Some users allege that the debt recovery proposal uses their assets for repayment without their consent.

Decentralized finance (DeFi) borrowing and lending protocol Moonwell wants to use its $2.3 million worth of digital asset collateral to offset bad debt from its Frax Finance (FRAX) pools from a hack almost two years prior, but not all users are happy.

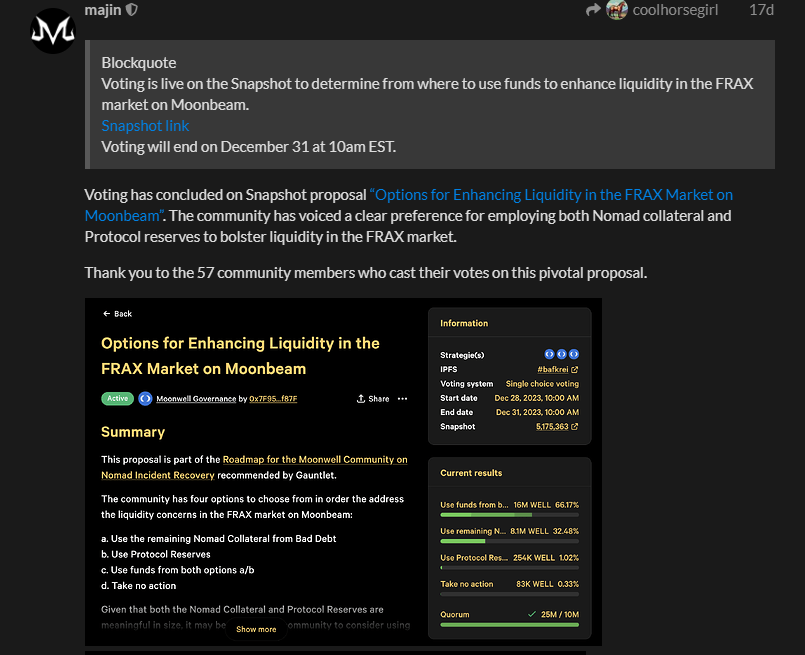

In a plebiscite dated Dec. 31, 2023, titled “Options for Enhancing Liquidity in the FRAX Market on Moonbeam [on which Moonwell is built],” 25 million votes, denominated in the protocol’s WELL token, were in favor of using a combination of Nomad collateral and protocol reserves to address its Frax bad debt. Moonwell’s protocol reserves currently amount to $466,000, which is insufficient to cover the balance of its Frax liabilities alone.

The plebiscite was over 98% in favor and passed its 10 million WELL quorum threshold. That said, only 57 individuals or entities voted. Developers wrote: