HodlX Guest Post Submit Your Post

According to the latest report, digital currency transactions are expected to explode in the near future.

The technology’s supporters point to increased convenience, while its opponents worry it will give the government too much power and erode privacy.

What evidence is there to support the claims of both sides of the debate? Let’s delve a little deeper to see what’s underneath.

According to Statista data, between 2023 and 2030, there will be an astonishing 260,000% increase in the number of transactions processed through CBDCs (central bank digital currencies).

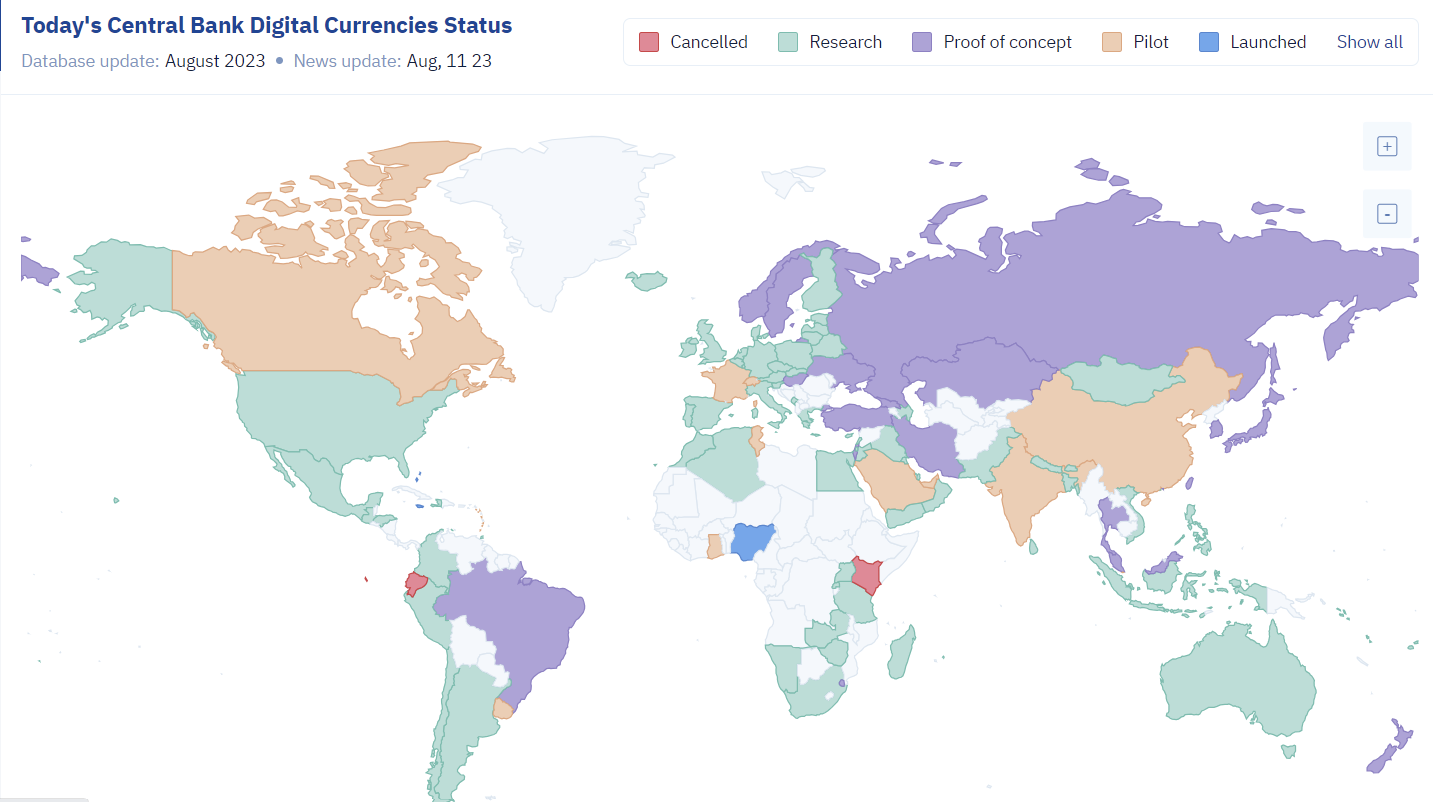

In 2023, 105 countries are working on this kind of currency. That may or may not be good news to you, but so far only a handful have fully implemented it and we have the first half of 2023 behind us.

These countries are Nigeria, the Bahamas, Jamaica and the Eastern Caribbean Currency Union.

Source: Cbdctracker.org

In case you missed what CBDCs are, they are merely digital versions of existing fiat currencies that come from central banks.

While cryptos were created to reverse the power back to the public, CBDCs are government-issued digital currencies, enabling the central bank to monitor your identity, location and spending data.

Under the current system, commercial banks are required to keep all information about their customers confidential, unless a legal requirement requires them to do so.

Once CBDCs are up and running, central banks will use a blockchain most likely a private one to keep track of who spends money where and how.

The bank could limit the ways in which money can be spent or even ban you.

Assume another lockdown is in place, and you can only buy things within walking distance of your home and only on certain days.

It wouldn’t be technically impossible for you to buy a ticket and get out of there. Doesn’t that make you think of a dystopian future?

All this boils down to one question do central banks really want to give us a safer digital payment environment or do they simply want to monitor our spending habits and control us even more?

CBDCs make central banks nervous as well

Studies have shown that CBDCs could have a negative impact on retail, wholesale and cross-border payments.

Retail CBDCs can cause portfolio changes in the public’s relative holdings of cash and deposits, disintermediating bank deposits and increasing volatility in bank reserves at the central bank.

If substantial, these outcomes can undermine monetary policy transmission channels, such as credit and interest rates, which hamper the central bank’s ability to forecast reserves and conduct effective OMOs (Open Market Operations) thereby making money and IT (inflation targeting) regimes less effective.

By using CBDCs for cross-border payments, recipient countries may face currency substitution risks during crisis periods, could see capital flow reversals accelerate, weakening the ability of domestic monetary authorities to control exchange rates and monetary policy.

According to Paolo Ardoino, CTO of Tether, central banks themselves are also wary of CBDCs replacing physical cash.

In an interview with Mike Ermolaev, he said that their private conversations with central bank representatives revealed their concerns about the uncertain effects CBDCs will have on their economies in the long run and the inability to reverse course if things don’t turn out well.

According to Ermolaev, real CBDCs not pilot projects will be launched no earlier than 20 years from now.

Tether’s Paolo Ardoino said,

“Humanity has been using pocket money for peer-to-peer transactions for 5,000 years, and now we are forcing them to hold something digital for the first time in history without any paper money or coins.

“Leaving aside all the potential fears where central banks can have access to every single transaction that any person in that jurisdiction made, there are so many other concerns.”

According to Ardoino, there is a fine line between central banks and the banking industry on one side and people who don’t want to live in an Orwellian world on the other.

A number of central bank officials have publicly questioned CBDCs. The Fed’s Neel Kashkari, for instance, wasn’t afraid to state the obvious. He said,

“I keep asking anybody, anybody, at the Fed or outside the Fed, to explain to me what problem this [CBDC] is solving. I can send anybody in this room $5 with [digital wallet] Venmo right now.

“No, seriously. So, what is it that a CBDC can do that Venmo can’t do? And all I get is a bunch of hand waving.

“If they want to monitor every one of your transactions, you could do that with a [CBDC]. You can’t do that with Venmo.

“If you want to impose negative interest rates, you can do that with a [CBDC] you can’t do that with Venmo.

“And if you want to directly tax customer accounts, you can do that with a [CBDC] you can’t do that with Venmo. Why would the American people be for that?”

Privacy-preserving CBDCs are feasible

According to the ECB (European Central Bank), 41% of responses relating to a Euro-denominated CBDC during its consultation period focused on privacy.

Actually, there is potential for CBDCs that would not infringe upon citizens’ privacy rights.

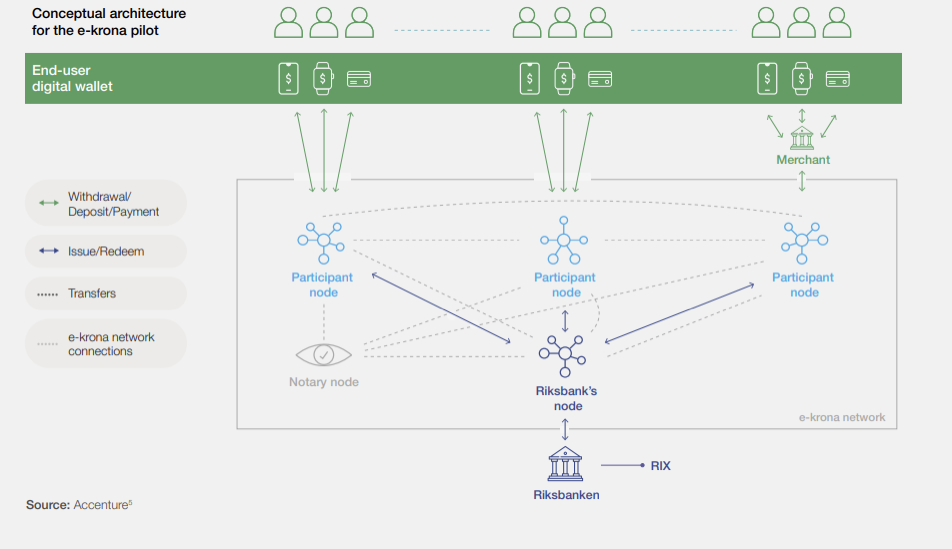

An example of privacy architecture in a CBDC is the e-crona pilot of Riksbank. It is based on Corda, an open-source blockchain project developed by Accenture.

In this model, transactional actors and central banks are physically separated so that the data is distributed on a need-to-know basis.

Those involved in the transaction are the only ones who receive the transaction’s data.

The proposed designs of CBDCs that protect privacy also include token-based, software-only CBDCs.

These types of CBDCs would allow users to withdraw coins on their smartphones or computers without banks having any record of the transaction or a ledger linking the CBDC to its owner.

In this case, privacy could be achieved through a cryptographic technique called, ‘blind signatures,’ in which users have control over accessing the data.

This way, central banks cannot learn the identities of consumers or merchants nor the amounts of transactions only the withdrawal and redemption of electronic coins.

The question is how far banks would be willing to go with these types of CBDCs.

Final thoughts

To conclude, CBDCs offer potential benefits, but their implementation must be carefully considered in order to ensure that privacy, financial freedom and market stability are not compromised.

Consequently, there is a need for further exploration and discussion to ensure CBDCs are developed in a way that benefits everyone.

Maria Carola is the CEO of StealthEX.io, an instant, non-custodial cryptocurrency exchange with over 1,300 assets listed. After graduating the University of Vilnius, Maria spent almost a decade in the crypto space, working in marketing and management for a variety of blockchain projects including wallets, exchanges and aggregators.

Follow Us on Twitter Facebook Telegram

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/X-Poser/Fotomay

The post CBDCs – A Tool for Big Brother’s Sway or Just a Cool New Way To Pay appeared first on The Daily Hodl.