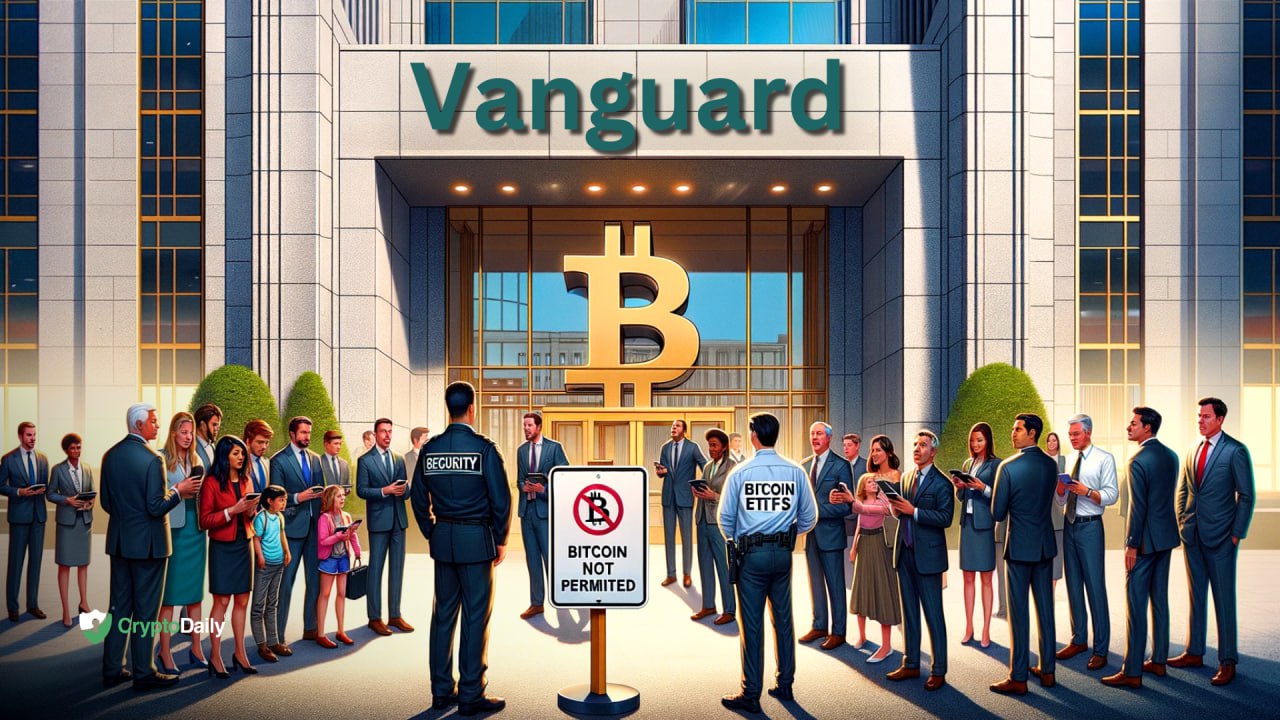

The world’s second-largest asset manager, Vanguard, has stated it will not allow customers to purchase any spot Bitcoin ETFs launched on Thursday.

The asset manager said that it does not view crypto as part of a “well-balanced” investment portfolio, even as its main rival, BlackRock, has taken the opposite stance and is embracing Bitcoin.

Vanguard Will Not Support Spot Bitcoin ETFs

The Securities and Exchange Commission approved several spot Bitcoin ETFs, which began trading on Thursday. However, Vanguard has refused to be drawn into the ETF hype and allow its customers to buy Bitcoin ETFs. Several Vanguard customers attempted to buy shares of a Bitcoin ETF on Thursday. However, they were greeted with a message telling them the trade could not be completed, leading to considerable disappointment.

Those who tried to purchase a share of BlackRock’s IBIT were shown a message stating that the trade could not be completed because “securities may be unavailable for purchase at Vanguard due to several variables including regulatory restrictions, corporate actions, or trading and settlement limitations.”

This sharply contrasted with other brokerages where users could purchase the spot Bitcoin ETFs of their choice.

A representative from Vanguard stated that Bitcoin ETFs were not available on the Vanguard platform because they were highly speculative, unregulated, and did not align with the company’s long-term investing philosophy. The representative also clarified that Vanguard did not offer several other investments, such as leveraged ETFs. Vanguard also does not have any plans to create a Bitcoin ETF of its own.

“While we continuously evaluate our brokerage offer and evaluate new product entries to the market, spot Bitcoin ETFs will not be available for purchase on the Vanguard platform. We also do not plan to offer Vanguard Bitcoin ETFs or other crypto-related products. Our perspective is that these products do not align with our offer focused on asset classes such as equities, bonds, and cash, which Vanguard views as the building blocks of a well-balanced, long-term investment portfolio.”

BlackRock’s Contrasting Position On Bitcoin ETFs

Meanwhile, Vanguard’s main rival, BlackRock, has taken the opposite stance and embraced Bitcoin, launching its own spot Bitcoin ETF, which began trading on Thursday under the ticker IBIT. BlackRock and Vanguard are the dominant players in the US ETF markets. Several fund companies, including BlackRock, have offered temporary waivers.

BlackRock’s spot Bitcoin ETF led early trading after launch, with data suggesting that BlackRock’s and Fidelity’s spot Bitcoin ETFs had seen over $958 million in trading volume by 11:10 am EST on Thursday,

A Conservative Stance

Vanguard’s stance is similar to the one adopted by the United States Securities and Exchange Commission Chair Gary Gensler. While the SEC may have approved spot Bitcoin ETFs, Gensler had some harsh words in his approval statement. The SEC Chair stated that Bitcoin is primarily a speculative and volatile asset used for illegal activities such as money laundering, sanction evasion, and ransomware.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto.”

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.