Coinspeaker

Manta Pacific Overtakes Base as 4th Largest Ethereum L2

In a recent development, Manta Pacific, the native layer 2 of Manta Network, has emerged as the fourth-largest scaling solution, surpassing Coinbase’s Base, according to data from L2Beat.

Manta Pacific’s Rise to Prominence

The Total Value Locked (TVL) on Manta Pacific currently stands at an impressive $850 million, leaving Base behind at $756 million. This shift in rankings highlights the growing prominence of Manta Pacific in the Decentralized Finance (DeFi) space. Layer 2 solutions, such as Manta Pacific, are secondary blockchains built atop primary or native blockchains to mitigate congestion issues, enhance speed, and facilitate smoother transactions.

Total Value Locked (TVL) serves as a crucial metric in gauging the popularity of DeFi protocols. It represents the notional value of tokens deposited within a protocol, reflecting user engagement and the overall health of the platform.

Notably, L2Beat’s TVL methodology considers the dollar value of tokens canonically bridged, externally bridged, and natively minted. In contrast, DeFiLlama, another reputable source, focuses solely on assets actively engaged in decentralized applications. According to DeFiLlama, Manta and Base are in a tight contest for the ninth spot, both boasting a TVL of approximately $420 million.

Last year, Manta Pacific transitioned to a zero-knowledge rollup, leveraging zero-knowledge proofs, a cryptographic technique that gained prominence in 2023 for its ability to ensure rapid transaction settlement, also known as “finality.” This technological advancement has contributed to Manta Pacific’s success and its ascent in the scaling solution hierarchy.

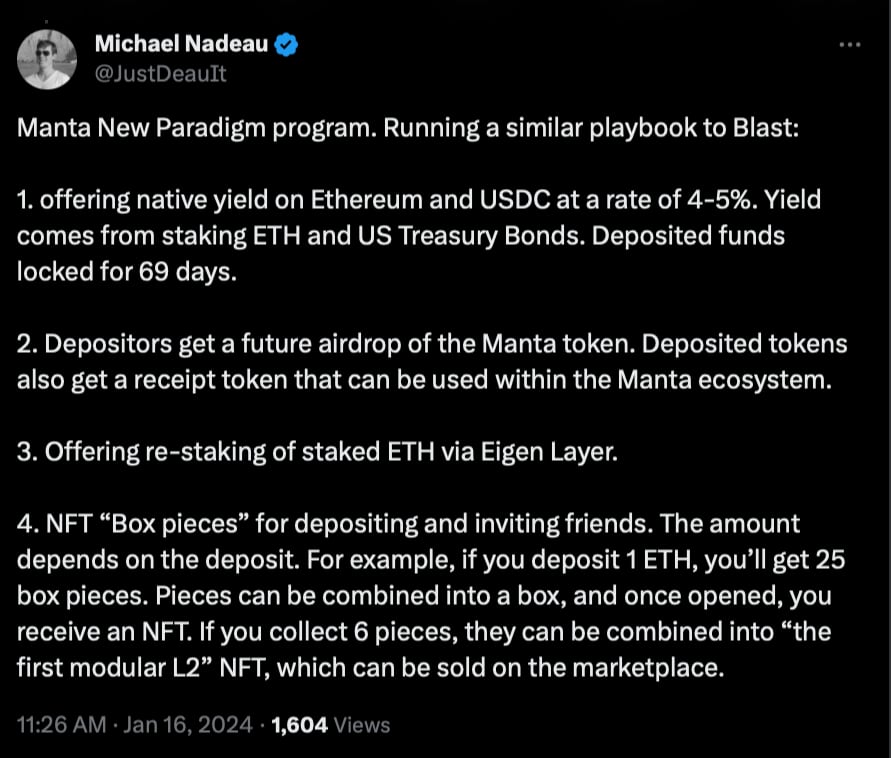

Additionally, Manta Pacific’s paradigm bridging program, launched in December, played a pivotal role in the platform’s accelerated growth. Bridging involves transferring assets from one blockchain to another, and Manta Pacific incentivizes users by offering rewards for bridging Ethereum (ETH) and USD Coin (USDC) to its network. The layer 2 solution adopts a strategy reminiscent of Ethereum layer 2 Blast, as noted by Michael Nadeau, founder of the DeFi report.

Users bridging ETH and USDC to Manta Pacific enjoy a staking yield ranging from 4% to 5%, with their coins locked for a duration of 69 days. Depositors are also eligible for future airdrops of MANTA tokens. The program further offers NFT box pieces to depositors, and staked ETH can be re-staked on the Eigen Layer protocol.

Binance Embraces Manta

In a move that solidifies Manta Pacific’s dominance in the industry, Binance recently introduced MANTA as its 44th project on the Launchpool.

This integration allows Binance users to earn MANTA tokens by staking their BNB and FDUSD tokens. The addition of Manta to the Binance ecosystem introduces a modular Layer 2 solution tailored for Zero-Knowledge (ZK) applications. The Launchpool initiative, which began on Monday spans two days and enables users to farm MANTA tokens.

As Manta Pacific continues to gain traction and secure its position in the scaling solution landscape, the crypto community eagerly awaits further developments and innovations from this project in the DeFi space.