Coinspeaker

Bitcoin (BTC) Price Tanks Under $25K, Altcoins Face Even Deeper Crash

On Monday, September 11, the world’s largest cryptocurrency Bitcoin (BTC) faced a major price correction with its price taking a dip under $25K. However, the BTC price has recovered since and is currently trading at $25,807 levels.

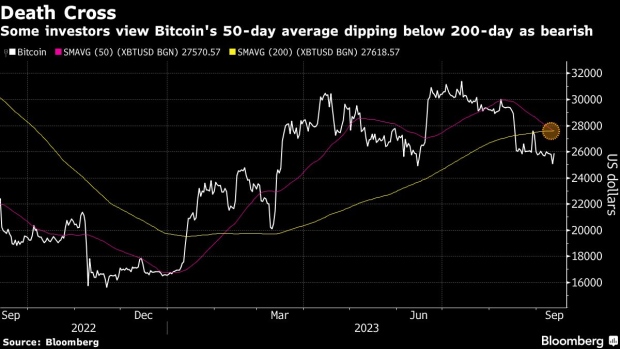

On the technical charts, the BTC price has formed a death cross pattern with its 50-day short-term moving average having breached its 200-day short-term moving average. This suggests strong bearish formations on the technical charts with further possibility of price correction.

-

Photo: Bloomberg

- On the other hand, the liquidity in the crypto market has been on a steady decline during this continuous selling pressure. At the same time, the on-chain and the off-chain volumes are also about to reach the historical lows.

FTX Creditor Liquidation

Along with Bitcoin, the altcoins have faced a severe price crash with Ethereum falling all the way to $1,540 levels falling under crucial support levels. Similarly, Ethereum competitor Solana has been facing huge selling pressure and has been trading at $18.00.

FTX’s administrators have successfully reclaimed approximately $7 billion worth of assets, $3.4 billion of which are in cryptocurrency. A court hearing scheduled for Wednesday will evaluate a proposal to initiate token sales as a means to repay creditors, as outlined in recent submissions.

An accompanying presentation reveals that FTX possesses approximately $1.2 billion in SOL, the native token of the Solana network, alongside holdings of $560 million in Bitcoin, the largest cryptocurrency, and $192 million in Ether, the second-ranked cryptocurrency. This has left the market feeling uncertain and anxious about the impending FTX creditor liquidation.

FTX is in the process of considering the appointment of the asset management division of Galaxy Digital Holdings Ltd., owned by billionaire Michael Novogratz, to assist in managing the significant pool of tokens held by the distressed exchange. According to a filing made in August, the weekly limit for cryptocurrency divestments varies, spanning from $50 million to a potential maximum of $200 million.

Alternative cryptocurrencies, often referred to as altcoins, are experiencing a period of underperformance, with Solana’s SOL leading the decline with a drop of over 8%. Other notable altcoins, including Toncoin’s TON and layer 2 Arbitrum’s ARB, have also experienced significant declines of a similar magnitude. Additionally, Ripple’s XRP has faced a 5% loss in value during this period.

Bitcoin (BTC) Price Tanks Under $25K, Altcoins Face Even Deeper Crash