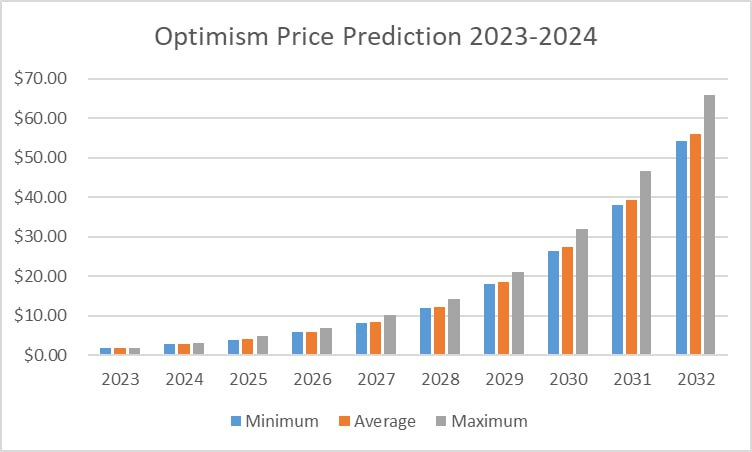

Optimism Price Prediction 2023-2032

- Optimism Price Prediction 2023 – up to $2.73

- Optimism Price Prediction 2026 – up to $9.65

- Optimism Price Prediction 2029 – up to $30.13

- Optimism Price Prediction 2032 – up to $89.53

Imagine a world where Ethereum, the second largest cryptocurrency by market cap, is not just a giant because of its support for smart contracts, but also a fast, affordable, and efficient platform. This is the world that the Ethereum community dreams of, a world where decentralized apps (dApps) and decentralized finance (DeFi) platforms thrive without the burden of high transaction fees. But alas, this dream is yet to be realized.

Enter Optimism, a shining knight in the world of Ethereum, here to rescue us from the dragon of slow and costly transactions. This layer-2 scaling solution, powered by the innovative technology of Optimistic rollups, is like a super-efficient postman who bundles large amounts of transaction data into manageable parcels, delivering them swiftly and affordably.

Optimism is not just a solution, it’s a revolution. It’s cheaper, faster, and is gaining popularity faster than a viral dance challenge on social media. It stands tall among other layer 2 solutions, like Arbitrum, and is becoming a favorite among the Ethereum community.

But what’s a revolution without its own currency? The Optimism network is governed by its very own token, charmingly named OP. In a move that caused quite a stir, a chunk of OP tokens was generously airdropped to early Optimism users in late May 2022. And the best part? The developers behind Optimism have promised to continue this airdrop, making it rain OP tokens for its users.

So, while we wait for Ethereum to roll out its planned upgrades, Optimism is here, making Ethereum transactions faster, cheaper, and well-optimized!

How Much is Optimism Worth?

The live Optimism price today is $3.20 USD with a 24-hour trading volume of $1,138,447,946 USD. We update our OP to USD price in real-time. Optimism is up 13.99% in the last 24 hours. The current CoinMarketCap ranking is #32, with a live market cap of $2,884,005,755 USD. It has a circulating supply of 911,294,948 OP coins and a max. supply of 4,294,967,296 OP coins.

Optimism price analysis: Bullish momentum builds to $3.20, setting a new high for OP/USD

TL: DR Breakdown

- Optimism price analysis shows an uptrend

- The digital asset has increased by nearly 13.38% in the last 24 hours and is currently trading at $3.20

- The market is facing strong resistance at the $3.52 level.

Optimism price analysis shows an uptrend for OP/USD. The cryptocurrency spiked to $3.20 as buyers gained confidence in the coin. After retracing its gains, OP/USD is now trading above the $3.05 support level, and the cryptocurrency has managed to hold above this level for a few days. The bears have repeatedly attempted to break through the support level but without success, and buyers are taking control of the market and pushing prices higher.

Optimism price analysis 1-day chart: Bulls struggle to make a breakthrough above $3.20

The 1-day Optimism price analysis confirms that the market has been trading in green over the past few days, with many other major altcoins also seeing price increases. The current bullish momentum is likely to continue, and Optimism may soon reach the $3.76 resistance level, which could be a crucial milestone for the altcoin. After that, the next target could be set at $3.20, which will further validate the long-term bullish outlook for Optimism (OP).

OP/USD 1-day price chart, Source: TradingView

The relative strength index (RSI) indicator is also in the bullish zone, signaling that there is still room for OP/USD to further appreciate. Moreover, it appears that the 20-day EMA has flipped from bearish to bullish, confirming the uptrend and further strengthening the bulls’ position in the market.

OP/USD 4-hour price chart: Recent Updates

The 4-hour Optimism price analysis also shows that OP/USD has retraced to $3.20 over the last 24 hours, as buyers are now taking a break after the recent rally. However, OP/USD is still trading within an uptrend channel that started yesterday, and this could be an indication that the bulls are still in charge. As such, traders should look for buying opportunities on dips and aim for the next resistance level of $3.80 for maximum gains.

OP/USD 4-hour price chart, Source: TradingView

The exponential moving average (EMA) is also in the bullish zone, further confirming that buyers are still taking control of the market. The relative strength index (RSI) indicator is trading in the overbought region currently at 60.49, indicating that buyers could take a pause before attempting to drive prices higher.

What to expect from Optimism price analysis next?

Optimism price analysis is well-positioned for further gains in the near term, and investors may use this as an opportunity to enter the market at current levels. The Bulls need to break above the $3.52 level of resistance to sustain their momentum and reach new highs. On the downside, a breach below $3.08 could indicate a bearish trend and push prices lower in the near term. Investors need to keep an eye on these critical levels for further price movements in the OP coin.

Optimism Price Predictions 2023-2032

Price Predictions By Cryptopolitan

| Year | Minimum | Average | Maximum |

| 2023 | $2.42 | $2.65 | $2.73 |

| 2024 | $3.83 | $3.97 | $4.49 |

| 2025 | $5.57 | $5.76 | $6.72 |

| 2026 | $8.09 | $8.37 | $9.65 |

| 2027 | $11.71 | $12.05 | $13.97 |

| 2028 | $17.20 | $17.68 | $19.96 |

| 2029 | $25.31 | $26.19 | $30.13 |

| 2030 | $37.11 | $38.42 | $44.68 |

| 2031 | $51.64 | $53.18 | $64.59 |

| 2032 | $75.37 | $78.03 | $89.53 |

Optimism Price Prediction 2023

Based on the technical analysis by cryptocurrency experts regarding the prices of Optimism , in 2023 OP is expected to have the following minimum and maximum prices: about $2.42 and $2.73, respectively. The average expected trading cost is $2.65.

Optimism Price Prediction 2024

The price of Optimism is predicted to reach at a minimum level of $3.83 in 2024. The Optimism price can reach a maximum level of $4.49 with the average price of $3.97 throughout 2024.

OP Price Forecast for 2025

The experts in the field of cryptocurrency have analyzed the prices of Optimism and their fluctuations during the previous years. It is assumed that in 2025, the minimum OP price might drop to $5.57, while its maximum can reach $6.72. On average, the trading cost will be around $5.76.

Optimism (OP) Price Prediction 2026

As per the forecast and technical analysis, In 2026 the price of Optimism is expected to reach at a minimum price value of $8.09. The OP price can reach a maximum price value of $9.65 with the average value of $8.37.

Optimism Price Prediction 2027

Cryptocurrency analysts are ready to announce their estimations of the price. The year 2027 will be determined by the maximum OP price of $13.97. However, its rate might drop to around $11.71. So, the expected average trading price is $12.05.

Optimism Price Prediction 2028

The price of Optimism is predicted to reach a minimum value of $17.20 in 2028. The Optimism price could reach a maximum value of $19.96 with an average trading price of $17.68 throughout 2028.

Optimism (OP) Price Prediction 2029

After years of analysis of the Optimism price, crypto experts are ready to provide their OP cost estimation for 2029. It will be traded for at least $25.31, with the possible maximum peak at $30.13. Therefore, on average, you can expect the OP price to be around $26.19 in 2029.

Optimism Price Forecast 2030

The price of Optimism is predicted to reach a minimum value of $37.11 in 2030. The Optimism price could reach a maximum value of $44.68 with an average trading price of $38.42 throughout 2030.

Optimism (OP) Price Prediction 2031

Optimism price is forecast to reach the lowest possible level of $51.64 in 2031. As per our findings, the OP price could reach a maximum possible level of $64.59 at the average forecast price of $53.18.

Optimism Price Prediction 2032

Cryptocurrency analysts are ready to announce their estimations of Optimism’s price. The year 2032 will be determined by the maximum OP price of $89.53. However, its rate might drop to around $78.03 So, the expected average trading price is $78.03.

Optimism Price Prediction By Coincodex

Optimism had its peak price on February 24, 2023, when it traded at its all-time high of $3.26, while it reached its lowest price on June 18, 2022, when it traded at its all-time low of $ 0.401121. Since its ATH, the lowest price was $0.896377(a (cycle low). Since the last cycle low, the highest OP price was $ 1.500900 (cycle high). The current price prediction sentiment is bearish, with the Fear & Greed Index reading 56 (Greed).

Optimism has had 13 out of 30 green days in the last 30 days,

Optimism Price Forecast By Digital Coin Price

Digital Coin Price’s OP price forecast expects a gradual increase in the token’s value in the upcoming years. According to the website, Optimism’s price is anticipated to surpass the $3.36 mark in 2024. By the year’s end, it is projected that Optimism will attain a minimum value of $3.11. Furthermore, the price of OP has the potential to achieve a peak level of $3.57.

In 2032, it is anticipated that the price of Optimism (OP) will exceed $27.25. As we approach the end of the year, the minimum value of Optimism is projected to be $27.16. Moreover, the price of OP has the potential to reach a high of $27.29.

Optimism Price Prediction By CryptoPredictions.com

According to CryptoPredictions.com’s Optimism price prediction, the OP token’s price may surge further following its current hype. In July 2023, it is anticipated that Optimism (OP) will begin at a value of $2.006 and conclude the month at $1.839. Throughout the month, the highest projected price for OP is expected to reach $2.097, while the lowest price is predicted to be $1.426.

By the end of 2027, the OP token’s price may attain an average trading price of $4.195, with a minimum price of $3.566 and a maximum price of $5.244.

Optimism Overview

Optimism Price History

Let’s delve into the price history of the OP token. While it’s important to remember that past performance doesn’t guarantee future results, understanding the token’s trading history can provide a useful context for interpreting or making an Optimism price prediction.

When the OP token was first introduced to the open market via the initial airdrop on May 31, 2022, it was valued at $4.57, as per CoinMarketCap. However, this price seemed overly optimistic as the market quickly deemed it overvalued, causing it to drop to a low of $0.7973 before ending the day at $1.44 – a 68.5% decrease from the opening price.

Despite the initial price being the all-time high for Optimism, the OP token price has seen some fluctuations.

In June 2022, the market was still recovering from the depegging of the UST stablecoin and the subsequent collapse of the associated LUNA cryptocurrency. This was quickly followed by the Celsius crypto lending platform freezing withdrawals, further confirming the bear market. This series of events negatively impacted the newly launched Optimism, causing it to drop to its all-time low of $0.4005 on June 18, 2022 – less than a tenth of its launch price.

However, the token made a slow recovery, ending the month at $0.5434. But by July 13, 2022, the token fell to $0.4147, continuing its bearish trend.

Following Ethereum’s Merge – the transition to a proof-of-stake (PoS) consensus mechanism aimed at making the blockchain faster and more eco-friendly – on September 15, 2022, the crypto markets didn’t react as positively as many investors had hoped. Despite launching on OpenSea, Optimism was trading at $0.8917 on September 28. The OP token continued to fall, reaching $0.649 by October 21. However, by November 4, 2022, the token had regained over 108% and surged to $1.3512 following the launch of Pragmatism, a library design system created by Figma for the Optimism Collective.

This bullish run was short-lived, though, as the token fell to $0.7952 by November 10, 2022, triggered by the collapse of the FTX (FTT) exchange. Throughout the rest of November, the token fluctuated between $1 and $0.8 before starting a steady rise in December, spurred by Optimism’s announcement of the deployment of the AttestationStation, an attestation smart contract providing “a permissionless, accessible data source for builders creating reputation-based applications”.

On December 15, 2022, the platform also announced that an Optimism non-fungible token (NFT) would be “coming soon” on the AttestationStation, serving as a “customisable profile picture that can represent user identity across the Optimism Ecosystem”.

Earlier, the platform had announced Retroactive Public Goods Funding Round 2, set to launch in February 2023, aimed at giving back to those “powering the public goods that make Optimism possible”.

The first half of December saw OP rising, reaching a high of $1.19 before dropping to close the year at $0.9172. OP then experienced a rally at the start of the New Year, reaching $3.21 on February 3. A drop was followed by a recovery to $3.26 on February 24, but then it decreased to trade at about $2.52 on March 7, 2023. Optimism further declined and touched the $1.5 mark in early June.

Arbitrum Vs. Optimism

Arbitrum and Optimism, both classified as Optimistic rollups, have notable differences. One key distinction is their dispute-resolution processes for transaction validation. Optimism employs single-round fraud proofs executed on layer-1, while Arbitrum uses multi-round fraud proofs executed off-chain. Arbitrum’s multi-round fraud proofing is more advanced, offering greater cost-effectiveness and efficiency compared to Optimism’s single-round proofing.

Additionally, although both platforms are EVM compatible, they differ in their underlying virtual machines. Optimism uses Ethereum’s EVM, whereas Arbitrum operates on its own Arbitrum Virtual Machine (AVM). Consequently, Optimism supports only the Solidity compiler, while Arbitrum is compatible with all EVM-compiled languages, such as Vyper and Yul.

Optimism and Arbitrum diverge in terms of their development roadmaps. Optimism has a clearly outlined roadmap extending until 2024, which includes objectives like introducing advanced interactive fraud proofs, sharded rollups, and a decentralized sequencer.

On the other hand, Arbitrum does not publicly disclose its future plans on its website or Github.

More about the Optimism Network

What Is Optimism?

Optimism operates as a second layer chain, functioning atop the Ethereum mainnet, which is the first layer. Transactions are conducted on Optimism, but the transaction data is relayed to the mainnet for validation. This is akin to driving on a less congested side road while still enjoying the security of a major highway.

As per the current data from Defi Llama, Optimism is the second largest Ethereum layer 2, having $313 million locked in its smart contracts. Arbitrum leads the pack with $1.32 billion.

Synthetix, a protocol providing liquidity for derivatives, holds the position of the largest protocol on Optimism, with a total value locked (TVL) of $125 million. Uniswap, a decentralized exchange (DEX), is the second most utilized protocol on this chain. As of the current data, there are 35 protocols on Optimism, each having at least $1,000 locked in their smart contracts.

Optimistic rollups operate on the principle of ‘optimistic’ validation, where all transactions within the rollup are presumed to be valid. This approach saves time as individual transactions aren’t required to provide direct proof of their validity. Validators within the rollup are given a week to scrutinize the entire rollup for any fraudulent data.

According to a Dune Analytics dashboard, Optimism remarkably reduces Ethereum transaction fees, also known as gas fees, by an impressive 129 times. It is backed by DeFi platforms such as Synthetix and Uniswap. As of March 2022, Dune Analytics reports that Optimism safeguards approximately $740 million of on-chain value, a decrease from just over $1 billion in January.

Optimism was first introduced in June 2019, with a testnet launched in October of the same year. However, it wasn’t until January 2021 that an alpha mainnet was launched. It took until October 2021 for Optimism to release a version of the Alpha mainnet that was compatible with the Ethereum Virtual Machine. Finally, an open mainnet was launched in December 2021.

How Does Optimism Work?

Optimism essentially functions as a large, append-only record of transactions. All of its consolidated blocks are stored in an Ethereum smart contract known as the Canonical Transaction Chain.

Unless a user directly submits their transaction to the Canonical Transaction Chain, new blocks are generated by an entity known as a sequencer. This sequencer promptly validates transactions, then constructs and executes blocks on Optimism’s layer 2, a blockchain that resides on top of the layer 1 blockchain, in this case, Ethereum.

These blocks, referred to as ‘rollups’, are batches of Ethereum transactions. The sequencer further compresses this data to minimize the transaction size (thereby saving money) and then submits the transaction data back to Ethereum.

The layer 2 software of Optimism is engineered to closely resemble Ethereum’s code. For example, it utilizes the same virtual machine as Ethereum and calculates gas charges in a similar manner (though at a reduced rate, courtesy of its optimistic rollup solution).

Due to the underlying similarities between Ethereum and Optimism, any ERC-20 asset, which is a cryptocurrency that complies with the generic Ethereum token standard, can be transferred between the two networks.

How Do You Use Optimism?

For users, the experience of using Optimism closely mirrors that of the Ethereum mainnet. Your Optimism address is identical to your Ethereum mainnet address, starting with 0x. The blockchain explorer of Optimism is also the same as Etherscan, which is the blockchain explorer for the Ethereum mainnet. Optimism is compatible with a variety of decentralized finance (DeFi) wallets, including MetaMask, which is the most commonly used option.

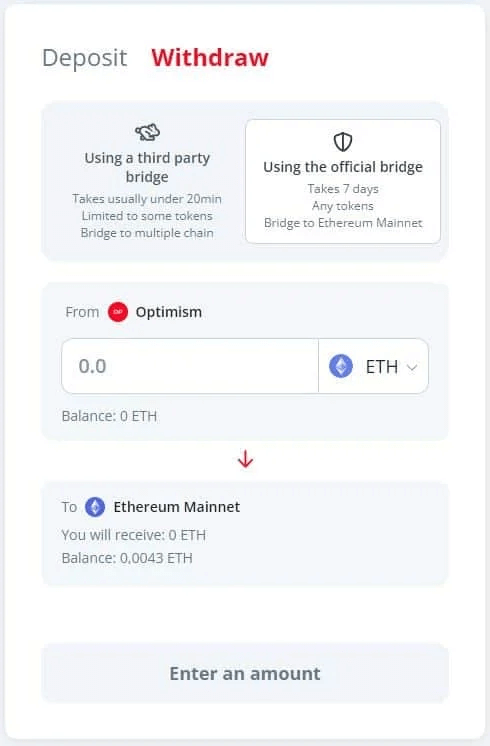

To utilize Optimism, you need to deposit your ETH or ERC-20 tokens into the Optimism token bridge. This enables you to carry out transactions on Ethereum via Optimism. Once done, you can convert your tokens back to the Ethereum mainnet.

To deposit your tokens, you must do so through the Optimism Gateway. This can be accessed via a Web3 wallet, such as MetaMask. Deposits typically take around twenty minutes, and for transferring 1 ETH, MetaMask estimated a fee of $18.

Optimism indicated that withdrawing the funds would take a week and cost $52.72. This delay is a characteristic of the week-long challenge period incorporated into Optimism’s optimistic rollup.

After depositing funds on Optimism, you can utilize them within supported decentralized applications. For example, Uniswap allows you to execute trades via Optimism to save on fees. Simply select Optimism from the network menu, and you can proceed with trading as usual.

You also have the option to use a centralized cryptocurrency exchange to deposit ETH into your Optimism address. However, before attempting to transfer funds to a layer 2 from your centralized exchange, always ensure that the exchange supports withdrawals to that particular chain. If you transfer funds to an unsupported address, you risk losing your funds irretrievably. As of the time of this writing, exchanges such as Binance, Bybit, and Huobi permit withdrawals to Optimism.

What is Optimism’s token (OP)?

Optimism introduced its OP token on May 31. A total of 231,000 addresses were eligible to claim 214 million OP tokens for free, a process known as an “airdrop”. This represents 5% of the total supply of 4.29 billion, implying that 95% of the supply is yet to be released into the market. The number of users who claimed the first airdrop can be tracked on this Dune Analytics dashboard.

The airdrop encountered significant issues. Optimism confessed that they “grossly underestimated the traffic surge that the airdrop would generate,” resulting in many eligible token holders being left without tokens.

However, Optimism faced further negative publicity on June 8, when an exploit led to the theft of 20 million OP tokens intended for the liquidity provider Wintermute. According to Optimism, the exploit happened when Wintermute provided an Ethereum L1 address that had not yet been deployed on Optimism. Before the problem could be resolved, an attacker managed to seize the funds.

Wintermute accepted full responsibility. Since the hacker only liquidated one million OP tokens, Wintermute speculated that the attack was carried out by a whitehat (ethical) hacker. In a message to the hacker, Wintermute stated: “You have one week to consider being a whitehat. If this doesn’t happen, we are 100% committed to recovering all the funds, identifying the person(s) responsible for the exploit, fully exposing them and handing them over to the appropriate legal system.” Despite the assignment of blame, Optimism received a significant amount of criticism on Twitter.

The OP token grants holders the right to participate in The Optimism Collective, a two-tier governance system consisting of the Token House and the Citizens’ House. The Citizens’ House, set to be operational later in 2022, will govern decisions related to public-goods funding. The Token House, which is already active, sees technical decisions related to Optimism, such as software upgrades. In its early stages, Optimism raised funds on Gitcoin, a prominent public-goods funding platform.

What’s The Future Of Optimism?

In March 2022, Optimism secured $150 million in Series B funding, valuing the startup at $1.65 billion. The company plans to enhance its protocol with new features like a next-gen fault proof, sharded rollups, and a decentralized sequencer.

Despite its centralization, Optimism is moving towards decentralization, launching a DAO, the Optimism Collective, in April 2022. It also started distributing OP tokens to users and contributors to promote its decentralized future.

Conclusion

Optimism has rapidly ascended as a favored Ethereum scaling solution. The Optimism Foundation recently put forth a proposal for transitioning the Optimism mainnet to Bedrock, a novel decentralized Rollup architecture devised by Optimism Labs.

The team expressed their confidence in the positive impact of the post-Bedrock experience for developers within the Optimism ecosystem and shared the consistent enthusiasm they’ve received from their partners regarding the upgrade. They affirmed their dedication to ensuring the success of this upgrade and are looking forward to observing the outcomes in the forthcoming months and years.

The evolving competition between optimistic rollups and ZK-rollups in the upcoming years, as they vie for dominance in layer-two solutions, also presents an intriguing aspect to keep an eye on.