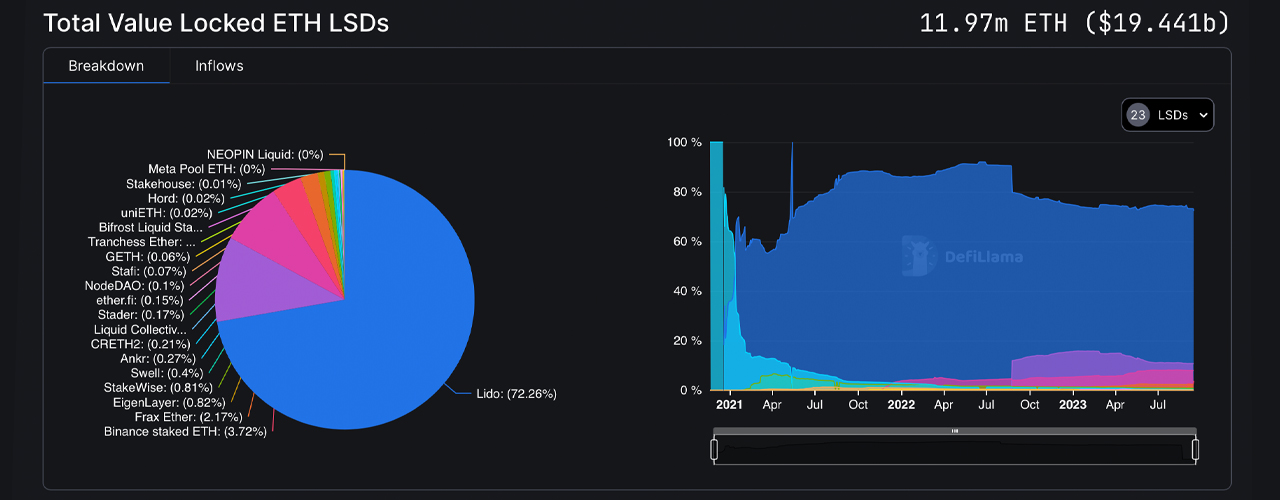

Over 20 days, 640,000 ETH valued at just over $1 billion was added to liquid staking derivatives platforms. Additionally, the amount of ether staked in such protocols is approaching 12 million, with 11.97 million total value locked (TVL) as of September 15, 2023.

Ethereum Staking Platforms Race to 12M Ether With $1B Boost

Ethereum-based liquid staking protocols continue to experience significant growth. In the past 20 days, platforms have added 640,000 ETH worth approximately $1.04 billion. Among 23 different liquid staking decentralized finance (defi) protocols, the top five reported 30-day gains. Lido saw a 30-day increase of about 6.32%. As of 1 p.m. ET Friday, the protocol held 8.65 million ETH valued at $13.97 billion.

Twenty days prior, Lido held 8.38 million ETH, which represented 73.98% of the market share. With its current 8.65 million ETH, Lido’s share now stands at 72.26% as other protocols have attracted more deposits. Coinbase’s liquid staking protocol experienced a 5.57% increase over 30 days, and it now manages 1.27 million ether, accounting for 10.65% of the market share in liquid staking derivatives platforms.

Rocket Pool is close behind with 935,568 ETH, having seen a 5.91% growth since the previous month. The most substantial 30-day gain was posted by Binance’s liquid staking derivatives platform, with a remarkable 377% jump. Binance Staked Eth now holds 445,316 ether, or 3.72% of the total market share. In fifth place, Frax recorded a 3.73% increase over 30 days and currently has 259,733 ether locked.

In sixth place, the liquid staking derivatives platform Eigenlayer experienced a 554% rise in 30 days. Eigenlayer’s holdings total 98,156 ether, representing just 0.82% of the market share. Based on the current ETH exchange rate, Eigenlayer’s assets amount to $158.65 million. Given the ongoing growth rate, it appears that surpassing the 12 million mark in September 2023 is plausible if the trend continues.

What do you think about the growth of liquid staking protocols over the past 20 days? Share your thoughts and opinions about this subject in the comments section below.