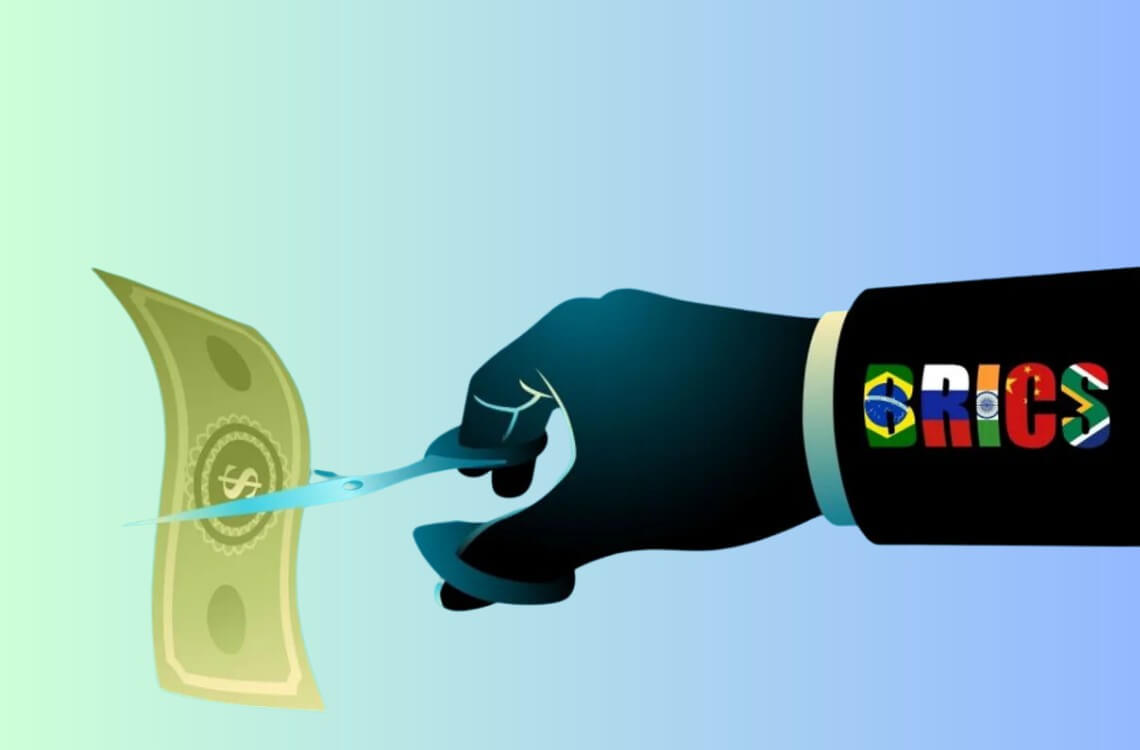

As the BRICS nations coalesce around the ambition of reshaping the financial world order, the whisper of a new currency intended to challenge the U.S. dollar has been echoing in the corridors of global finance.

This move by BRICS, which includes Brazil, Russia, India, China, and South Africa, embodies a defiance against the long-standing dollar hegemony and may indeed signal a monumental shift.

But it appears that these emerging economic powerhouses might just as effectively undermine the dollar’s supremacy without introducing a new currency at all.

The Power Shift Without a New Currency

Senior advisor at the Lindsey Group, Joe Sullivan, asserts that the BRICS consortium possesses the capability to displace the USD by enforcing trade settlements in their diverse local currencies.

This strategy could deal a significant blow to the dollar’s dominance, subsequently reconfiguring the currents of international trade.

By dismantling the customary use of the USD in trade agreements within the BRICS nations, they would essentially dethrone the currency that has ruled supreme for decades.

BRICS nations have been edging towards this monumental shift subtly, as they’ve begun to transact using their own currencies, thus sidestepping the U.S. dollar. This move is not merely symbolic; it carries the weight of potential economic reformation.

The concept is straightforward yet audacious: BRICS could decree that all trades between member states be conducted in their sovereign currencies, nullifying the need for the USD as a standard exchange medium.

Local Currencies: The Emerging Titans

Sullivan extrapolates that the introduction of this paradigm would not only reduce the reliance on the USD but would also elevate the status and stability of BRICS nations’ own currencies.

As these countries’ economies are among the fastest-growing in the world, their currencies’ enhanced status would reflect their economic statures more accurately.

This is not a trivial power play. It is a calculated economic strategy that could see the BRICS economies collectively wielding more influence over global trade dynamics, potentially leading to a recalibration of global economic power from the West towards the East.

The domino effect of such a shift could have far-reaching consequences. If the U.S. dollar were to lose its prominence in global trade, particularly in the critical markets of oil and gas, a multitude of sectors within the American economy might feel the impact.

The mere notion has sparked speculative analysis across various financial platforms, contemplating the vast repercussions of a reduced role for the USD in international trade.

In the forthcoming years, the strategic maneuvers of the BRICS alliance will be pivotal. Will they introduce a new currency, or will they ingeniously leverage their collective economic might to dethrone the U.S. dollar?

The answer lies in how adeptly BRICS plays its economic cards and whether it opts for a direct confrontation with the U.S. dollar or chooses to chip away at its foundations through subtler, more insidious means.

Regardless of the path chosen, the implications are clear: the global economic landscape is on the cusp of a tectonic shift.

As developing nations rise and establish their own rules of economic engagement, the world is witnessing the emergence of a new era in financial history.

The BRICS may not need a new currency to oust the USD — their burgeoning economic power and willingness to rewrite the rules may suffice.