MicroStrategy, a significant player in the cryptocurrency market, has seen substantial gains as Bitcoin (BTC) surged to nearly $53,000. As the largest corporate holder of Bitcoin, MicroStrategy’s holdings have surpassed $10 billion, translating to a profit of over $4 billion.

MicroStrategy nets $4 billion in profit from Bitcoin holdings

The company’s most recent investor presentation revealed that by the end of January, MicroStrategy possessed 190,000 bitcoins, which were acquired for a total of $5.93 billion. This equates to an average purchase price of $31,224 per coin. The company initiated its Bitcoin acquisition strategy in the second quarter of 2020 and has continued to purchase additional tokens every quarter since then.

The impressive rally in Bitcoin’s price, which has soared by over 20% since the beginning of 2024, has significantly boosted MicroStrategy’s profits. In December of the previous year, the company had already amassed a profit of nearly $2 billion, a figure that has now doubled.

Bitcoin’s ascent to $52,800 early on a Thursday morning propelled the value of its holdings above the $10 billion mark, with profits exceeding $4 billion. Although the price has slightly retraced, trading at $52,000 at the time of writing, the overall trajectory remains impressive.

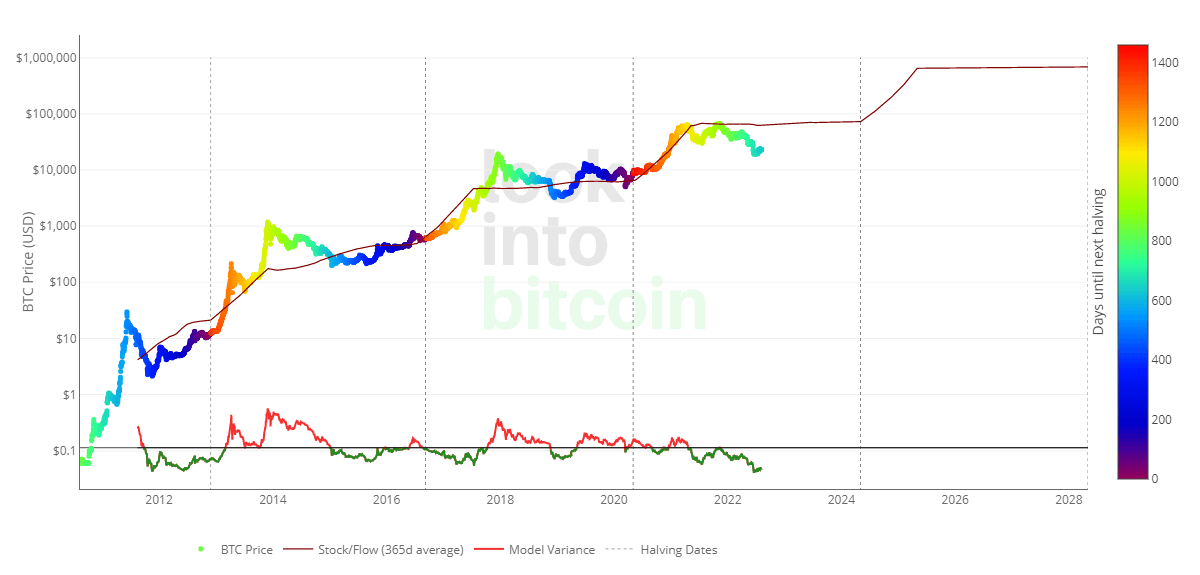

Michael Saylor, the co-founder and executive chairman of MicroStrategy, recently attributed Bitcoin’s price surge to the listing of spot Bitcoin exchange-traded funds (ETFs). He believes that this development has triggered a significant imbalance in the supply and demand dynamics, owing to a decade-long desire for a retail-accessible Bitcoin product.

Implications for institutional adoption

Despite this bullish sentiment surrounding Bitcoin, MicroStrategy’s shares remained relatively flat in Thursday morning trade, albeit showing a 21% increase year-to-date. The company’s strategic move to invest heavily in Bitcoin has proven to be immensely profitable, capitalizing on the digital asset’s remarkable price appreciation.

The company’s consistent accumulation of Bitcoin over several quarters underscores its long-term commitment and confidence in the future potential of cryptocurrencies. Furthermore, the company’s success serves as a testament to the growing institutional adoption of Bitcoin and other cryptocurrencies.

As more companies and institutional investors recognize the value and potential of digital assets as a store of value and hedge against inflation, the cryptocurrency market continues to attract significant interest and investment. While the volatility of Bitcoin remains a concern for some investors, MicroStrategy’s bold and pioneering approach has demonstrated the potential for substantial returns in the cryptocurrency space.

As Bitcoin continues to gain mainstream acceptance and adoption, MicroStrategy stands at the forefront of corporate entities embracing this digital revolution. MicroStrategy’s strategic investment in Bitcoin has yielded remarkable returns, with the company’s holdings surpassing $10 billion and profits exceeding $4 billion.

Despite the inherent volatility of the cryptocurrency market, MicroStrategy’s confidence in Bitcoin’s long-term potential has been vindicated by its impressive performance. As institutional adoption of cryptocurrencies continues to grow, MicroStrategy’s pioneering role underscores the transformative impact of digital assets on the financial landscape.