The latest Polkadot price analysis shows a bullish market sentiment. In the past 24 hours, DOT prices have increased from $5.22 to $5.30 at the time of writing. Despite trading on a bearish note earlier, buyers have revived the market sentiment by pushing up prices. The markets were much higher during the day, with a peak of $5.30 before it dropped slightly to the current price.

Resistance and support levels have been identified at $5.30 and $5.22, respectively, according to the Polkadot price analysis. If DOT prices are able to break beyond resistance, then they could go up a further level of $5.35 – $5.40. On the other hand, if prices face a bearish turn, they may dip to hit support levels of $5.20 – $5.15.

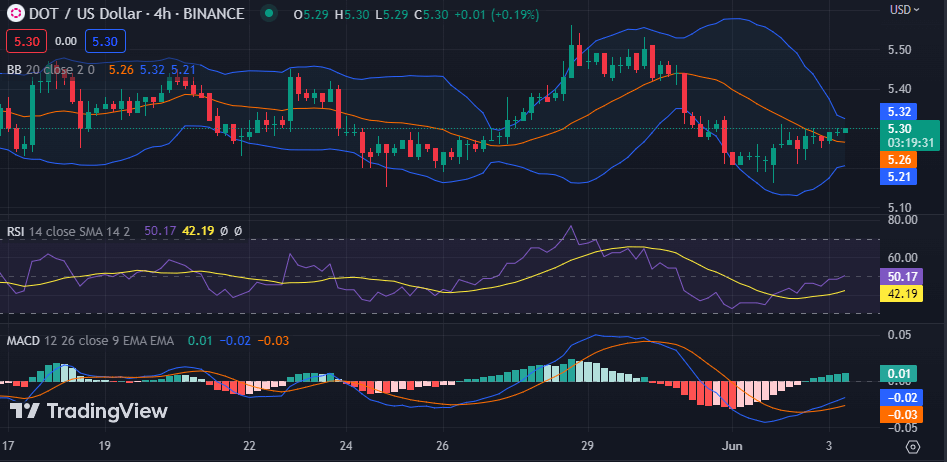

Polkadot price analysis: DOT’s uptrend movement face resistance at the $5.30 mark

On the daily chart, Polkadot’s price analysis shows an uptrend in the past 24 hours. DOT prices are currently trading at $5.29, up by 0.58 percent. The daily chart also suggests that the resistance level has been identified at the $5.30 mark, and DOT prices are likely to face more resistance if the buyers cannot push the prices any higher.

Technically, the Relative Strength Index is currently at the 43.94 index mark, which indicates that the market is currently a neutral region. If the buying volume increases, then the RSI might cross above the 50 indexes and enter into the bullish region. Similarly, if DOT prices start to go down, they could enter into the oversold zone with the RSI going below 30.

Moving Average Convergence Divergence is also in the bullish region. The MACD line has crossed above the signal line, which could suggest a possible uptrend in the DOT prices. However, the green bars on the histogram are losing strength, which could suggest a weakening bullish momentum in the market.

Furthermore, the Bollinger Bands shows a narrow path which could indicate a low trading volume. Still, since the green candlesticks are forming on the chart, it could also signify a volatility incoming in the market.

Polkadot price analysis 4-hour chart: Latest developments

The 4-hour chart for Polkadot price analysis confirms the bullish move in the market. DOT is trading in a narrow range of $5.27 to $5.30. The trend line is heading upwards, which indicates a bullish movement in the market. The bulls need to push the prices above $5.30 for the uptrend to continue in the market.

The RSI has moved up to the 50.17 level, which suggests that buyers have taken control of the market and might continue pushing prices higher. The MACD line is above its signal line, signifying a bullish momentum in the markets. The histogram is firmly in the positive territory.

The Bollinger Bands are showing a narrow path which could indicate a low trading volume in the markets but at the same time, it could also indicate that DOT prices might break out from current levels and move higher or lower depending on the market sentiment.

Polkadot price analysis conclusion

To conclude the Polkadot price analysis, DOT prices have been heading upward and are currently trading at $5.29. The 4-hour chart suggests that buyers have taken control of the market and might continue pushing DOT prices higher in the near future. Resistance has been identified at the $5.30 mark, which needs to be broken for bulls to take control of the market.