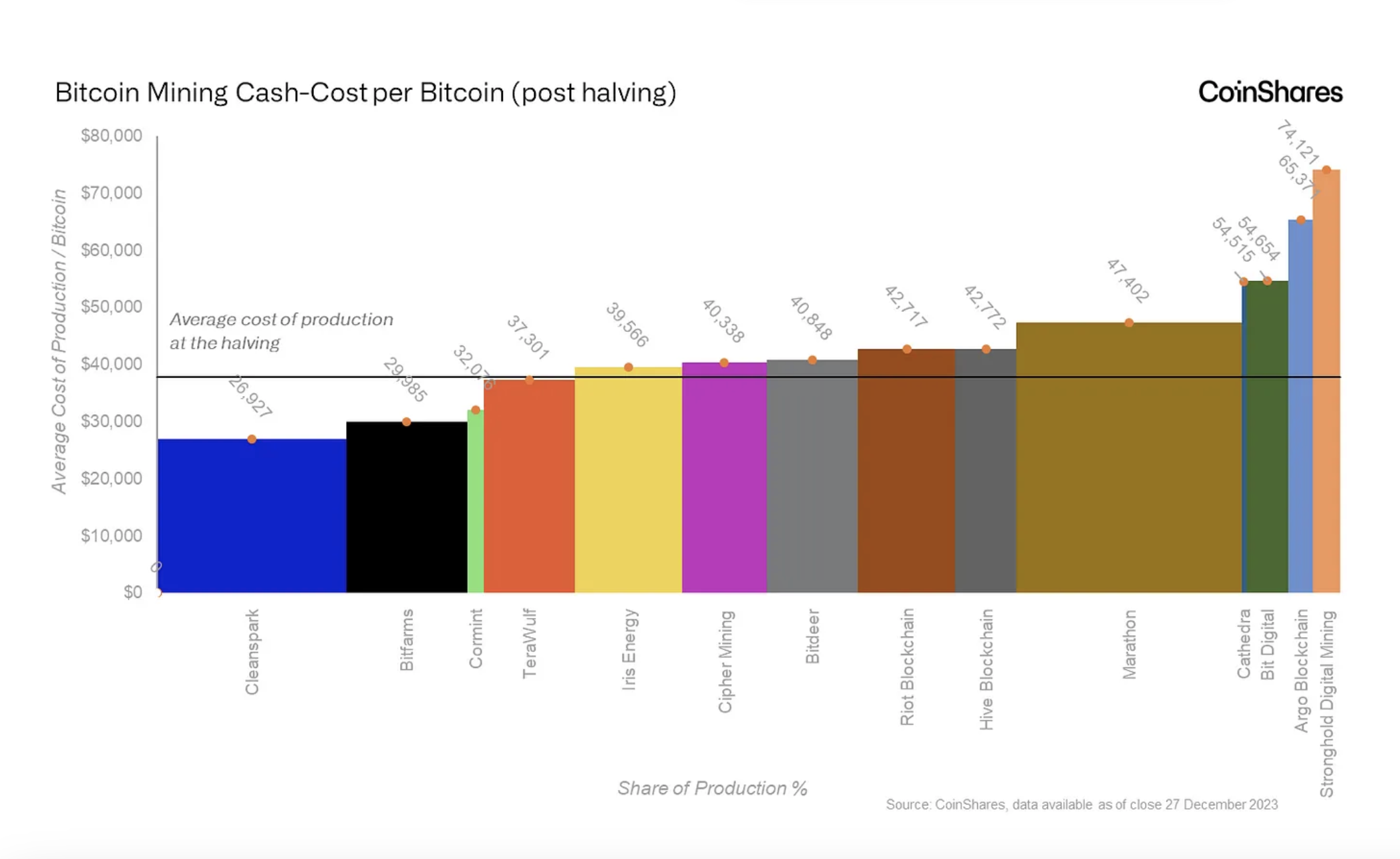

CoinShares projects the average cost of production for crypto miners post-halving at $37,856 per Bitcoin.

Bitcoin mining firms Riot, TeraWulf, and CleanSpark are the best-positioned within the industry to handle the significant cost increases expected following the Bitcoin halving event in April, according to analysis by asset manager CoinShares.

As a result of halving, CoinShares predicts that the cost of production and cash costs will increase from approximately $16,800 and $25,000 per Bitcoin in the third quarter of 2023 to $27,900 and $37,800, respectively. The average cost of production post-halving for crypto miners is projected to be $37,856.

The halving reduces the block reward given to miners by half, thereby slowing down the rate of new Bitcoin creation as part of the network supply control deflationary policy. The next halving, estimated to take place in April 2024, will reduce the Bitcoin block reward to 3.125 BTC. The cost of mining, however, remains the same or may even increase due to miners’ expansion of operations to remain profitable.