One of the crypto winter catalysts was the Federal Reserve’s announcement of a rate increase to curb inflation, taking the country towards a recession. As soon as the information reached the crypto community, investors and traders started a panic sell-off that plummeted crypto prices.

Even though the Terra crash exacerbated the situation, prices have fluctuated whenever the Feds meet to discuss measures to fight inflation.

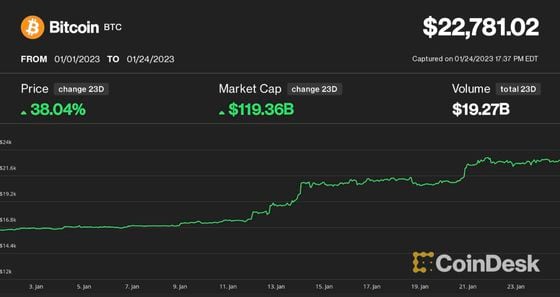

But in July, crypto prices showed signs of recovery, but the trends didn’t last long. From August 22 to 24, Bitcoin is on the verge of losing its hold on the $21K price. Ethereum is not faring well either, as growth seems to stop.

Data shows that BTC lost nearly 10% while ETH lost more than 11% instead of the anticipated recovery. But recent reports from the Fed’s activities indicate a more bearish trend.

According to the trendy information now, the CEO and President of the Minneapolis Federal Reserve Bank, Neel Kashkari, disclosed that he is interested in a Volcker-Esque decision by the Federal government.

The Volcker rule protects the banks’ customers by prohibiting financial institutions from making speculative investments. In addition, it bans banks from engaging in short-term proprietary trading involving derivatives, securities, commodity futures, etc., with their accounts.

There has been criticism against the Volcker rule, and even President Donald Trump ordered a review of financial system regulations, including the VR.

Can The Feds Create A Recession To Curb inflation?The control of inflation in the US lies under the power of the Federal Reserve. The body releases Consumer Price Index to gauge the country’s inflation level. Unfortunately, the data for June was very high, causing the Fed to hike interest rates to the extent that caused mayhem in the financial market.

Luckily, subsequent CPI data didn’t cause the same panic. Instead, the July CPI didn’t shake the stock market as expected. But everyone expected inflation to reduce. Instead, by August, the CPI data was lower than expected, leading to a price rally in the crypto market.

Cryptocurrency market trends sideways | Source: Crypto Total Market Cap on TradingView.comBut if the Feds enact the Volcker-esque themselves, everything will go worse than the initial experience. The world is waiting for the second quarter of the US GDP. Unless it shows signs of recovery, the data will indicate two-quarters of negative growth in the United States.

The data already meets the criteria for a technical recession which might lead to a stricter approach. If the Feds continue the aggressive approach, the result might cause more price slumps.

Recall that Paul Volcker was the chairman of the Federal Reserve that stopped inflation in the 1920s. According to history, the economist created two massive recessions to curb spending and push inflation down. But then, the recession was brief to force the growing crisis down.

This approach indicates that the control of the Federal Reserve over recession gives it the power to tip the scale to any side. But even though it could, it’s unlikely that the body would take rash decisions that could affect the economy.

Featured image from Pixabay, charts TradingView.com