Avalanche price analysis indicates the emergence of a bearish trend that is progressively gaining strength, with substantial potential for further downward movement. The AVAX/USD trading pair is currently priced at $14.8, showing a decline of 0.48% within the past 24 hours. Yesterday, the market witnessed a substantial downturn, marked by a swift downward trajectory, and is now showing early signs of optimistic bullish activity after falling below the $14.6 threshold. Additionally, there is a decrease in market volatility, creating a favorable environment for the bulls to initiate a significant rebound.

As of today, the price of Avalanche (AVAX) stands at $14.80, accompanied by a 24-hour trading volume of $203.96 million. The market capitalization of AVAX amounts to $4.93 billion, indicating a market dominance of 0.43%. Over the past 24 hours, the AVAX price experienced a decrease of -0.36%. Currently, the sentiment for Avalanche price prediction is bearish, while the Fear & Greed Index indicates a neutral value of 50.

The circulating supply of Avalanche is currently 332.90 million AVAX out of a maximum supply of 720.00 million AVAX. The yearly supply inflation rate stands at 23.70%, resulting in the creation of 63.79 million AVAX in the past year. In terms of market cap rankings, Avalanche holds the seventh position in the Proof-of-Stake Coins sector, first position in the Avalanche Network sector, and eleventh position in the Layer 1 sector.

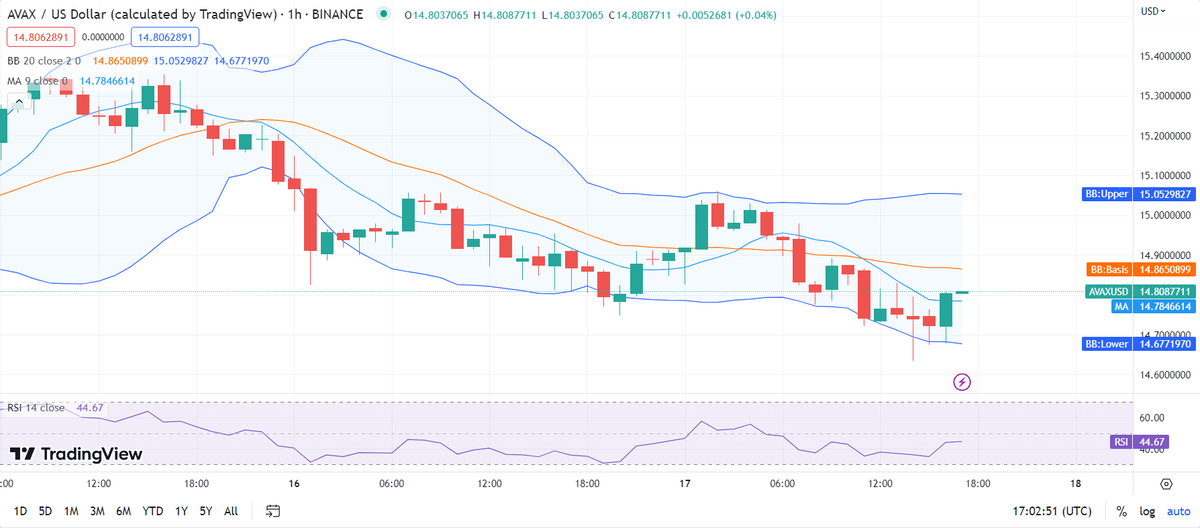

AVAX/USD 1-hour analysis: Latest developments

Avalanche price analysis suggests an increasing trend in market volatility, implying that the AVAX/USD prices are becoming more susceptible to significant fluctuations. The Bollinger Bands exhibit a noteworthy resistance level for AVAX at $15, while concurrently presenting a significant support level at $14.6.

The AVAX/USD price has recently exhibited a downward movement, falling below the Moving Average curve. This occurrence signifies a bearish trend in the market, indicating that sellers are exerting significant influence and driving the price lower. The presence of bearish market participants has been consistently observed over the past few hours, suggesting that their impact is likely to endure. Furthermore, as the price approaches the support level, the prevailing bearish sentiment becomes more pronounced. This situation indicates the potential for a market breakout, emphasizing the prevailing downward pressure on AVAX/USD.

Avalanche price analysis reveals that the Relative Strength Index (RSI) currently stands at 43, indicating that the cryptocurrency is stable. Additionally, the RSI has been following a linear trajectory within the central neutral range, suggesting an equivalent selling and buying activity in the market.

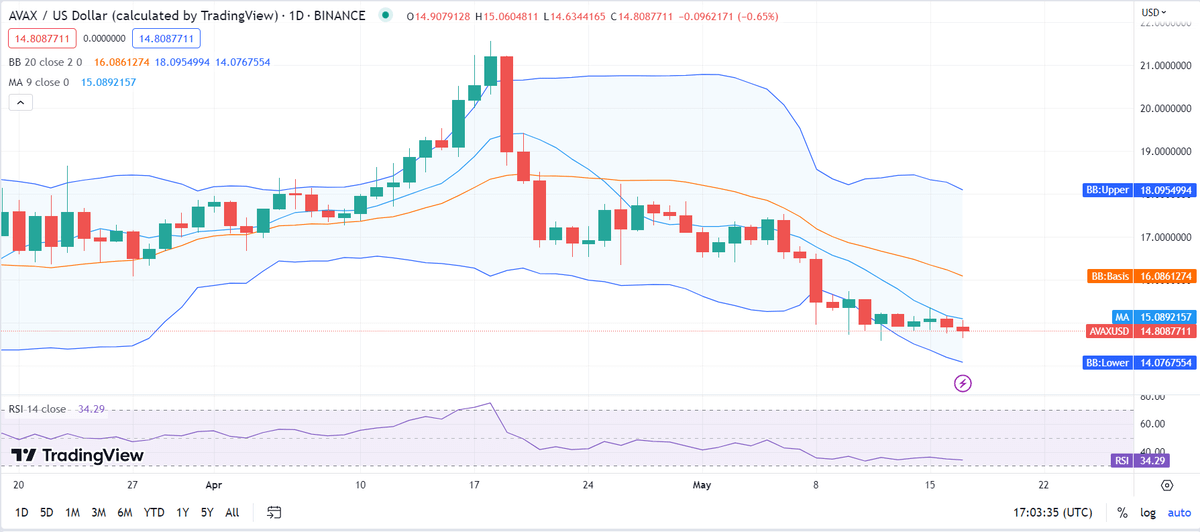

Avalanche price analysis for 1-day

Avalanche price analysis indicates an increasing trend in market volatility, suggesting a higher probability of AVAX/USD experiencing fluctuations as volatility rises.

The Bollinger Bands depict a noteworthy resistance level for AVAX at $18, which holds considerable significance in impeding the price from further upward movement. Conversely, the Bollinger Bands establish a robust support level for AVAX at $14, indicating its efficacy in preventing the price from declining further. These levels serve as crucial benchmarks for traders and investors, offering valuable guidance for evaluating and analyzing AVAX’s price dynamics.

The AVAX/USD price is currently crossing below the Moving Average curve, signaling a bearish move in the market. Despite the market’s direction appearing relatively stable in recent days, bears have exerted control, weakening the position of the bulls. Additionally, the AVAX/USD price breaking below the support band suggests a potential market breakout.

The Relative Strength Index (RSI) is currently at 34, suggesting that the cryptocurrency is undervalued. Moreover, the price of the cryptocurrency is displaying a downward trajectory within the undervalued region, indicating a decline in value and a shift towards devaluation, accompanied by increased selling activity. This situation has the potential to trigger a strong reversal movement in the market, potentially favoring a shift in momentum and providing an opportunity for a bullish market trend to emerge.

Avalanche Price Analysis Conclusion

Avalanche price analysis indicates a prevailing bearish trend in cryptocurrency. However, there exists a notable possibility of a reversal if the support level is breached. The current market conditions demonstrate a strong influence exerted by bearish participants, who have maintained control. Despite the challenges faced by the bulls, they have the potential for a significant resurgence if they can capitalize on a potential breakout. This presents an opportunity for a noteworthy recovery in the upcoming days.