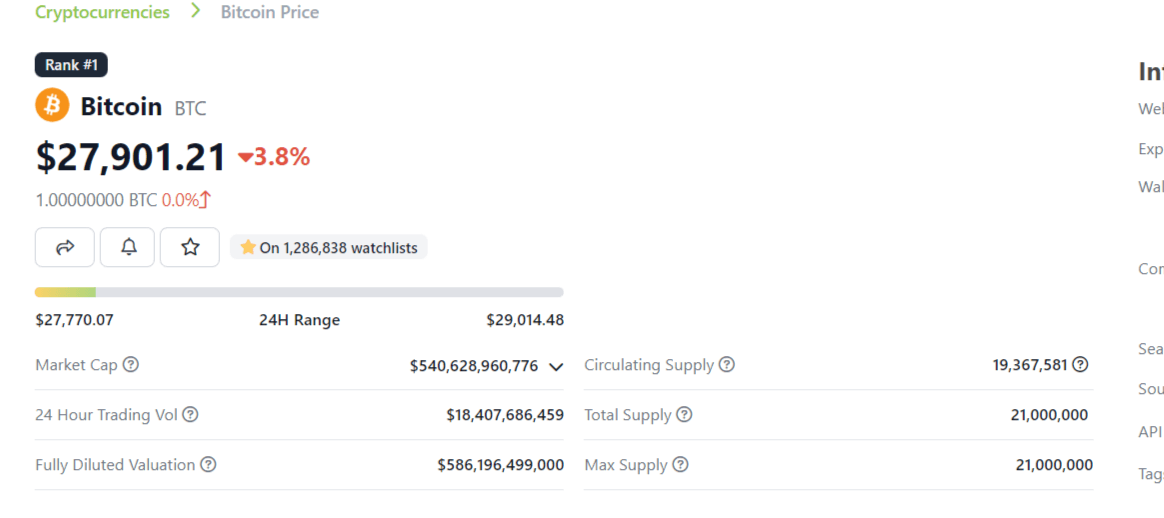

According to CoinGecko the price of Bitcoin stands at $27, 901. The price is down 3.83%. Over the past week, the price has dropped by 4.98%.

The largest crypto continues to experience a decline in sentiment after transaction fees reached all-time highs and the mempool nearly reached capacity. In the news, Binance suspended Bitcoin transactions for a second time in a few hours because the network became congested, resulting in a significant increase in transaction fees.

According to market participants, the root of the problem is mass transactions “spamming” the Bitcoin network. Binance, which blamed “congestion” for the disruptions, caused a withdrawal backlog, which exacerbated the already tense market sentiment. A subsequent tweet verified the clearing of the backlog.

Since April 14, the TOTALCAP has dropped. It fell below the $1.16 trillion mark on April 20. Binance Coin, the company’s in-house token, equaled Bitcoin’s 24-hour losses, falling roughly 2.4% to trade near $315. Whether they were supportive or not, traders agreed with Binance CEO Changpeng Zhao when he labeled the market reaction to the withdrawal pauses “FUD.”

It’s not the first time Binance has been in the heart of a dispute over the price of bitcoin. Late in March, another news that Zhao also referred to as “FUD” had a similar impact.

Does the crypto market risk an other crypto winter?

The Bitcoin price has traded within a tight 8.5% range between $27,250 and $29,550 for the past 17 days, causing the 40-day volatility metric to fall below 40%. This was not limited to cryptocurrencies, as the historical volatility of the S&P500 index has reached 17%, its lowest level since December 2021.

The comparatively low price fluctuations in risk markets can be attributed to a variety of factors, such as the anticipation of a recession, investors’ reluctance to place new bets until the U.S. Federal Reserve stops raising interest rates, and increased demand (and emphasis) on fixed income trades.

No one has been able to establish what has been causing investors to limit their risk appetite and push Bitcoin’s price sideways. Warren Buffett, a multibillionaire fund manager, is among those who fear that commercial real estate is a growing concern that could spark significant turmoil in the future.

Buffett does not foresee any alternatives to the weakening of the U.S. dollar, despite the belief of some that the U.S. debt ceiling debate and the financial crisis will exacerbate the dollar’s decline. As his investment thesis prioritizes yield-generating assets, the finance magnate has been a longtime critic of the precious metal gold.

The drama surrounding the debt ceiling has prompted Treasury Secretary Janet Yellen to warn of a “severe economic downturn” if Congress fails to act within the next few weeks.

This complex environment of inflation risks, an economic downturn, and a weakening U.S. dollar may have caused investors to lose interest in risk assets and focus their wagers on fixed income trades as annual interest rates have risen above 5%.

For crypto, a negative futures contract premium or an increase in option-hedging costs would be an alarming portent. Investors should therefore carefully monitor these BTC derivatives metrics.