A recent move by Judge Analisa Torres has thrown a spotlight on the ongoing legal battle between the Securities and Exchange Commission (SEC) and Ripple Labs. To the surprise of many, the judge has given the nod to the SEC’s plea for more time to file critical documents in their case against Ripple. This decision has effectively pushed back the timeline for a case that’s been under the microscope since December 2020.

The legal documents, filed at the dawn of March, have granted the SEC a breather, allowing them until March 22 to present their opening brief. Ripple Labs, the defendant in this high-stakes legal drama, has been given until April 22 to counter the SEC’s arguments. The final word from the SEC, in the form of a reply, is now expected by May 6, 2024.

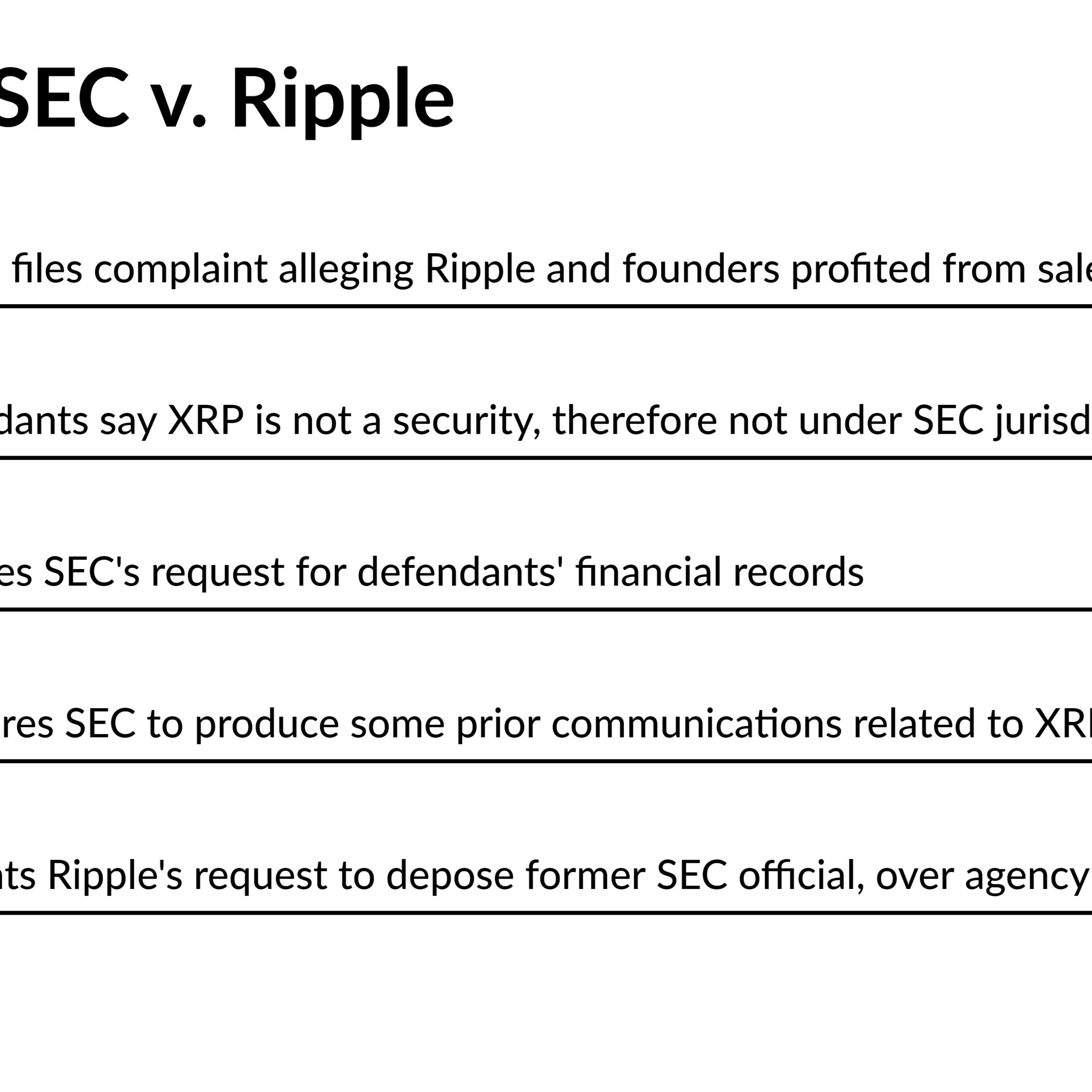

The basis of the regulator’s accusation is the classification of XRP as a security, which would bring it under the umbrella of more stringent regulatory requirements. Ripple’s counterargument is straightforward yet effective: XRP is not a security, and the SEC dropped the ball by not providing clear guidance for the classification of crypto tokens.

The main issue usually comes back to the “Howey test,” which is a legal standard used to see if a transaction is an investment contract and, by extension, a security under U.S. law. The SEC believes XRP fits the bill, while Ripple begs to differ.

A critical moment in this ongoing legal drama came in July 2023, when Judge Torres handed down a mixed verdict. She declared that XRP was not a security in the context of its sales on digital asset exchanges to the general public. However, in a twist, she also ruled that XRP could be considered a security in transactions involving institutional investors.

What does this delay in deadlines mean for the parties involved and the broader cryptocurrency market? First and foremost, it gives both Ripple and the SEC additional time to sharpen their arguments and strategize. For Ripple, it’s an opportunity to fortify their defense against a regulatory body that seems bent on setting a precedent with this case. For the SEC, it’s extra time to strengthen their case against a backdrop of increasing scrutiny regarding the regulation of cryptocurrencies.

This extended timeline also means that the resolution of a case that could have significant implications for the cryptocurrency industry is pushed further into the future. Market participants, investors, and other digital currency entities are left hanging in suspense, pondering the outcomes and potential precedents that this case might set.