In recent market observations, Cathie Wood, the CEO of ARK Invest, has pointed out a noticeable shift in investment preferences, with a growing inclination toward Bitcoin over traditional gold investments. This shift has gained momentum following the introduction of spot bitcoin exchange-traded funds (ETFs), which provide investors with a more streamlined avenue to participate in the cryptocurrency market.

Cathie Wood highlights the importance of Bitcoin

Cathie Wood highlighted the changing landscape during a recent discussion with Brett Winton, ARK’s chief futurist. She emphasized Bitcoin’s resilience and growth, particularly during periods of financial uncertainty. Notably, in March 2023, amidst a regional bank crisis in the U.S., bitcoin experienced a remarkable 40% surge while the regional bank index plummeted.

This incident underscored Bitcoin’s emerging status as a “flight to safety” asset during market turmoil. A compelling illustration shared by Wood is a chart comparing Bitcoin’s price to that of gold, demonstrating a robust long-term uptrend. This trend signifies Bitcoin’s gradual encroachment on gold’s traditional role as a preferred investment avenue.

Cathie Wood expressed confidence in this shift, noting the ongoing substitution into Bitcoin by investors seeking alternative stores of value. Acknowledging the volatility accompanying the launch of spot bitcoin ETFs, Wood explained that a subsequent price correction was to be expected.

Ark Invest’s strategic moves in the crypto sector

Despite a 20% drop in Bitcoin’s price following the ETF launches, Cathie Wood remains optimistic. She cited data indicating that a significant portion of the existing Bitcoin supply has remained untouched for over 155 days, suggesting a strong holding pattern among investors and a belief in the long-term potential of the cryptocurrency.

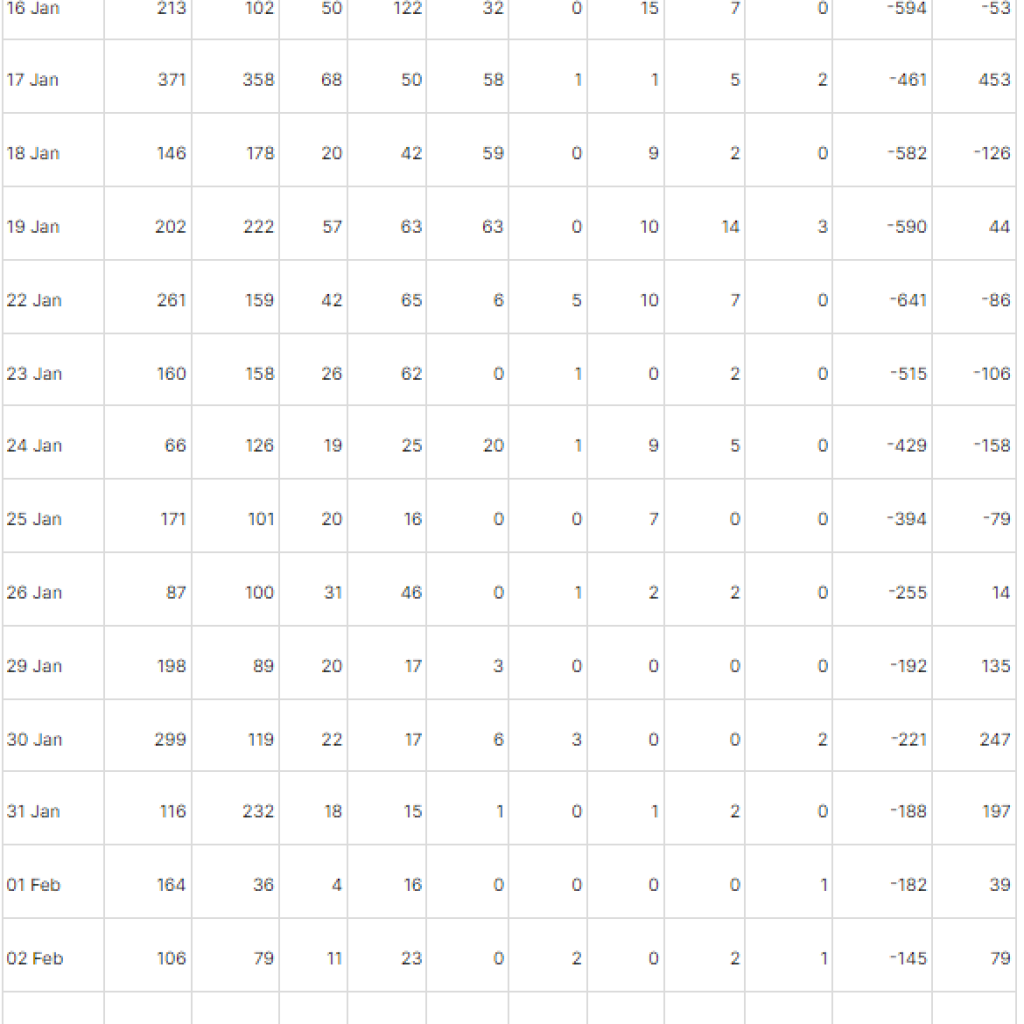

ARK Invest’s strategic positioning within the cryptocurrency space extends beyond Bitcoin. The firm has notably invested in Coinbase stock (COIN), though it has scaled back its holdings since June 2023. Presently, ARK holds 7.187 million shares in Coinbase, valued at $843 million, underscoring its continued confidence in the crypto sector despite market fluctuations.

Wood’s observations and ARK Invest’s strategic moves reflect a broader trend in the investment landscape, where traditional asset classes like gold are facing competition from emerging digital alternatives like bitcoin. The increasing accessibility of cryptocurrencies through ETFs and other investment vehicles is democratizing access to these assets, attracting a broader range of investors seeking diversification and potential growth opportunities.

While the cryptocurrency market remains volatile and subject to regulatory uncertainties, Wood’s insights and ARK Invest’s continued involvement indicate a growing acceptance and integration of digital assets into mainstream investment strategies. As the market matures and regulatory clarity improves, Bitcoin and other cryptocurrencies may further solidify their position as viable investment options alongside traditional assets like gold.