On-chain data shows that the amount of Bitcoin held by investors for more than one year has hit a new all-time high.

Bitcoin Investors Have Continued To Show HODLing Behavior

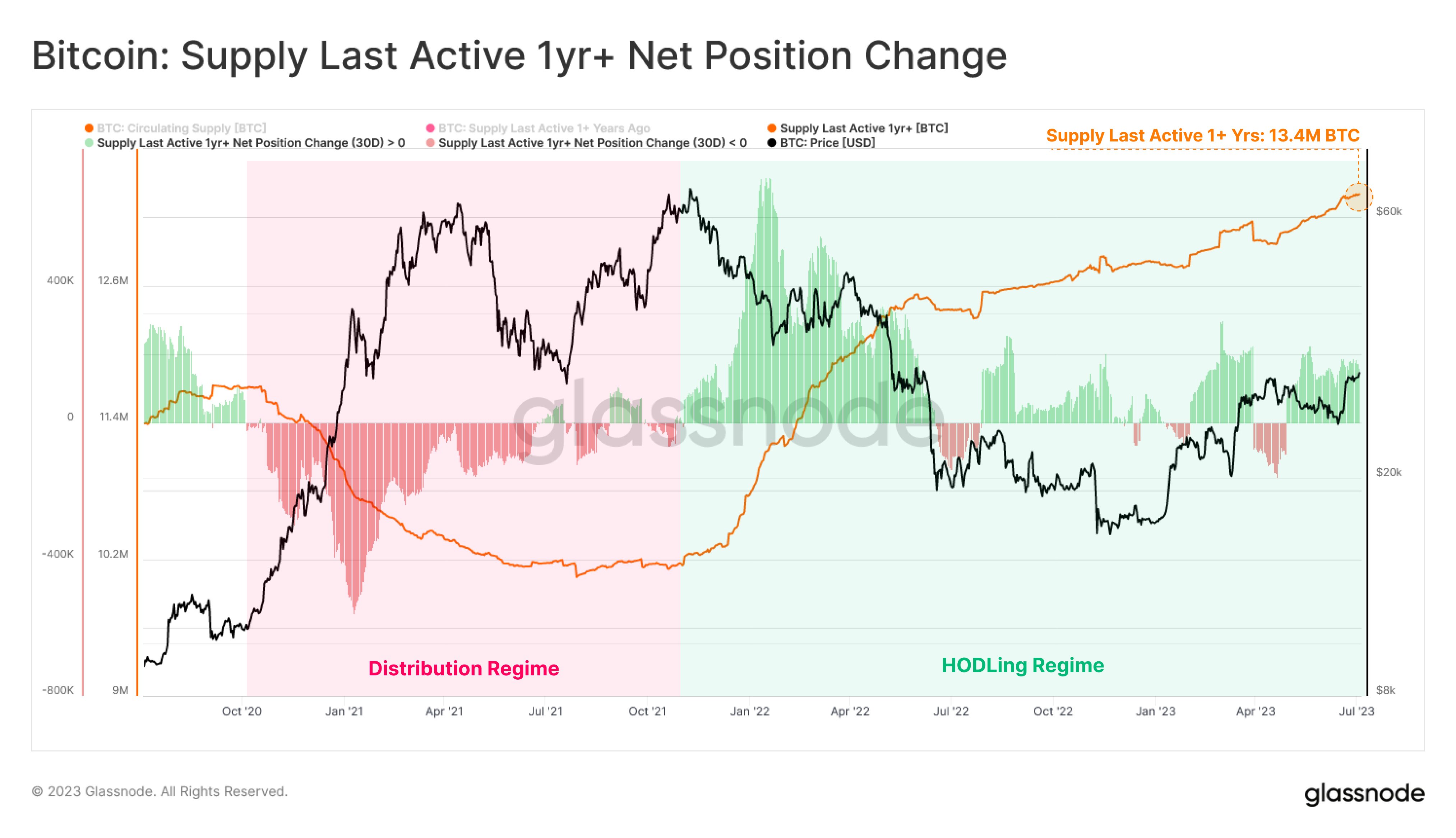

According to data from the on-chain analytics firm Glassnode, the 1+ years old supply now measures around 13.4 million BTC, a new all-time high. The indicator of interest here is the “supply last active 1+ years,” which keeps track of the total amount of Bitcoin that has been sitting dormant on the blockchain since at least one year ago.

When the value of this metric goes up, it means that a net number of coins is maturing into this group right now. Note that this doesn’t mean this group is “buying” currently, as the buying actually happened one year ago, which is why the coins have been able to reach the one-year age cutoff.

Rather, what this trend of the indicator implies is that some of the investors have been comfortable sitting on their coins long enough to age into this group recently. Naturally, this is usually a sign that the holders have a HODLing mentality at the moment.

On the other hand, though, when the metric’s value goes down, it can be a sign that these investors are selling in the present, as they are moving around their coins (thus shifting their age back to zero). Obviously, any movements aren’t strictly because of selling, but when these experienced hands move their coins, chances are higher than usual that they are selling.

Now, here is a chart that shows the trend in the Bitcoin supply last active 1+ years over the past few years:

As displayed in the above graph, the Bitcoin supply last active for 1+ years has been rising on an overall uptrend since around the late 2021 bull run top. This suggests that the market has primarily been participating in HODLing during this period.

The chart also contains the data for another metric, the “net position change” of this indicator, which measures the net amount of Bitcoin exiting or entering into the 1+ years supply.

From the graph of this indicator, it’s visible that there were a few instances where the trend temporarily broke. A recent occurrence was back in April of this year when Bitcoin topped out as these investors transferred their coins. Given this timing, it’s likely that their selling contributed to the rally running out of steam.

Since then, however, the HODLing behavior has been back in the market, suggesting that the experienced hands have continued to hold their coins long enough to mature into this range despite the price volatility (first towards the down direction and then up) that the cryptocurrency has experienced recently.

The Bitcoin supply last active for 1+ years has now hit a new all-time high of around 13.4 million off the back of this new accumulation streak.

BTC Price

At the time of writing, Bitcoin is trading around $30,300, up 1% in the last week.