The year 2023 witnessed an extraordinary surge in the crypto markets, reshaping the way we perceive and engage with digital assets. CoinGecko, a prominent cryptocurrency data aggregator, has meticulously compiled and analyzed market trends, trading volumes, and a myriad of other factors to present an insightful report on the remarkable growth experienced by the crypto markets throughout the year.

Crypto markets grow amid bear and bull troubles

CoinGecko, a platform for analyzing the crypto market, has compiled a forecast of the sector’s expansion in 2023 in light of several events that have generated optimism and anticipation, such as the forthcoming Bitcoin halving and the recent sanction of spot Bitcoin exchange-traded funds (ETFs).

The report highlights significant expansion in various sectors of the market, such as decentralized finance (DeFi), non-fungible tokens (NFTs), centralized exchanges (CEXs), and decentralized exchanges (DEXs).

The crypto market witnessed an upsurge in expectations regarding exchange-traded funds (ETFs) during the fourth quarter of 2023, especially in light of the increasing confidence encircling the possible authorization of US spot Bitcoin ETFs.

This optimism contributed to a bullish market sentiment, which resulted in a substantial 55% increase in the total crypto market capitalization from $1.1 trillion to $1.6 trillion. The price of Bitcoin increased from $27,000 to $42,000 during this time period.

During the course of the entire year of 2023, the crypto market experienced significant expansion, with its total market capitalization more than doubling from $832 billion at the start of the year. The notable growth was predominantly propelled by the remarkable resurgence of Bitcoin, which witnessed a 2.6-fold increase.

Ethereum market performance

Ethereum (ETH) closed 2023 at $2,294, up +90.5% for the year. In the first quarter of 2023, ETH saw its biggest gains, growing by 49.8% from $1,196 to $1,792. It then consolidated for the most part in Q2 and Q3 before surging by 36.4% in Q4. ETH reached a yearly high of $2,376 in December.

Despite the launch of the Shanghai Upgrade in April, which enabled the withdrawal of staked ETH, no substantial price changes occurred during that time. In 2023, average daily trading volume remained relatively steady, with the exception of Q4, when it increased by 100% from $7.2 billion to $14.4 billion.

Solana market performance

Solana (SOL) rose +917.3% in 2023, from $10.0 to $101.3. SOL experienced its first leg up in the first quarter of 2023, increasing by +112.9%. The price activity of SOL in Q2 and Q3 was generally quiet, with the FTX bankruptcy estate selling its stake. It subsequently had a strong rally in Q4, reaching a high of $121.5.

Average daily trade volume also increased in 2023, reaching $827.0 million in Q1 and rising to $2.0 billion in Q4. Solana has experienced a comeback in bullish storylines, such as OPOS (“Only Possible on Solana”), its rebirth and resilience following FTX’s collapse, and a number of high-profile airdrops, including Pyth Network (PYTH) and Jito.

The NFTs market

NFT trading volumes across the top ten chains were $11.8 billion in 2023. However, this sum is less than half of the total NFT trading volume in 2022, which was $26.3 billion.

Trading volume in 2023 Q1 was $4.5 billion, but it declined substantially in Q2 and Q3, with values of $2.7 billion and $1.4 billion, respectively. It then recovered to $3.2 billion in Q4, thanks in part to high Bitcoin Ordinals trading volumes.

Ethereum remained the dominant NFT chain in 2023, accounting for 72.3% of trade volume. However, this is a far cry from the 90% dominance it enjoyed in 2022. Blockchains like Bitcoin and Solana were on the rise, particularly in the fourth quarter of 2023. Bitcoin’s trade volume topped Ethereum’s in December, totaling $808.0 million. This can be ascribed to the introduction of Ordinals earlier this year.

CEX’s and DEX’s

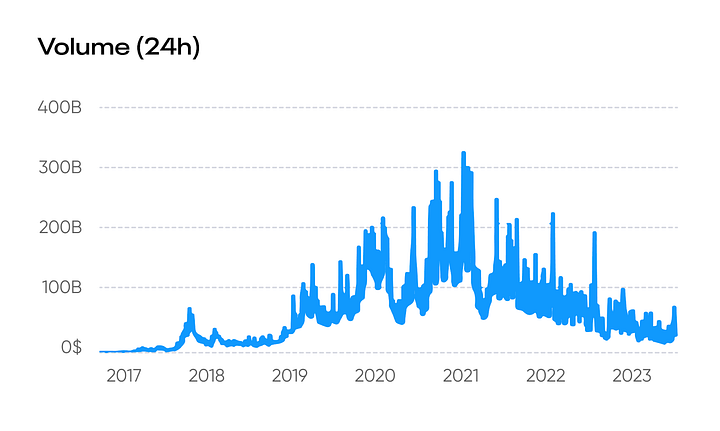

Crypto trading volume reached $36.6 trillion in 2023. Volume surged by 53.1% in Q4 of 2023, from $6.7 trillion in Q3 to $10.3 trillion. This was the first quarter-on-quarter rise of the year, owing to market sentiment turning optimistic in anticipation of Bitcoin ETFs.

Despite the fall of FTX in 2022 and Binance’s regulatory obstacles in 2023, centralized exchanges (CEXs) dominated trading volume. CEX:DEX spot ratio was 91.4%, while CEX:DEX derivatives ratio was 98.1%.