Jupiter Asset Management, a prominent London-listed firm overseeing assets worth over $65.8 billion, faced a setback as its crypto investment was abruptly terminated following a compliance hiccup,

Compliance issue derails Jupiter’s crypto investment

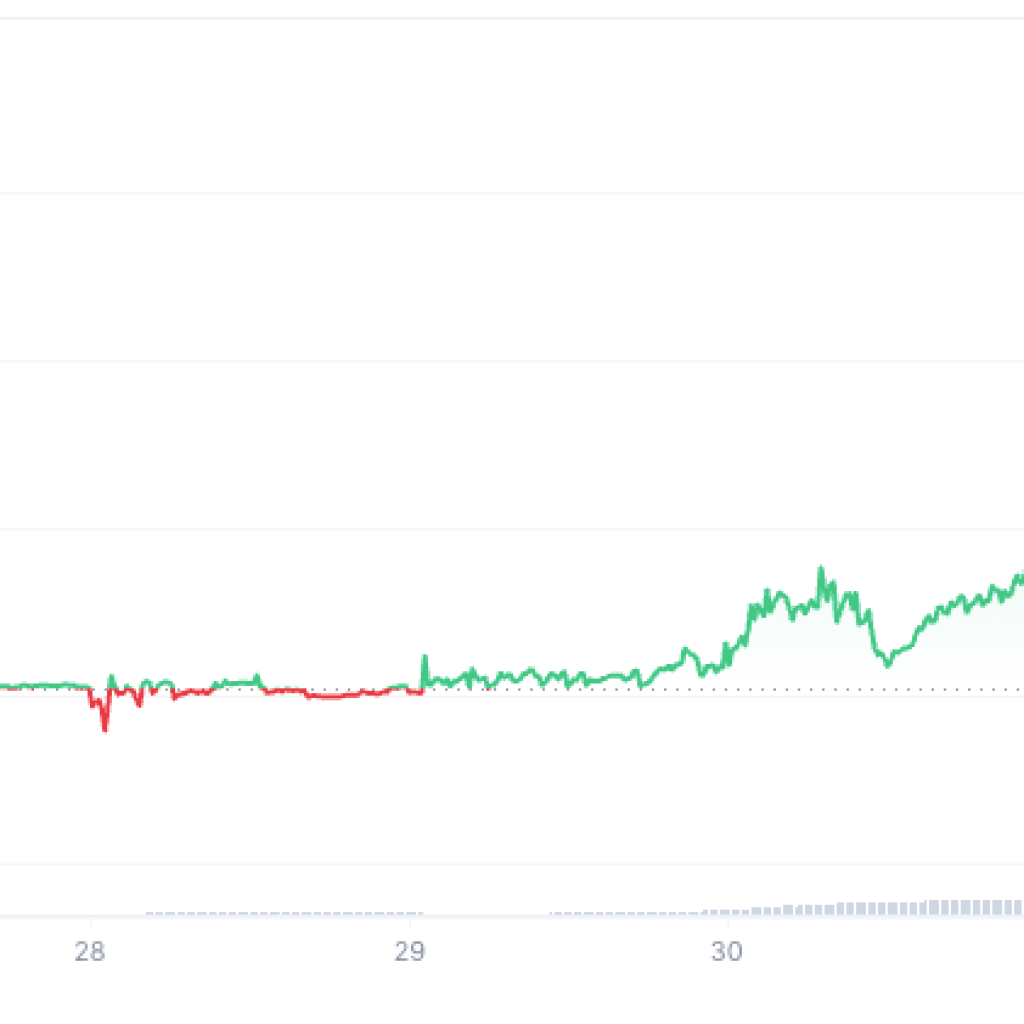

Jupiter’s Gold & Silver fund, a significant player in the investment landscape, had ventured into the realm of cryptocurrencies with a $2.58 million stake in 21Shares’ Ripple XRP Exchange-Traded Product (ETP) during the first half of 2023.

However, the investment hit a snag when it was flagged during the company’s routine oversight process. Consequently, the investment had to be canceled, incurring a loss of $834.

Divergent crypto regulations across Europe

The root cause behind the investment’s cancellation lies in the disparate regulatory landscape governing cryptocurrencies across Europe. While some jurisdictions like Germany permit investment funds to engage with crypto assets, others, such as Ireland, where Jupiter’s Gold & Silver fund is domiciled, prohibit crypto investments for UCITS funds.

UCITS, or undertaking for collective investment in transferable securities, sets out regulatory standards for investment funds under the European Commission’s purview.

Call for a unified framework

Jupiter’s stumble in the crypto investment arena underscores the pressing need for a unified regulatory framework governing crypto investments. The lack of coherence in regulations across European jurisdictions poses challenges for investment firms navigating the burgeoning crypto market. Despite the recent surge in the launch of spot crypto products in the United States, advocating for a streamlined regulatory approach remains imperative to ensure market stability and investor protection.

Industry response and Jupiter’s silence

In response to inquiries regarding the incident, Jupiter Asset Management did not provide immediate commentary. However, the episode serves as a cautionary tale for investment entities treading into the volatile terrain of cryptocurrencies.

With regulatory ambiguity looming large, firms must exercise heightened diligence to steer clear of compliance pitfalls and safeguard investors’ interests.As the crypto market continues to evolve, the incident involving Jupiter Asset Management sheds light on the intricate interplay between regulatory frameworks and investment strategies.

Amidst divergent regulatory stances across jurisdictions, the call for a harmonized approach to crypto regulation grows louder. While the allure of crypto investments persists, prudence dictates a thorough understanding of regulatory nuances to navigate the terrain effectively.