The financial landscape is ever-evolving, and in this dynamic world, Bitcoin ETFs are making their mark, unfazed by the challenges faced by their counterparts. While Grayscale Bitcoin Trust (GBTC) navigates through turbulent waters, witnessing significant outflows, the performance and appeal of spot Bitcoin ETFs managed by powerhouses like BlackRock and Fidelity are soaring. This phenomenon underscores a pivotal shift in investor sentiment and market dynamics, signaling a robust appetite for Bitcoin-focused investment products.

Last week’s financial narratives were dominated by a remarkable turnaround in the crypto sector. After a period of outflows, the tide turned positive, as evidenced by a surge in investments into crypto products. Leading the charge were the BlackRock- and Fidelity-run Bitcoin funds, which collectively amassed inflows that not only eclipsed the outflows from GBTC but also marked a significant milestone in the crypto investment domain. This shift in capital flow, amounting to a staggering $708 million, was a clear departure from the previous week’s $500 million outflow, showcasing the volatile yet opportunistic nature of the market.

A Tale of Two Titans: BlackRock and Fidelity’s Ascendancy

At the heart of this resurgence are BlackRock and Fidelity, whose Bitcoin ETFs have become beacons of growth in the crypto investment sphere. Last week alone, their funds attracted $884 million and $674 million in inflows, respectively. These figures not only highlight the growing investor confidence in these funds but also reflect a broader acceptance of Bitcoin as a viable investment asset.

The iShares Bitcoin Trust (IBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) have witnessed remarkable growth, with their assets ballooning to more than $3 billion and $2.6 billion, respectively. This growth trajectory is especially noteworthy given the backdrop of GBTC’s struggles, which, despite managing a hefty $20.5 billion in assets, saw its inflows dwindle.

The narrative around Bitcoin ETFs is not just about numbers but also about the changing landscape of cryptocurrency investments. The launch of these ETFs was met with skepticism, with many questioning their long-term viability. However, the sustained inflows and growing asset base of these funds are a testament to their staying power and the evolving investor mindset towards cryptocurrencies.

Mining the Future: The Impact on Bitcoin Reserves

Beyond the immediate investment flows, the launch of Bitcoin ETFs in the United States has had a profound impact on the broader cryptocurrency ecosystem, particularly on Bitcoin miners. The approval of these ETFs has catalyzed a significant movement of BTC from miner wallets to exchanges, signaling a strategic shift in how miners manage their reserves in response to market dynamics. This trend was highlighted by a record outflow of over $1 billion of BTC to exchanges within just 48 hours of the ETFs’ trading commencement, underscoring the miners’ need for liquidity and their response to the ETF-driven market conditions.

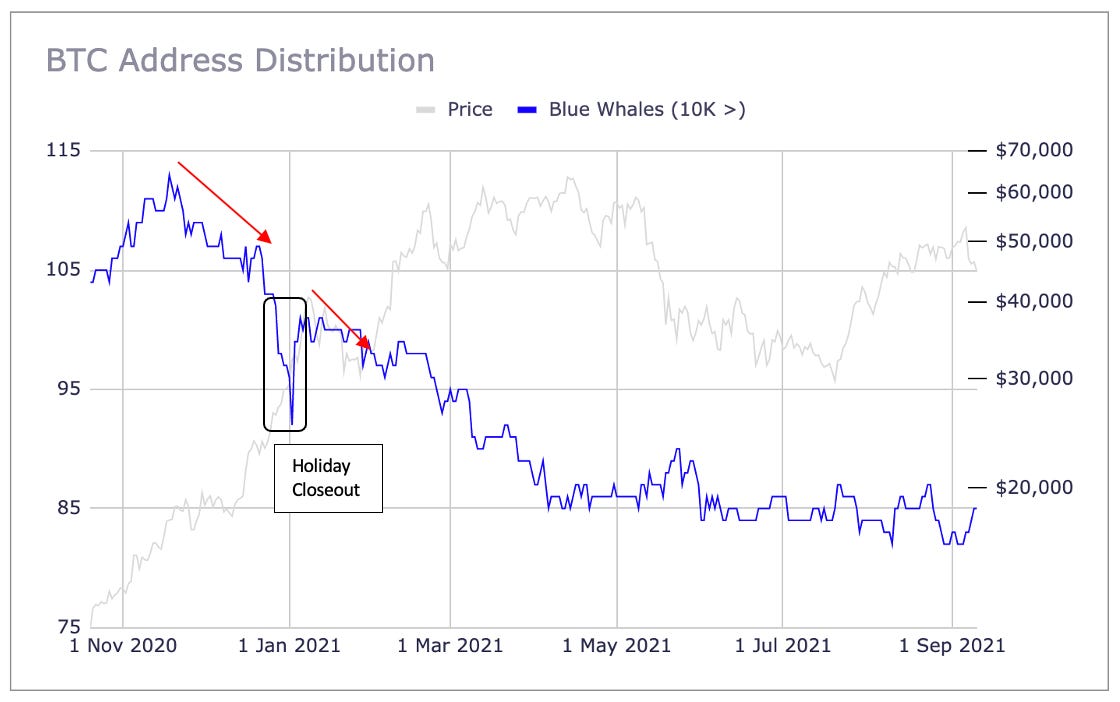

This shift is not merely a reaction to the ETF launches but also a reflection of the strategic decisions by miners in the face of market volatility and operational needs. The decrease in Bitcoin miner reserves to its lowest point since June 2021 further illustrates the impact of these investment products on the cryptocurrency market’s supply dynamics. It’s a complex interplay of market sentiment, liquidity needs, and strategic positioning that underpins these movements.

The introduction of Bitcoin ETFs has also sparked a notable shift in investor behavior, particularly among long-term holders. Despite the market fluctuations and the transformative effect of ETFs, there’s a discernible trend of holding among investors who believe in Bitcoin’s future value. This steadfastness among long-term investors, coupled with the dynamic inflows into Bitcoin ETFs, paints a picture of a market that is maturing, diversifying, and increasingly nuanced in its approach to cryptocurrency investments.