Is Ethereum under siege? The Ethereum ecosystem is embroiled in a controversy over the outsized impact one of its staking pools, Lido Finance (LDO), has on the network as a whole. Anthony Sassano, the proprietor of The Daily Gwei and independent Ethereum educator, is credited with sparking the centralization concerns with a tweet.

Ethereum faces controversial issues over centralization

The current controversy encircling the Ethereum ecosystem concerns liquid staking derivatives or LSDs, and Lido Finance in particular.

Liquid staking refers to the procedure of depositing Ethereum into a protocol that combines it with other user deposits and stakes it on their behalf. In exchange, users receive a second token that represents their staked position and accrues its own rewards. In the case of Lido, consumers receive Staked Ethereum (stETH).

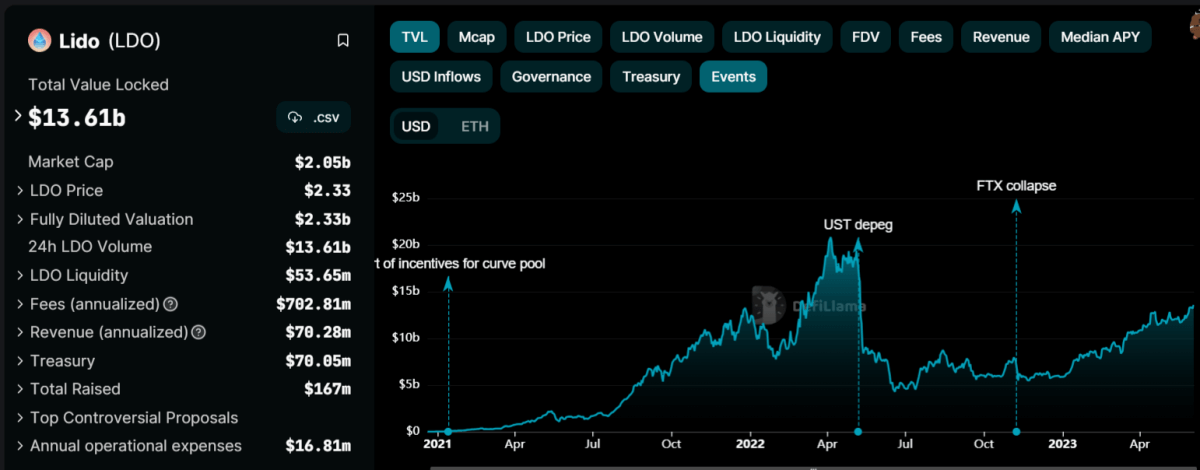

According to DeFi Llama, the threat at issue is Lido’s current market dominance, which accounts for 74% of all LSDs. The pool contains over 7 million ETH, valued at approximately $13 billion, and it has grown by 12% over the past thirty days. The issue is that centralization is straightforward. Although Lido is a stakes provider, the company’s current circumstance is precarious. It is unable to stop the chain or transactions. It remains a significant danger to the social decentralization of the chain.

The aforementioned LSDs, which are derived from the deposited ETH, are also a source of concern. In finance, a derivative is an instrument whose value is derived from another asset. They are used to speculate further on a given asset, ETH, in this instance.

Another source of concern is the aforementioned LSDs, which are derivatives generated on top of the staked ETH. In finance, a derivative is an instrument whose value is derived from another asset. They are used to speculate further on any particular asset, in this case ETH.

The concerns of other analysts echo the discourse surrounding centralization from the previous year, prior to the Ethereum merge. At the time, there was concern that centralized entities, such as wallets that had interacted with the US-sanctioned Ethereum aggregator Tornado Cash, would block certain transactions.

The Ethereum Foundation echoes centralization concerns

There are additional concerns authored by the ETH Foundation itself. In a blog post titled The Risks of LSD, the foundation explains that if LSD exceeds consensus thresholds, it could lead to the formation of “block space cartels.” Due to their coordinated maximal extractable value (MEV) extraction, block timing manipulation, and censorship, these cartels can generate enormous profits.

Simply put, the larger a particular pooled staking “cartel” becomes, the greater the rewards it obtains and the greater the incentive for users to pool their funds with that provider.

Eric Conner, an Ethereum core developer and co-author of EIP-1559, states that not staking through a pool entails substantial disincentives. “Solo staking is a nightmare,” he said, adding that he doesn’t blame anyone for turning to LSDs. Solo staking can be a daunting endeavor, which is why many individuals utilize platforms such as Lido.

It requires 32 ETH, or roughly $60,500, in addition to a fair quantity of technical expertise. Maintaining a validator node necessitates specific hardware, knowledge of key management, and mitigating the risk of going inactive, as doing so could result in financial penalties.

Adding that ETH must improve the UX of individual staking, he thanked Dappnode for making the process “as simple as one click.” The company sells “no technical knowledge required” hardware that can be used to set up Ethereum or Bitcoin nodes at home, as well as free open-source software for a more do-it-yourself approach.