Record year-to-date crypto product inflows, slowing outflows, and positive price action have made the perfect recipe for the swelling AUM.

A record week of inflows for crypto-derived exchange-traded products (ETPs) has pushed their combined assets under management (AUM) to levels not seen since the last bull market peak in 2021, according to CoinShares.

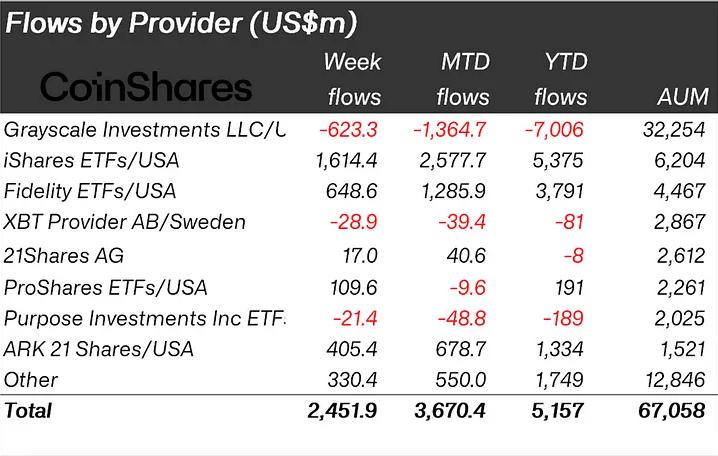

Crypto investment products’ AUM now stands at $67 billion, “marking the highest level since December 2021,” CoinShares research head James Butterfill wrote in a Feb. 19 report, pinning the AUM rise on year-to-date inflows of $5.2 billion and positive crypto market price action.

It comes as crypto ETPs notched a record $2.45 billion inflows on the week ending Feb. 16, with 99% due to United States-listed crypto ETPs, including the 10 approved spot Bitcoin ETFs, which saw a “significant acceleration of net inflows,” said Butterfill.