Digital assets manager CoinShares says institutional investors are increasing their conviction in Bitcoin (BTC) and crypto more than they have since 2021, with a massive allocation in recent weeks.

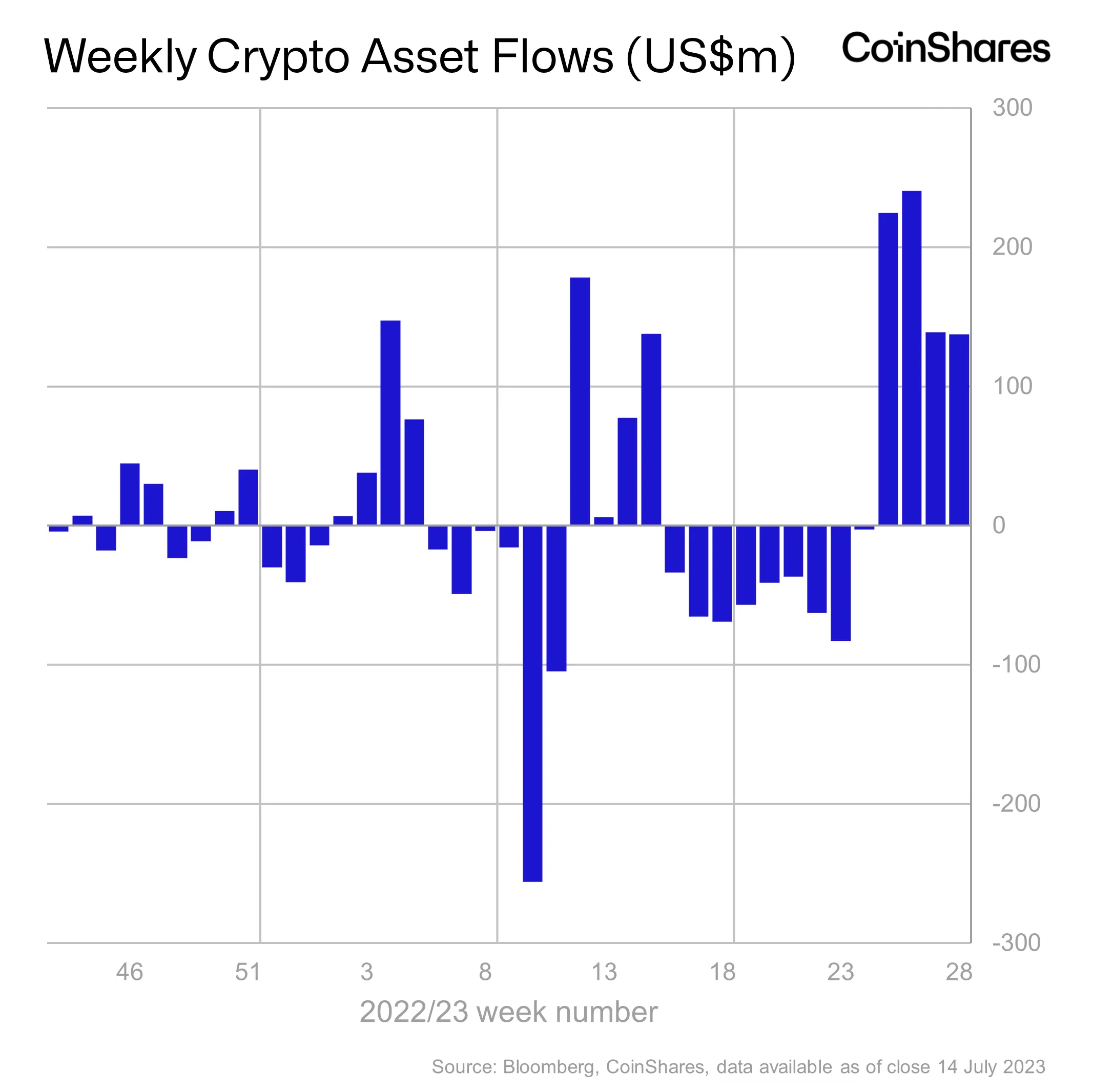

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional investors poured $137 million into the crypto markets last week, continuing a four-week run of inflows that has seen $742 million poured into the markets.

“Digital asset investment products saw US$137m of inflows last week. Following a few late updates to prior weekly data, inflows for the last 4 weeks now total US$742m, representing the largest run of inflows since the final quarter of 2021. Trading volumes on investment products remain well above the year average of US$1.4bn, totaling US$2.3bn for last week. The volumes are currently making up a far greater proportion of total crypto volumes, comprising 11% last week compared to the 2% average.”

According to CoinShares, most of the inflows originated from North American investors, with $109 million coming from US investors alone.

Bitcoin, in step with its share of the market, took home most of the inflows.

“Bitcoin saw inflows totaling US$140m, comprising 99% of all inflows. While short Bitcoin investment products saw a 12th week of outflows of US$3.2m. A combination of recent price appreciation and outflows have seen short Bitcoin total assets under management fall from their April US$198m peak to just US$55m.”

While Litecoin (LTC), Solana (SOL), XRP, Cardano (ADA) and Polygon (MATIC) all enjoyed inflows of $0.5 million or less last week, Ethereum (ETH) suffered outflows of $1.6 million.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Featured Image: Shutterstock/Andy Chipus

The post Institutions Pour $742,000,000 Mostly Into Bitcoin in Largest Run of Inflows Since 2021: CoinShares appeared first on The Daily Hodl.