Coinbase Global Inc. is expanding its services by adding spot crypto trading on its foreign exchange as part of a global expansion strategy to appeal to users who are skeptical of U.S.-based platforms.

Institutional investors can now trade Bitcoin and Ether against the USDC stablecoin on Coinbase’s global platform. This move is part of the platform’s global development strategy, primarily aimed at customers who may be wary of US-based venues due to regulatory uncertainty.

Coinbase goes global with game-changing spot markets

Although Coinbase’s stock has increased significantly this year and is now worth around $140 per share, it is still a long way from its peak of over $300 in 2021.

The international platform, which was originally focused on derivatives trading, now includes spot trading, allowing both to run concurrently.

According to Greg Tusar, Coinbase’s head of institutional solutions, this dual strategy is critical because it allows each market segment to complement the others, providing a deep and liquid market. The exchange notes that:

We are excited to announce the next phase of our Coinbase International Exchange expansion – the launch of non-US spot markets for eligible customers. This latest development is designed to address the unique needs and demands of our global user base while reinforcing our strategic mission to expand international access to trusted products and services.

Coinbase

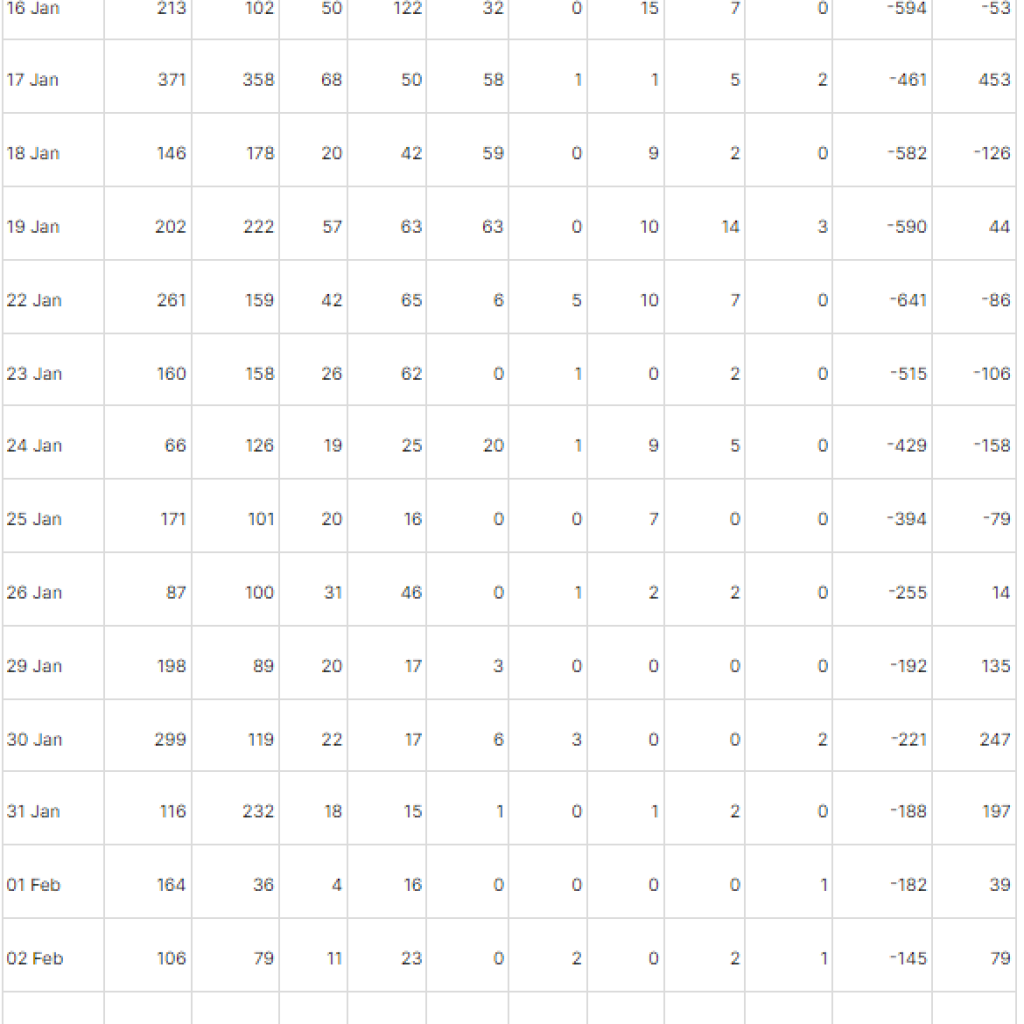

Coinbase International Exchange was founded in May 2023 and has had rapid growth in recent months: Over 100 institutions have been onboarded, with over $10 billion in perpetual futures trading activity in Q3 alone.

In October 2023, Coinbase Advanced made perpetual futures available to qualifying retail users. 15 perpetual contracts have been listed, covering more than 70% of the addressable perpetual futures trading market.

Maximum leverage has been increased to 10x for all mentioned contracts.

Coinbase International Exchange aspires to be a pillar of the global cryptocurrency ecosystem, providing functionalities that redefine industry norms, all the while upholding its dedication to security, privacy, and ease of use.

Are COIN shares in trouble?

Since the beginning of the month, renowned asset management firm Ark Invest has been selling COIN stocks. The investment manager has sold more than $119 million in COIN in less than two weeks.

While Ark has been selling shares at regular intervals in recent months, it increased its sales after the price rose alongside bitcoin (BTC) to a 19-month high.

On December 5, Ark sold its first COIN of the month, 237,572 shares, for approximately $33 million at the day’s closing price of $140.20. This came after the company made nearly $15 million from the sale of over 119,000 shares on November 27, 29, and 30.

The first sale of the month came from three exchange-traded funds (ETFs): Fintech Innovation (ARKF), Innovation (ARKK), and Next Generation Internet (ARKW).

On December 6, Ark Invest sold another lot of COIN shares for $24.3 million. The investment firm sold 180,422 shares from its ARKK, ARKW, and ARKF ETFs at the day’s closing price of $134.63.

On Friday, December 8, Ark completed its largest COIN sale since July, selling 335,860 shares across three ETFs, the majority of which came from ARKK. The sale raised $49.2 million at Coinbase’s closing price of $146.62, a little less than the $50.5 million raised from the July sale of 480,000 shares.

In May, the exchange expanded its international exchange, attempting to diversify away from the US market. As liquidity grows, the platform intends to list more tokens and eventually offer offshore spot trading to regular investors. Coinbase sees offering spot and futures activity on the same platform as a means to increase trade volumes.

Meanwhile, the crypto industry has recovered somewhat from the troubles of 2022, with investors anticipating the approval of the first spot Bitcoin exchange-traded funds (ETFs) in the United States in the following weeks.