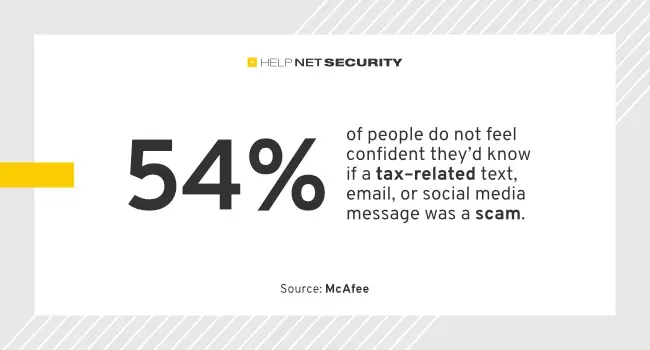

As tax season unfolds, anxiety surges among Americans, not only over the complexities of filing taxes but also due to the escalating threat of online tax scams. According to recent findings by McAfee, a leading cybersecurity firm, 25% of Americans have fallen victim to online tax scams. The prevalence of these scams underscores the pressing need for heightened vigilance and awareness among consumers.

In a disturbing trend, cybercriminals are increasingly turning to advanced artificial intelligence (AI) tools to orchestrate their fraudulent activities. McAfee’s research highlights the proliferation of deepfake technology, particularly in deceptive robocalls. These AI-generated calls, often embellished with regionally appropriate accents, pose a formidable challenge to unsuspecting recipients.

Despite the growing sophistication of these scams, a concerning number of Americans remain inadequately prepared to discern fraudulent content. Alarmingly, nearly half of respondents express confidence in their ability to identify deepfake videos or AI-generated audio, leaving a significant portion vulnerable to manipulation and exploitation.

Consumer education and vigilance are crucial

Against this backdrop of evolving cyber threats, McAfee emphasizes the paramount importance of consumer education and proactive measures to thwart online tax scams. With tax-related phishing emails emerging as a prevalent tactic, consumers are urged to exercise caution when encountering messages purporting to be from tax authorities, particularly those with PDF attachments.

Steve Grobman, Chief Technology Officer at McAfee, underscores the imperative for consumers to leverage AI-powered protection mechanisms to safeguard their personal information and privacy. He emphasizes the need for a balanced approach, advocating for adopting cyber hygiene practices alongside utilizing advanced security measures.

Despite widespread concerns surrounding online tax scams, a significant portion of Americans remain ill-equipped to combat this menace. McAfee’s findings reveal a striking lack of confidence among individuals in discerning the authenticity of tax-related communications, with over half expressing uncertainty in identifying potential scams.

Furthermore, some respondents admit to overlooking basic security measures during tax season, such as refraining from clicking on unfamiliar links or opening attachments from unknown sources. Alarmingly, only a third of individuals utilize two-factor authentication, leaving their accounts vulnerable to exploitation.

Pervasive nature of online tax scams

The pervasive nature of online tax scams is underscored by the prevalence of deceptive messages impersonating tax authorities. McAfee’s research indicates that many Americans have encountered fraudulent messages purporting to be from the IRS or state tax authorities, often soliciting sensitive personal information.

In response to these escalating threats, McAfee urges consumers to remain vigilant and proactive in safeguarding their financial and personal information. By exercising caution and leveraging AI-powered security solutions, individuals can mitigate the risks posed by cybercriminals seeking to exploit the anxieties of tax season.

The convergence of tax season anxiety and the proliferation of AI-driven scams underscores the urgent need for heightened awareness and proactive measures among consumers. By staying informed and adopting robust security practices, individuals can navigate the intricacies of tax season while safeguarding themselves against online threats.