Key Takeaways

- Bitcoin dominance has risen above 50%, having started the year at 42%

- Traditionally, dominance falls while market prices are rising in the sector, marking the year 2023 out as unusual

- This hammers home how Bitcoin is still finding its feet, and why prudence needs to be taken when extrapolating past performance to the future

- Bitcoin was only launched in 2009 and had minimal liquidity for the first few years, meaning our sample space of data is too short to make assumptions solely based on the past

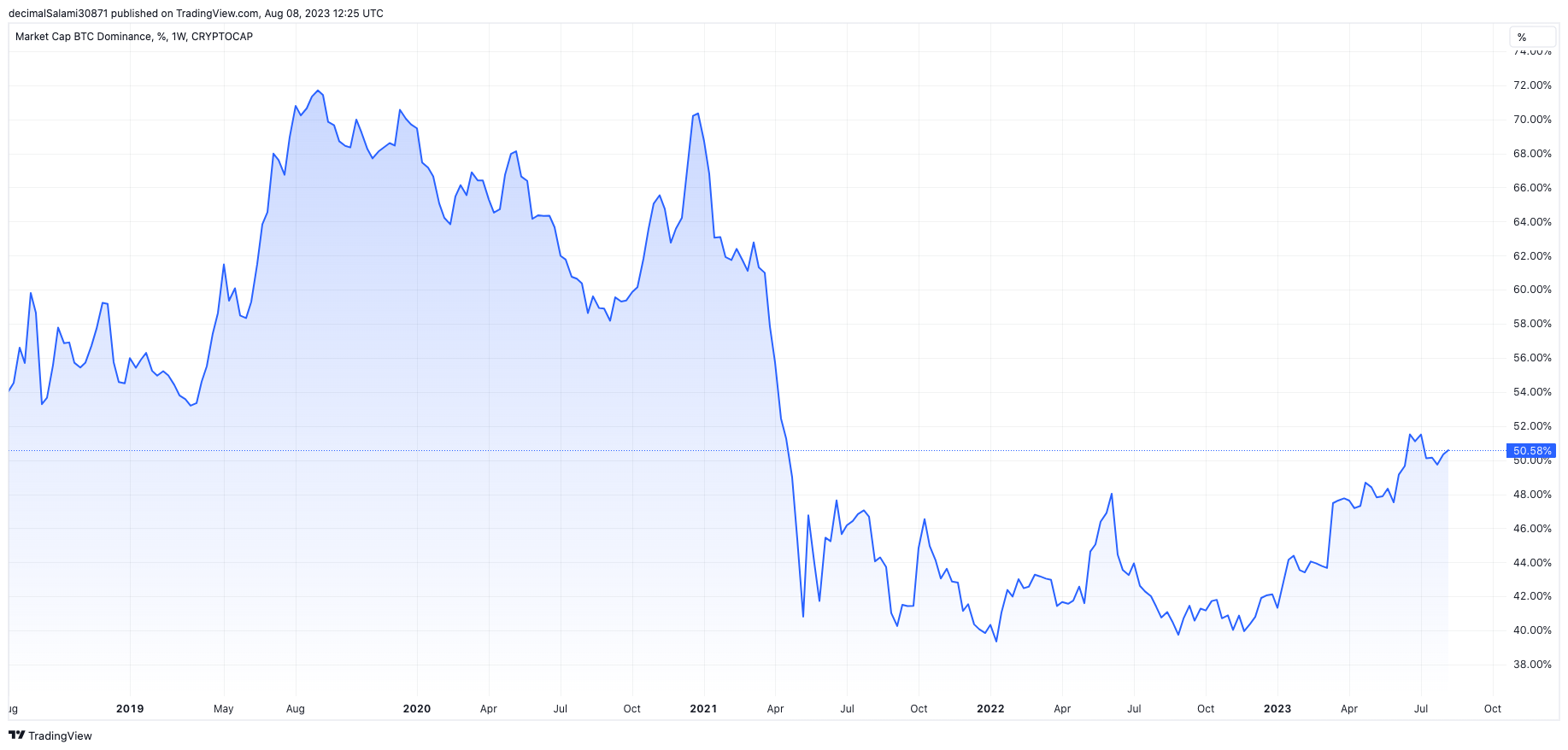

Bitcoin dominance, which measures the ratio of the Bitcoin market cap to the entire cryptocurrency market cap, has clambered back above 50%. With the period of relative serenity in the crypto markets recently, it has been rangebound for the last two months, although dipped to 49% last week.

However, the dominance of the world’s biggest crypto has surged since the start of this year, having been in the low 40’s as the book was closed on the year 2022.

The increase is the biggest prolonged expansion in Bitcoin dominance since 2019, when it rose from 53% to 72% in a five-month period beginning that April.

Notably, the rise of Bitcoin’s dominance this time around contrasts with what we have seen in the past regard the timing of cycles. Despite its extreme volatility when comparing to other major asset classes, Bitcoin can generally be viewed as the lowest-beta option within digital assets.

Notably, the rise of Bitcoin’s dominance this time around contrasts with what we have seen in the past regard the timing of cycles. Despite its extreme volatility when comparing to other major asset classes, Bitcoin can generally be viewed as the lowest-beta option within digital assets.

In previous cycles, the dominance has hence tended to fall in bull markets as altcoins outpace Bitcoin’s gains. The pattern has tended to be as follows:

- Bear market

- Bitcoin rises, dominance jumps

- Altcoins rise more, dominance falls

This time around, the altcoins have not fulfilled their end of the bargain.

Crypto market is changing fundamentally

There are a few theories which spring to mind to explain these occurences. The first is that Bitcoin is separating itself from the rest of the crypto market. Regulation is one factor here – Bitcoin has proven to be more immune than many other coins in the space, many of whom have been weighed down by the crackdown in the US around securities laws.

The SEC explicitly named many tokens as securities, including SOL (Solana), MATIC (Polygon) and ADA (Cardano). While Ripple won a landmark case (at least partially) against the SEC last month, providing hope for the future legal path of these proceedings, the intense hostility shown by lawmakers in the US has undoubtedly served to dampen token prices. Bitcoin, however, seems to be in its own genre, targeting “commodity” status rather than a security.

Then there is the elephant in the room: all the sordid activity that has taken place in the crypto industry over the past eighteen months. From the Terra death spiral to the Celsius scandal to the FTX “deceit”, crypto has taken a beating. This has undoubtedly affected Bitcoin too (as its price chart will so obviously indicate), but it is fair to say that the part of the crypto space that lies further out on the risk curve may find it harder to regain trust from institutions and trad-fi actors (or to win it to begin with, if it never had it in the first place).

Many have always argued that Bitcoin is separate from the rest of crypto, so much so that the faction who advertise this aggressively have been labelled with the moniker “Bitcoin maximalists”. As least as far as regulation goes, it seems lawmakers may be coming around towards also separating out the asset from the rest of the crowd.

Bitcoin has suffered immensely in the last year, however less so price-wise than other coins, while its network has remained online, always, without a hitch. There are many other cryptos who can argue the same, but whether fair or unfair, they may be getting caught up in the reputational crossfire a little more than Bitcoin is.

Beyond these speculative theories, perhaps the greatest lesson of all is to be aware of how fickle many of the trends within the crypto are. Are we really surprised that Bitcoin dominance has risen and altcoins have not caught up as the positive sentiment continues? Why? Because of history?

Let us remind ourselves that “history” pertains to barely a minute here. Bitcoin was launched in 2009, and didn’t trade with any sort of genuine liquidity until perhaps 2015 (if even). Altcoins were even later. The sample size which we have to work with here is far too small to make any sort of concrete conclusions. Compare this to the stock market, or bonds, where we can make all sorts of return and risk assumptions to fit nicely into our Black-Litterman models or so forth.

Not only is the sample size small, but the timing is important, too. Bitcoin was borne out of the embers of one of the greatest crashes in economic history, launched two months before the stock market bottomed in March 2009. Following those tumultuous years, we embarked upon one of the longest bull markets in history. Risk assets went parabolic as generationally-low interest rates fuelled dizzying gains.

Therefore, until last year, Bitcoin – and crypto – had only ever experienced a low-interest rate, free money economy of up-only risk assets. I have spent a lot of time having fun with Bitcoin models, and my number one takeaway is that, quite simply, we don’t know.

The world is still figuring out what cryptocurrency is. One day, we will know exactly how to model this thing, just like pension funds know exactly how to apply Markowitz theory to stock/bond portfolios. There will come a day when an efficient frontier portfolio has magic Internet money in it.

But we aren’t there yet. Hence, we can certainly lean on the past few years for guidance, but putting too much weight into this incredibly short and bespoke period (which also included a once-in-a-lifetime pandemic that saw the global economy abruptly lock down) would be misguided.

Perspective is needed. And we don’t have a good enough viewpoint yet to get that perspective.

The post How rising Bitcoin dominance invalidates many crypto assumptions appeared first on CoinJournal.