While some lawsuits cater to individuals who suffered losses, others claim that all shareholders who purchased stocks during the timeframe are entitled to compensation.

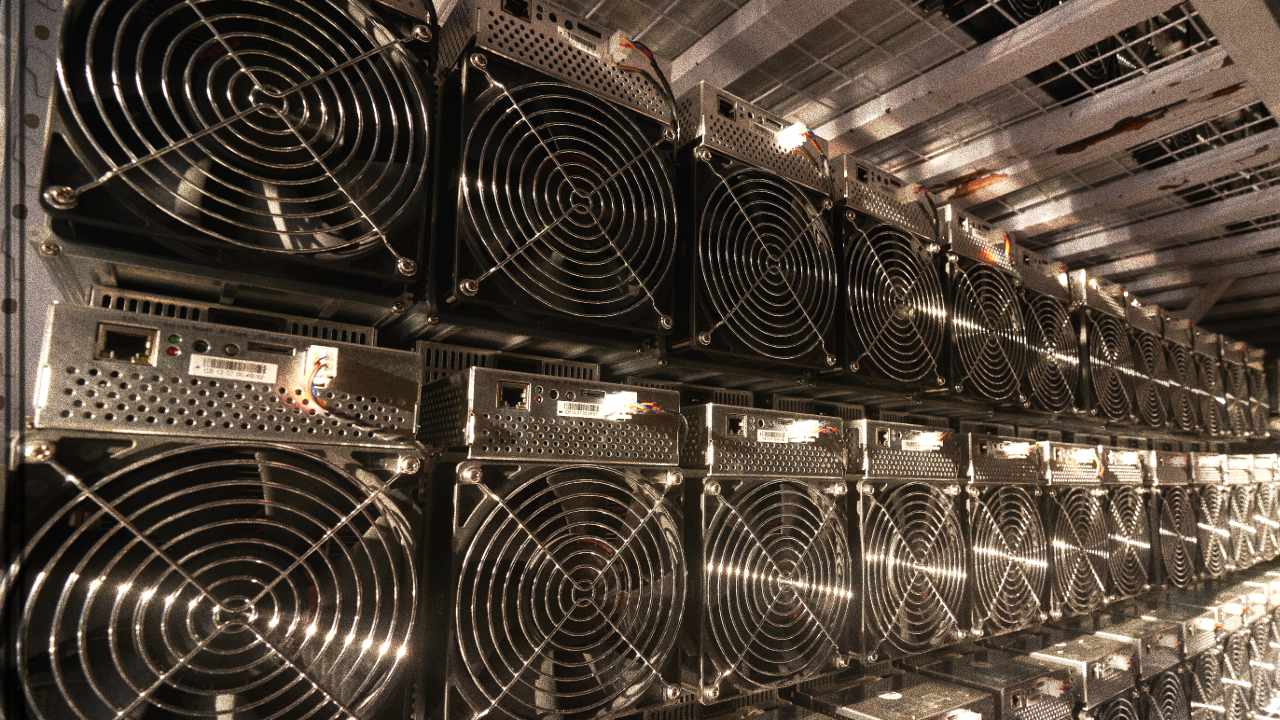

A number of law firms have offered to represent Hut 8 investors who recently incurred losses on the Nasdaq amid short-selling accusations.

On Jan. 19, the share prices of Bitcoin (BTC) mining firm Hut 8 tanked 23% — from $7.12 to $2.16 — after the release of an unverified J Capital report alleging insiders were preparing to dump Hut 8 stock. Hut 8 reviewed the report and, on Jan. 24, dismissed all allegations of short-selling. The company stated:

The J Capital report accuses Hut 8’s partner, USBTC, of a history of legal trouble in a $725 million merger deal. Jaime Leverton resigned as the CEO of Hut 8, and was later replaced by Asher Genoot, the president and a member of the company’s board of directors.