Wall Street analysts project a potential downside for Super Micro Computer (SMCI) stock over the next 12 months. Despite its impressive performance in 2024, with the stock more than doubling in value, the consensus among analysts suggests an average price target of $551. This reflects a decline of approximately 25.57% from the current price.

Strong fundamentals for AI stocks

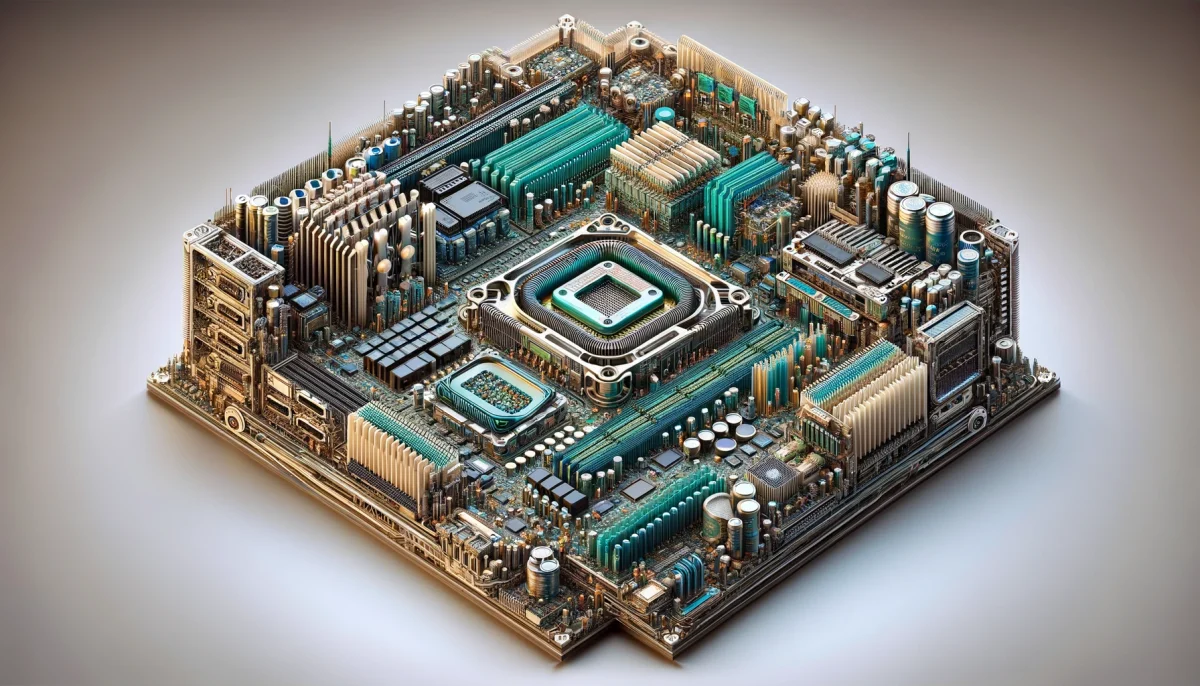

SMCI has capitalized on the artificial intelligence (AI) revolution, specializing in advanced servers and storage equipment tailored for AI applications. Its strategic partnerships with major AI chip manufacturers, such as Nvidia and Intel, position the company for further growth. Additionally, SMCI’s recent financial success, including a remarkable 103% increase in sales in the latest quarter, underscores its positive trajectory.

Market opportunities

The global server market presents a significant growth opportunity for SMCI, especially considering the aggressive investments in AI infrastructure by technology giants like Microsoft, Alphabet, Meta Platforms, and Amazon. Moreover, SMCI is actively expanding its production sites to increase its revenue generation capacity, aiming for over $25 billion annually.

Competitive landscape and risks

However, SMCI faces intense competition from industry giants like Cisco Systems and emerging players in the AI hardware market. Its growth is closely tied to partnerships with semiconductor leaders, making it dependent on their success. Additionally, concerns about portfolio diversification and patent protection add to the risks associated with investing in SMCI.

While the stock has surged in 2024, investors remain cautious about its sustainability. The meteoric rise in SMCI’s stock has raised questions about the longevity of the upward trend. Analysts are closely monitoring the trajectory of the stock to gauge its ongoing viability.

While SMCI has demonstrated impressive performance and possesses strong underlying fundamentals, there are concerns about its future prospects. The projected downside by Wall Street analysts highlights the uncertainties surrounding the stock’s trajectory. Investors should carefully consider the risks and opportunities associated with investing in SMCI before making any decisions.