A resurgence, almost seismic in its impact, is currently shaking the foundations of global economic systems. Big government is making a grand re-entry, challenging our long-held beliefs about fiscal policies and intervention. A paradigm shift is imminent, and its implications are daunting, both fiscally and politically.

New Directions in Financial Dialogues

Amidst a backdrop of the esteemed Jackson Hole symposium, where bankers usually dominate discussions with their monetary policy forecasts, an unexpected voice captured the limelight. Professor Barry Eichengreen, an academic and not a banker, brought sobering news.

The colossal public debts accumulated during the pandemic aren’t disappearing soon. Contrary to expectations of economic growth chipping away at these debts, governments are, in fact, ramping up spending.

The concerns aren’t baseless. A mere glance at the 1980s Reaganomics in the US and Thatcherism in the UK reveals a stark contrast. Then, the focus was on leaner states, fewer taxes, and minimal intervention.

Now, issues like the Covid-19 aftermath, the green energy revolution, and mounting geopolitical pressures are compelling governments to dive in headfirst.

Brave New Fiscal World

It’s not just about spending, though. It’s about fundamentally redefining the role of the government in economic cycles. With rising intervention comes the colossal task of financing it. Gone are the days of easy borrowing from bond markets. The cost of borrowing has surged, making further spending a challenge. The crux lies in navigating the treacherous waters of increasing tax revenues. But tax the youth for the benefits of an aging, economically passive population? It’s a recipe for political backlash.

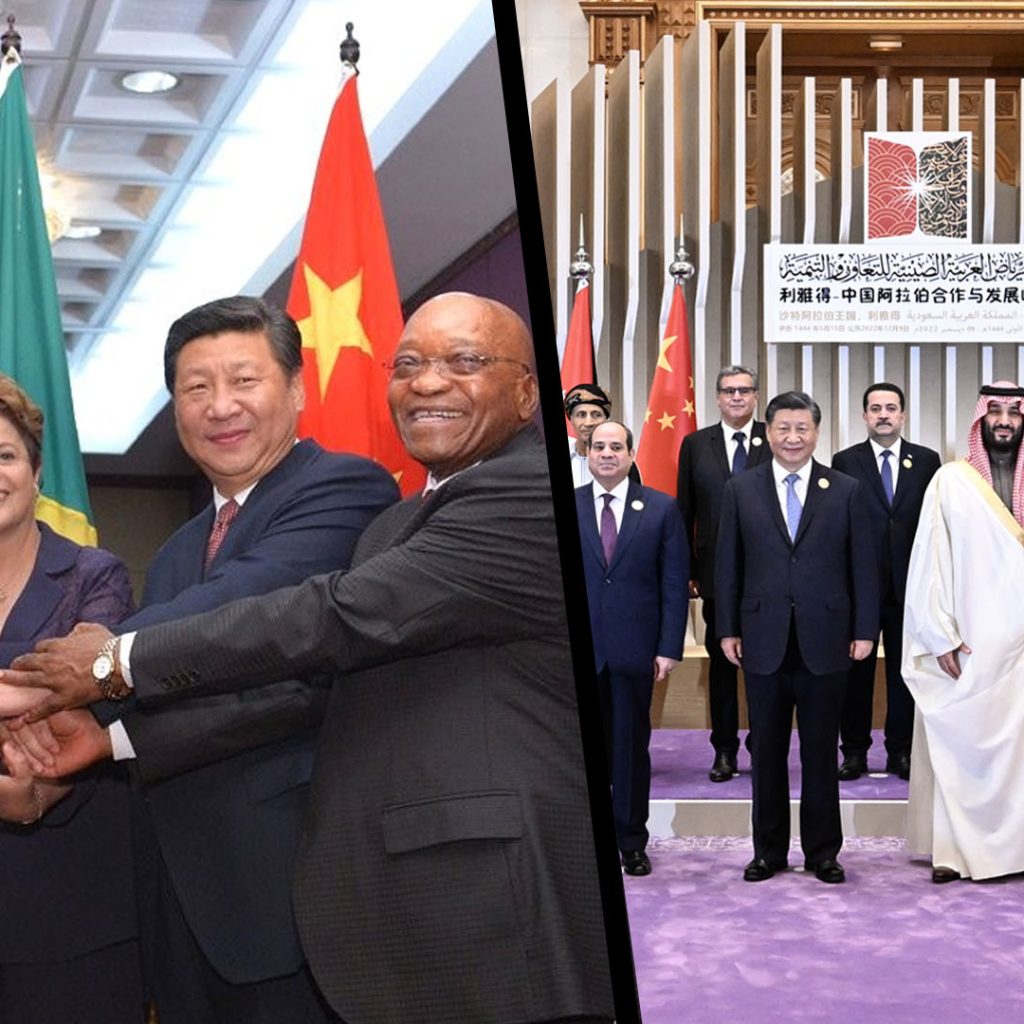

The focus of the increased spending is evident: defense, the evolving demographics, and the relentless march towards combating climate change. The once peace-ridden post-cold war era has given way to intensifying geopolitical scenarios. Just look at the radical defense budget expansions in nations like Japan or Germany’s commitment to NATO’s defense spending targets. These aren’t mere token gestures; they signal a significant policy reorientation.

Meanwhile, on the home front, an aging population looms large. By 2050, for every two working-age individuals, there’ll be one person over 65. This shift demands colossal healthcare and pension funds.

The path to net zero carbon emissions further complicates the scenario. While individual nations grapple with technological innovations, the collective will of governments becomes critical. Sole efforts might bolster national security, but they also amplify the costs associated with a greener future.

Treading the Fiscal Tightrope

Then there’s the Pandora’s box opened by the pandemic. Governments, in their bid to provide a safety net during the crisis, have inadvertently set precedents. The public has tasted active government intervention, be it in the form of mass vaccination drives or financial aids. Such involvements aren’t just logistical challenges; they’re political dynamites. They warrant hard decisions on where to allocate funds and whom to tax. To say it’s merely about balancing books would be a gross understatement.

For instance, consider President Joe Biden’s audacious green subsidy plan, the Inflation Reduction Act. By diverting substantial funds towards green tech and manufacturing, it’s setting new benchmarks in investment-focused governance. This strategy might echo the strategies of yesteryears, but its timing amidst economic sluggishness and straining financial conditions is unprecedented.

So, where does that leave us? A precarious dance on the fiscal tightrope. With already bloated public debts, rising inflation, and central banks scrambling to stabilize prices, everyday borrowing is becoming an uphill battle. While tax seems to be the magic word, there’s a limit to it. Historical data suggests we’re approaching the upper echelons of sustainable taxation levels.

In the face of such challenges, token measures won’t suffice. We need radical reforms, not just tweaks. From reevaluating capital and income tax dynamics to broadening the scope of wealth taxation, all cards must be on the table. And as we explore these avenues, lessons from history, like the 17th-century coal tax post the Great Fire of London, offer valuable insights. With environmental taxes on the horizon, it’s vital to weigh the pros against any potential consequences.

In sum, if the green transition is our shared vision, then robust public sector commitment, coupled with prudent carbon taxation, is non-negotiable. The return of the big government demands nothing less than our undivided attention, a brave face, and critical scrutiny.