In a surprising turn of events, video games have lost their decade-long reign as the UK’s primary entertainment medium, according to the Entertainment Retailers Association (ERA).

The ERA, a trade body representing video, music, and games retailers, has reported that for the first time in over ten years, video games have been eclipsed by the rising popularity of video-based content, including subscription services like Netflix, Disney Plus, and Apple TV.

The shift in dominance is marked by a 10% surge in revenue for video-based content, which now stands at £4.9 billion, overshadowing video games’ £4.74 billion in revenue, despite a 2.9% year-on-year growth in the gaming sector.

Video games vs. Video-based content: A shift in dominance

ERA’s latest data reveals a significant change in the UK’s entertainment landscape. Video games, which have held the top spot since 2012, faced tough competition from the booming subscription-based video content market. This shift in dominance has been driven by the popularity of streaming services, with subscription revenue accounting for a staggering 89% of the video market.

While video games saw continued growth, with a 2.9% increase in revenue, the video-based content sector experienced a substantial 10% surge in revenue, making it the new leader in the entertainment industry. This change reflects evolving consumer preferences and the increasing importance of streaming services in people’s daily lives.

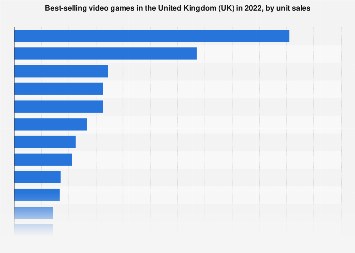

In terms of individual products, “Avatar: The Way of the Water” claimed the title of the best-selling video game in the UK for the year 2023, with 560,000 units sold. However, this achievement couldn’t prevent the overall decline of video games as the dominant entertainment medium in the country.

The revenue sources for both video games and video-based content are diverse. Video games generate revenue through sales of digital and physical copies, spanning various platforms such as PC, mobile, and consoles. On the other hand, video-based content relies heavily on subscription services, which constitute the bulk of its revenue, accounting for 89% of the market.

A snapshot of the entertainment industry

ERA’s comprehensive data offers valuable insights into the UK’s entertainment industry, shedding light on consumer trends and preferences. With the rise of subscription-based streaming services, it is evident that how people consume content is transforming.

While video games remain a significant part of the industry, they have been dethroned by the popularity of video-based content.

ERA also provided data comparing the current state of the entertainment market to pre-pandemic figures from 2019. The results showcase the resilience and adaptability of the industry in the face of unprecedented challenges.

Video game revenue in the UK for 2023 versus 2019 has seen remarkable growth, with a substantial increase of 29.2%. Video-based content experienced an even more impressive surge, with revenue up by 88.3%, while the music industry saw a notable increase of 38.8%.

These statistics illustrate the dynamic nature of the entertainment sector, with each medium evolving and adapting to changing consumer preferences. Despite the disruptions caused by the COVID-19 pandemic, the industry has recovered and thrived in various segments.

Digital dominance

One noteworthy trend across all three entertainment mediums is the increasing prevalence of digital downloading and streaming. In 2023, a staggering 92% of all sales within the industry were conducted through digital channels.

This shift towards digital consumption reflects the convenience and accessibility offered by online platforms, further highlighting the need for traditional retailers to adapt to changing consumer behavior.