A top-35 altcoin has jumped by nearly 45% in the past month, dramatically outpacing most of a middling crypto market.

The native governance token of the decentralized finance (DeFi) protocol Maker (MKR) is trading for $1,513 at time of writing, up from $1,047 one month ago.

The 34th-ranked crypto asset by market cap is also up more than 16% in the past seven days and nearly 3% in the past 24 hours.

Maker supports the decentralized stablecoin DAI, which aims to maintain a 1:1 peg to the US dollar. With a market cap of $3.81 billion, DAI is the third-ranked stablecoin by size after USDT ($83.22 billion) and USD Coin (USDC) ($25.54 billion).

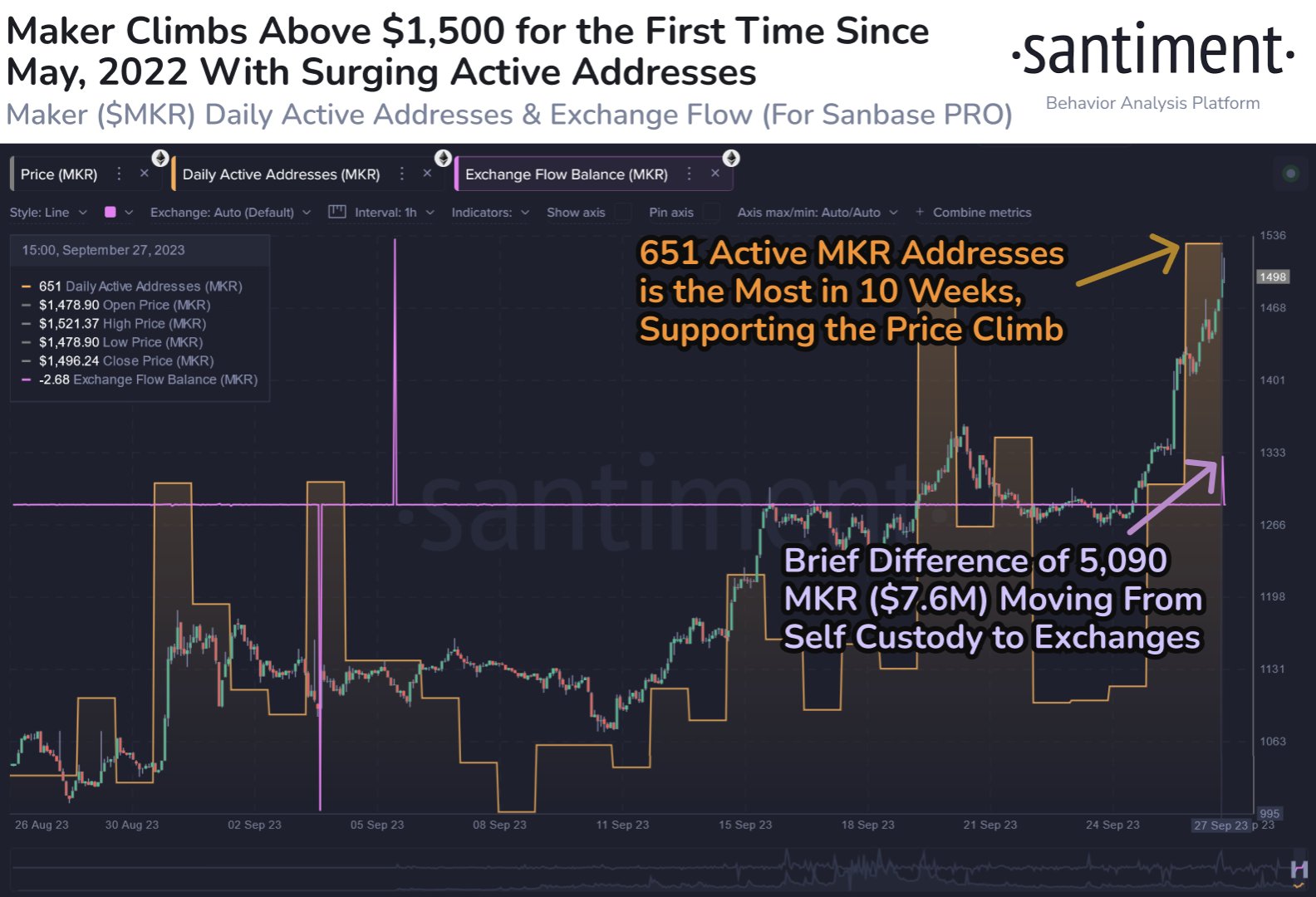

MKR’s recent price surge materialized amid an uptick in address activity, according to Santiment. The crypto analytics firm notes that the asset recently hit a 10-week high in terms of daily active addresses.

Crypto tracker Lookonchain also notes that a couple of crypto whales executed MKR purchases on Wednesday, with one spending 899 Ethereum (ETH) worth $1.44 million to buy 958 MKR, and another spending 800,000 USDT to pick up 536 MKR.

Despite the price gains in the past month, MKR remains nearly 76% down from its all-time high of more than $6,292, which it hit in May 2021.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

The post Top-35 Altcoin Ignores Crypto Market Doldrums and Surges by Nearly 45% in the Past Month Amid Spike in Activity appeared first on The Daily Hodl.