Rising optimism in crypto has pushed institutional investors into making their largest allocation of capital into digital assets markets in over a year.

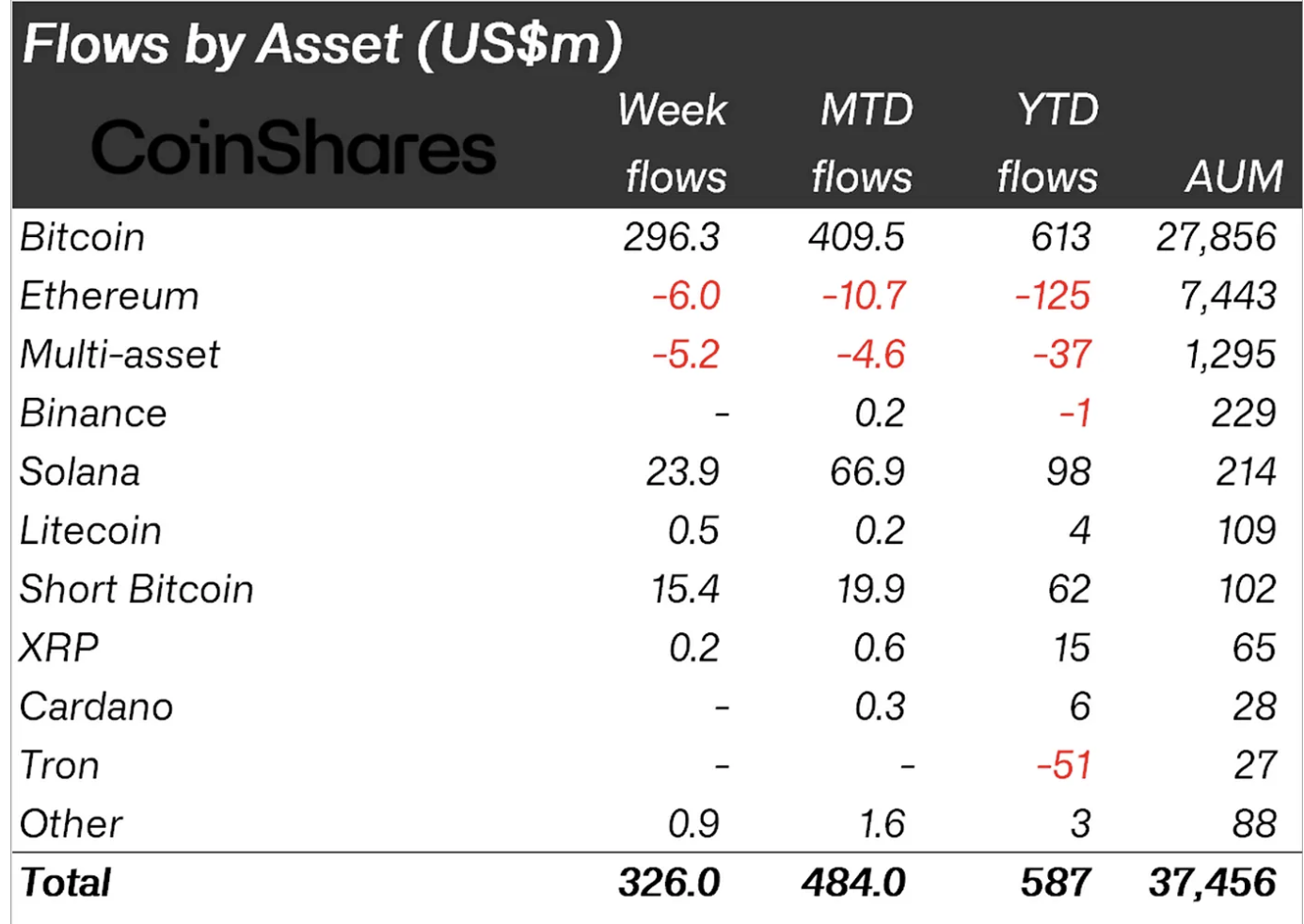

In its latest report, Digital assets manager CoinShares says institutions put $326 million into crypto investment products last week, the largest weekly inflow since July of 2022.

CoinShares says the inflows coincide with growing optimism from investors that the US Securities and Exchange Commission (SEC) is likely on the verge of approving a spot-based Bitcoin (BTC) exchange-traded fund (ETF) in the US.

With the perceived likelihood of a Bitcoin ETF, BTC saw 90% of the inflows from institutions, says CoinShares. However, the firm says that the inflows were still not historically significant for the king crypto, suggesting potential hesitancy among investors.

“While positive for Bitcoin, this weekly inflow ranks as only the 21st largest on record, suggesting continued restraint amongst investors, although we do believe a spot-based ETF is now highly likely in the coming months, and will represent a step-change for the industry from a regulatory perspective.”

CoinShares data shows that once again, Ethereum (ETH) rival Solana (SOL) saw the most amount of capital flows, making it a “favorite” among institutions in 2023.

CoinShares says that only 12% of the flows came from the US. The largest amount of capital flows came from Canada, Germany and Switzerland, with inflows of $134 million, $82 million and $50 million respectively. $28 million came from Asia, which is the largest weekly flow from the region in recorded history, says CoinShares.

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inboxCheck Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Agor2012

The post $326,000,000 in Institutional Capital Hits Bitcoin and Altcoins In Largest Wave Since July 2022: CoinShares appeared first on The Daily Hodl.